Gate Leveraged ETF Tokens: The Easiest Way to Start Multi-Leverage Trading

The Evolution of ETF Products

Exchange-Traded Funds (ETFs) bundle multiple assets into a single investment product, allowing users to buy and sell them on exchanges just like stocks. Because ETFs efficiently diversify risk and track various markets or indices, they have long been recognized as investment tools that offer both efficiency and stability.

As market structures and investor needs evolve, more strategic products have gained traction. Leveraged ETFs are a standout example. These instruments magnify the gains and losses of underlying assets by a set multiple, enabling investors to amplify returns in clear market trends. Their operation is also more intuitive compared to traditional leveraged tools.

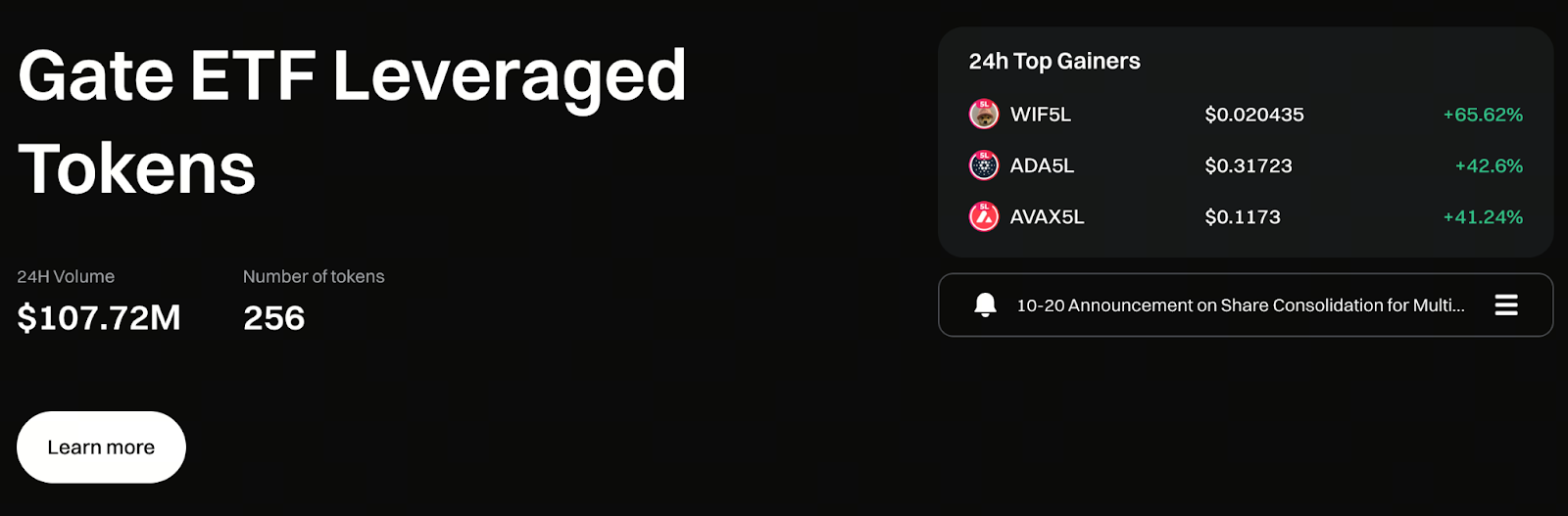

Overview of Gate Leveraged ETF Tokens

Gate’s leveraged ETF tokens are derivatives designed on a fund-based model. They maintain a fixed leverage ratio through perpetual contract positions, but users never need to interact with any contract interface. By simply buying or selling spot tokens, users immediately gain the corresponding leveraged exposure. Additionally, since the system manages all positions, there is no risk of forced liquidation—a common issue in contract trading.

Start trading Gate leveraged ETF tokens now: https://www.gate.com/leveraged-etf

How It Works

To ensure a stable leverage ratio, Gate’s professional team manages and maintains the tokens through several core mechanisms:

Maintaining Leverage with Futures Positions

Each leveraged ETF token is backed by a corresponding perpetual contract position, supporting its designated leverage—such as 3x or 5x.Daily Rebalancing

The system automatically adjusts positions based on market fluctuations, ensuring the leverage ratio returns to its target and doesn’t drift due to market changes.Spot Trading Simplicity

Users don’t need a margin account or contract knowledge—leverage is achieved simply through spot market trading.Daily Management Fee

The platform charges a 0.1% daily management fee to cover hedging and rebalancing costs.

Advantages of Gate Leveraged ETF Tokens

Amplified Market Moves

In strong market trends, 3x or 5x leverage can significantly boost returns.No Liquidation Risk

The system manages positions automatically, eliminating the forced liquidation risks that come with traditional margin contracts.Automated Compounding

When the market moves in your favor, ETF rebalancing increases your position, creating a compounding effect on returns.Low Barrier to Entry

Trading is as straightforward as buying or selling spot tokens. No borrowing or complex contract knowledge is needed, making it accessible for newcomers.

Key Risks to Know Before Trading

Despite their accessibility and ease of use, leveraged ETFs are inherently high-volatility products. Be aware of the following risks:

Magnified Volatility

Both profits and losses are amplified, so market swings have a more pronounced impact on your capital.Rebalancing Can Diminish Long-Term Returns

Frequent position adjustments in volatile markets can erode returns, making leveraged ETFs less suitable for long-term holding.Nonlinear Leverage Returns

Due to rebalancing and position adjustments, actual returns may not perfectly match the set leverage multiple.Costs Reduce Returns

Daily management fees and hedging costs can impact overall performance.

Leveraged ETFs are best suited for short-term trading or strong trending markets and are not recommended for long-term portfolio allocation.

Why Are Management Fees Necessary?

To maintain stable leverage, the platform must continuously rebalance and hedge in the perpetual contract market, which incurs several costs, including:

Contract Fees

Funding Rates

Trading Slippage

Gate charges a daily 0.1% fee to cover these expenses. This rate is among the lowest in the industry, with the platform absorbing part of these costs itself.

Conclusion

Leveraged ETFs let investors participate in multi-leverage market movements directly through spot trading—no contracts, no borrowing, and no liquidation risk. These products combine low entry barriers with high volatility, making them ideal for strategic trading in clear market trends. Investors seeking amplified returns should manage their risks carefully and find a balance between market volatility and rebalancing costs to fully realize the advantages of leveraged ETFs.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B