Gate Research: Crypto Market Rebound Triggers Largest Short Liquidations Since October | Fed Officials Reaffirm Policy Independence

Crypto Market Overview

BTC (+0.91% | Current Price: 96,365.4 USDT)

Bitcoin has reclaimed the $96,000 level and continues to move steadily within an ascending channel. This rebound shows notable strength in both magnitude and structure: prices rebounded from the $90,000–$92,000 short-term bottom range, posting a single-day gain of about 4.6% and reaching the highest level since late November. From a market-structure perspective, spot buying has been the primary driver of this move, followed by passive short covering in the futures market, which further amplified the upside. Meanwhile, the ten spot Bitcoin ETFs recorded combined net inflows of nearly 90,000 BTC, with other major crypto ETFs also seeing net inflows.

On-chain data points to increasing participant divergence: the average spot order size around the $90,000 level has expanded significantly, suggesting quiet accumulation by institutions or high-net-worth investors, while short-term holders have turned into net sellers, with the 30-day net change in short-term holdings falling into negative territory. Bitcoin is currently at a critical decision zone, and the next move will determine whether it can push toward a breakout above $100,000 or remain in a high-level consolidation phase.

ETH (-0.50% | Current Price: 3,317.79 USDT)

After two consecutive days of strong gains, Ethereum broke above the key $3,300 resistance formed in early January and briefly tested $3,400, before entering high-level consolidation around $3,300. This rally has been driven more by clear “hard catalysts” rather than pure sentiment: on one hand, progress on relevant legislative proposals has improved policy expectations; on the other, easing inflation has provided macro tailwinds, jointly lifting risk appetite and supporting a broad rebound in crypto assets.

From a technical perspective, on the daily chart Ethereum is gradually approaching the 200-day exponential moving average (EMA) near $3,600, marking the third test of this key dynamic resistance since November. It is worth noting that prices moving within a range often follow the inertia of “touching the upper bound and pulling back toward the lower bound.” Therefore, unless ETH can decisively break above and hold the 200-day EMA, attention should still be paid to the $2,600–$2,730 zone as a potential consolidation and support area.

GT (-2.77% | Current Price: 10.51 USDT)

GT has followed major tokens into an upward channel. On the 1-hour chart, after the previous high-volume surge, price action has entered a high-level consolidation phase, with short-term momentum clearly slowing. The current price is around $10.47, slightly below the MA5 and MA10, while still capped by the MA30. In addition, after pulling back from the upper Bollinger Band, the price is gradually converging toward the middle band, with the band width beginning to narrow. This suggests that the prior trending move has largely played out and the market is entering a consolidation phase ahead of a directional choice. The lower Bollinger Band around $10.44 serves as an important short-term support; a breakdown could lead to a further retest of the previous low near $10.20.

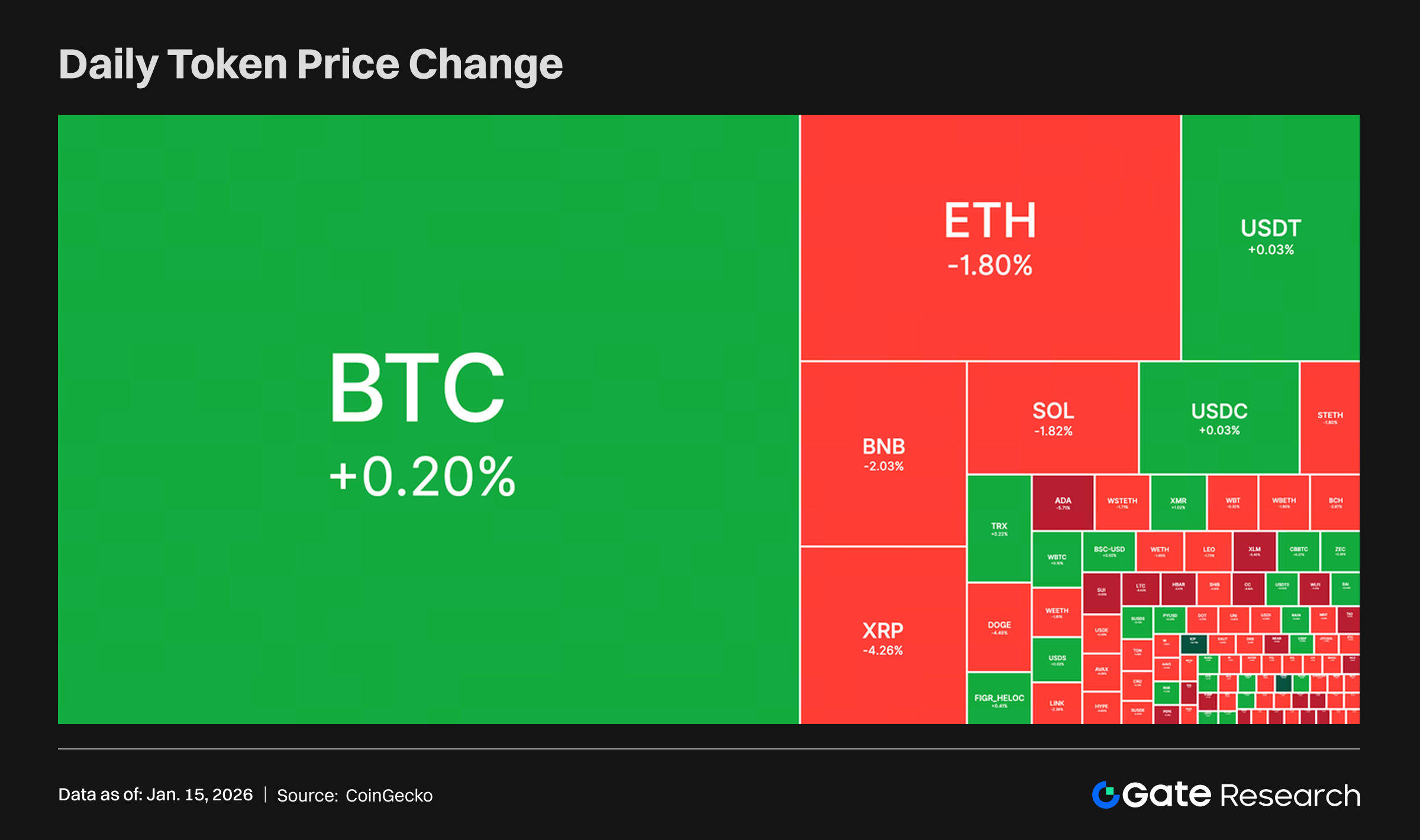

Tokens Heatmap

After a strong one-day rally, the crypto market showed clear divergence over the past 24 hours. Bitcoin edged up by about 0.2%, remaining relatively resilient among major assets and indicating continued capital allocation toward “core assets.” In contrast, major altcoins such as Ethereum, BNB, and SOL generally pulled back, with ETH down nearly 2% and XRP’s losses widening to over 4%, reflecting a temporary cooling in risk appetite. Overall, short-term capital has shifted toward a more defensive and wait-and-see stance, though some tokens continue to attract inflows. These assets are analyzed in detail below.

ICP Internet Computer (+27.85%, Circulating Market Cap: $2.432B)

According to Gate market data, ICP is currently priced at $0.0013709, up 27.85% over the past 24 hours. Internet Computer (ICP), launched by the DFINITY Foundation, is a decentralized network designed to enable developers to build and run scalable Web applications and services directly on-chain without relying on traditional cloud platforms. Its core innovations include chain-key cryptography and Canister smart contracts, supporting high-performance, low-cost on-chain computation and cross-chain interactions.

On January 15, the DFINITY Foundation released the Mission70 whitepaper, proposing to reduce ICP’s inflation rate by approximately 70% by 2026, primarily through lowering new token issuance. This proposal had been widely anticipated by the market prior to its official release. A declining inflation rate implies tighter long-term supply, especially given that around 40% of ICP is currently locked for staking, further constraining circulating supply. Overall, Mission70 aims to enhance the network’s long-term sustainability and address token holders’ concerns about dilution. However, the plan still needs to go through governance processes, with voting arrangements and implementation timelines yet to be clarified, leaving execution uncertainties.

DOLO Dolomite (+20.10%, Circulating Market Cap: $26.92M)

According to Gate market data, DOLO is currently trading at $0.07356, up 20.10% over the past 24 hours. Dolomite (DOLO) is a decentralized lending and margin trading protocol that supports multi-asset collateralization, leveraged trading, and efficient capital utilization. Its core strength lies in a highly modular risk management and account system, which enhances capital efficiency while maintaining security, catering to professional DeFi users and strategy-driven capital.

On January 12, World Liberty Financial (WLFI) launched “World Liberty Markets,” a lending platform built on Dolomite. Users can now directly borrow assets such as USD1 (a stablecoin issued by WLFI with a market cap of $3.4 billion), ETH, and USDC via Dolomite’s infrastructure. This integration introduces real-world demand into the Dolomite ecosystem. USD1’s scale provides immediate utility for DOLO as a settlement layer, while WLFI’s political connections have attracted mainstream capital attention. Increased protocol usage typically supports token value through fee mechanisms. Going forward, attention should be paid to the approval outcome of WLFI’s application for a national trust bank license, as approval would accelerate USD1 adoption on Dolomite.

ARRR Pirate Chain (+39.20%, Circulating Market Cap: $123M)

According to Gate market data, ARRR is currently priced at $0.6352, up more than 39.20% over the past 24 hours. Launched in 2018, Pirate Chain is a privacy-focused cryptocurrency built on zk-SNARK zero-knowledge proof technology, emphasizing a “privacy-by-default” on-chain transaction experience. Pirate Chain uses a PoW consensus with the Equihash algorithm and enhances security through a delayed Proof-of-Work (dPoW) mechanism, anchoring its block hashes to the Bitcoin blockchain to improve resistance against 51% attacks.

The latest ARRR price surge has been driven by a combination of renewed interest in privacy coins and increased community exposure. On one hand, ARRR’s rally has coincided with a broader resurgence in attention toward privacy coins, as regulators intensify scrutiny of transparent blockchains, leading some investors to view ARRR’s mandatory zk-SNARK privacy as a hedge against regulatory surveillance. On the other hand, community-driven speculation has also played a role: unverified rumors on X about Zcash developers migrating to ARRR sparked discussion and boosted the project’s visibility.

Hotpot Insights

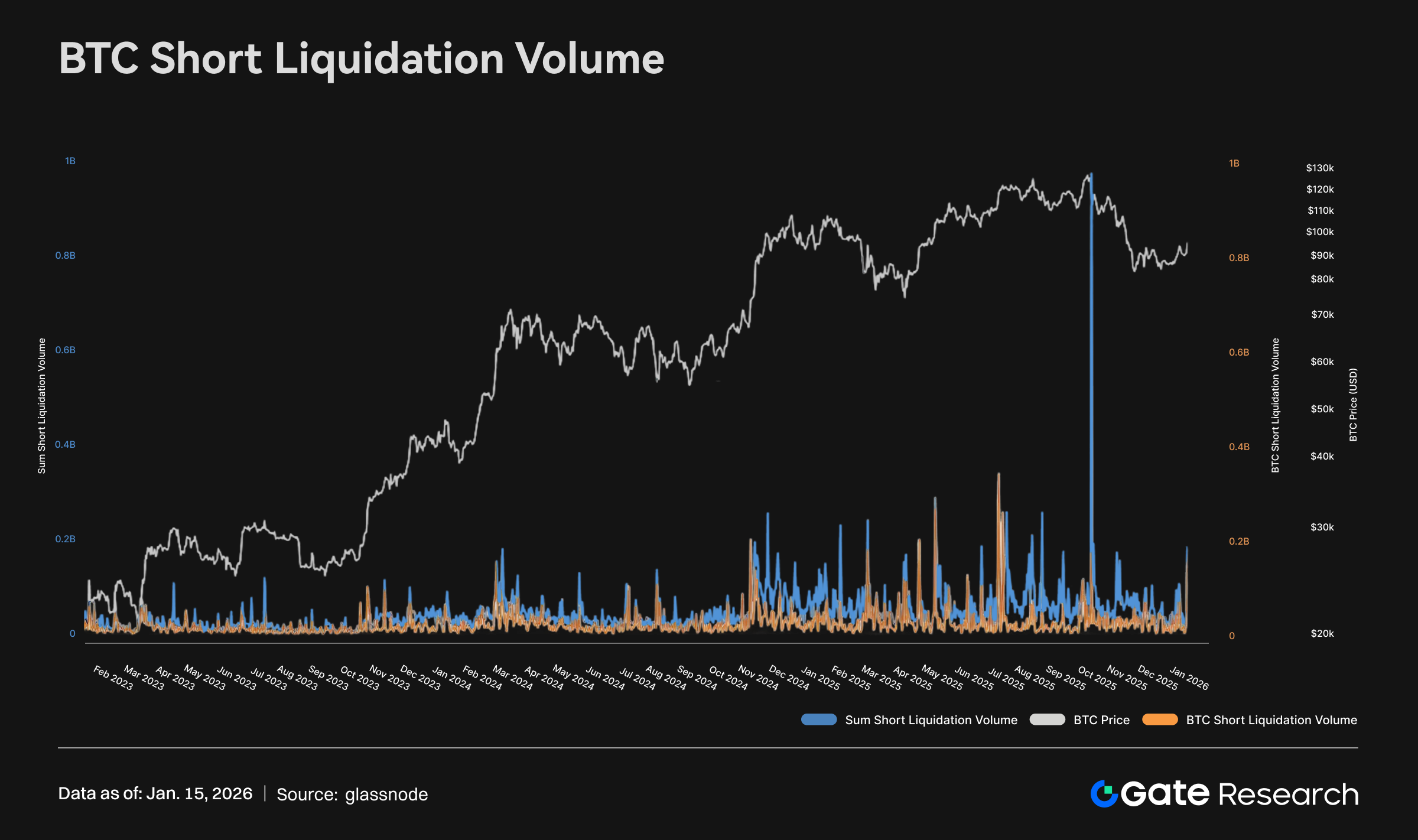

Crypto market rebound triggers the largest short squeeze since October, with $577 million in short positions liquidated over the past 24 hours

On January 14, according to Glassnode data, driven by the crypto market rebound, total liquidations across the market reached $684 million over the past 24 hours, of which $577 million were short liquidations. This rebound also marked the largest short liquidation by market cap among the top 500 cryptocurrencies since the “10/11 crash.”

The market may be approaching a critical psychological and technical inflection point. As crypto prices—led by Bitcoin—rapidly broke higher, a large buildup of short positions was forcefully liquidated, creating a classic “short squeeze.” In the short term, Bitcoin’s break above $95,000 serves as a key green light for renewed risk appetite across the digital asset market. This move has reignited bullish momentum, with market participants now watching closely for a potential push above the $100,000 threshold and a possible retest of all-time highs.

Key supporters falter as the Senate Banking Committee cancels the CLARITY Act amendment hearing

The Senate Banking Committee had originally scheduled a hearing for Thursday morning to consider amendments, but on January 15 it canceled the planned session to revise and vote on comprehensive crypto legislation. The CLARITY Act is designed to clarify regulatory jurisdiction between the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC), define when digital assets should be classified as securities or commodities, and establish new disclosure requirements. The bill text was released Monday evening, with the amendment submission deadline set for late Tuesday night, paving the way for a Thursday vote. However, cracks in support began to emerge on Wednesday.

Democratic Senator Ruben Gallego, a key negotiator on the bill, said he was supposed to meet with Patrick Witt, Executive Director of the President’s Digital Asset Advisory Committee, but the meeting did not take place. He stated that he is currently unable to support the bill. Shortly thereafter, the first publicly listed, fully licensed exchange announced it was withdrawing its support. CEO Brian Armstrong wrote on X that he had concerns about provisions related to stablecoin yields, tokenized equity, and decentralized finance. That said, other crypto companies and advocacy groups continue to back the bill and say they remain committed to pushing for it to become law in 2026.

FED officials jointly defend policy independence while signaling a pause in rate cuts

On January 15, several Federal Reserve officials emphasized publicly on Wednesday that political or judicial pressure should not interfere with monetary policy decisions, underscoring the importance of central bank independence. At the same time, officials broadly signaled that a pause in rate cuts is likely at this month’s meeting, citing the resilience of the U.S. economy and still-elevated inflation, which warrant maintaining restrictive monetary policy.

Notably, a consensus appears to be forming within the Fed. The presidents of the Chicago Fed, Atlanta Fed, and New York Fed stressed that maintaining long-term inflation stability is critical, and that keeping rates unchanged in the near term is a more prudent choice until inflation shows clearer and sustained progress downward. Regarding the economic outlook, only a small number of officials—such as Governor Mester—argued that inflation is clearly moving along the right path. Most officials indicated that another rate cut at the late-January FOMC meeting is unlikely. Markets generally expect that rate cuts may not resume until after June this year at the earliest.

References

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- CoinGecko, https://www.coingecko.com/en/cryptocurrency-heatmap

- X, https://x.com/glassnode/status/2011446639043756289

- The Block, https://www.theblock.co/post/385698/senate-banking-committee-postpones-markup

- Japan Times, https://www.japantimes.co.jp/business/2026/01/15/markets/fed-independence-rate-hold/

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024

Gate Research: October Crypto Market Review