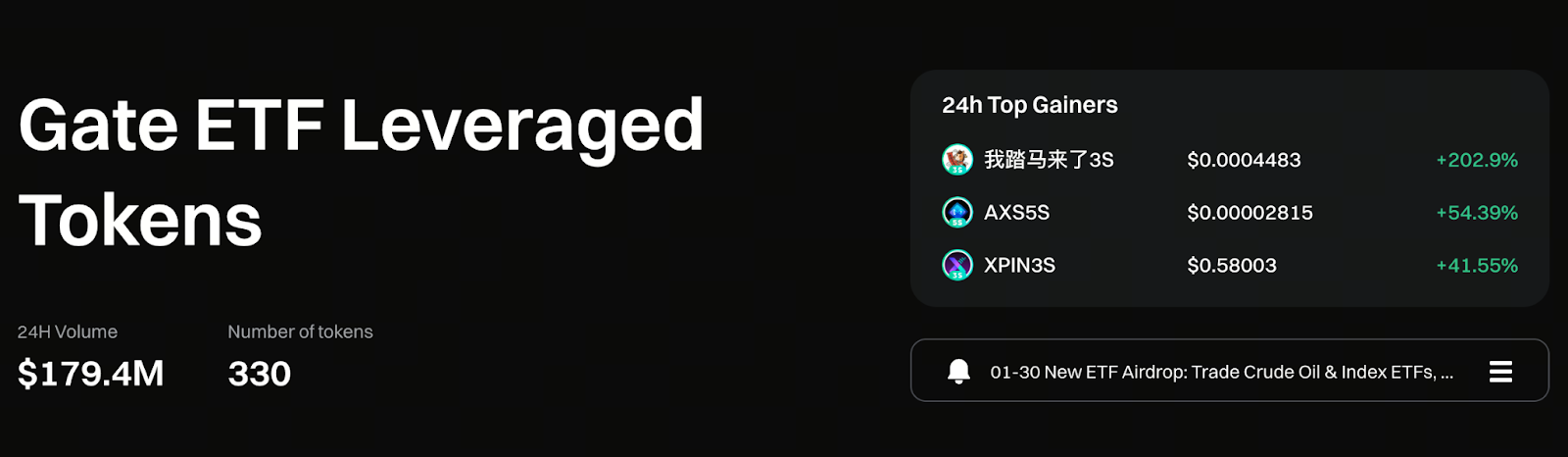

Gate Leveraged ETF: A Smarter Way to Amplify Market Moves

Accelerating Market Pace, Diversification of Investment Tools

As the crypto market enters a period of high-frequency volatility, prices move swiftly, leaving little time for investors to gradually build positions. Directional shifts and retracements often occur rapidly. For most traders, the challenge now extends beyond simply judging bullish or bearish trends—it’s about whether they can quickly adjust positions and execute strategies before risk intensifies.

In this environment, relying solely on a long-term holding strategy proves insufficient. Trading tools designed to enhance efficiency are increasingly becoming essential components in portfolio strategies.

Spot vs. Derivatives: Operational Gaps Remain

Spot trading is straightforward and simple, making it ideal for beginners and conservative users. However, when the market trend is clear, capital utilization is relatively limited. Derivatives trading can quickly amplify the impact of price movements, but it also introduces challenges such as margin management, funding rates, and the risk of forced liquidation.

The gap between these two models often leaves traders torn between pursuing higher efficiency and avoiding the risks associated with derivatives. This is the backdrop for the emergence of leveraged ETFs.

Leveraged ETF Tokens: Simplifying Structure for the User

On the Gate platform, leveraged ETF tokens are fundamentally based on perpetual contracts to deliver multiplied exposure. However, all these complex mechanisms are handled automatically by the system. For users, the experience closely resembles spot trading—simply buy or sell the corresponding token.

Gate leveraged ETF tokens require no manual leverage adjustments, margin management, or concern over forced liquidation from short-term price swings. The leverage effect is embedded within the product structure, making strategy execution straightforward and direct.

Trade Gate ETF leveraged tokens now: https://www.gate.com/leveraged-etf

Rebalancing Mechanism: Keeping Risk Predictable

Unlike one-time leverage amplification, leveraged ETFs feature a built-in rebalancing mechanism. The system periodically adjusts underlying positions in response to market changes, maintaining overall exposure within the predetermined range. This prevents leverage from spiraling out of control, but also means that actual performance depends on the price path—not just the difference between starting and ending prices.

Continuous Strategy Execution Without Forced Interruptions

In derivatives trading, a common risk is that short-term adverse moves can abruptly end a strategy. Leveraged ETFs do not eliminate market volatility; instead, risk is reflected in net asset value fluctuations, allowing strategies to persist rather than being forcibly interrupted. This structure lets traders focus on managing timing and direction, rather than constantly guarding against unexpected liquidations or exits.

Amplification Is Most Effective in Clear Trends

In trending or one-sided markets, leveraged ETFs can magnify the impact of price movements on capital without adding operational complexity. With the rebalancing mechanism, trending markets may experience effects similar to rolling accumulation. As a result, leveraged ETFs are often viewed as transitional tools between spot and derivatives, or used for strategy testing and short- to medium-term trend participation, rather than as speculative products seeking high multiples.

Structural Features Matter in Volatile Markets

It’s important to note that during prolonged sideways or volatile markets, the rebalancing mechanism may gradually erode net asset value, resulting in outcomes that differ from intuitive expectations. Factors such as volatility frequency, price path, and transaction costs during adjustments all play a role. This is why leveraged ETFs are typically not considered long-term passive holdings, but are better suited for use with clear entry and exit plans.

Management Fees: The Cost of Maintaining Structure

Gate leveraged ETFs charge a daily management fee of approximately 0.1%, supporting the overall mechanism—including underlying contract adjustments, funding rates, and rebalancing costs. This is not an additional hidden fee, but a necessary cost to sustain the leverage target over the long term.

Who Should Use Leveraged ETFs?

Practically speaking, leveraged ETFs are best suited for the following types of traders:

- Those with a clear market outlook

- Those with basic entry/exit and risk management plans

- Those seeking greater capital efficiency without engaging in derivatives

- Traders who can accept short-term net asset value fluctuations

Understanding the product structure is essential for maximizing efficiency.

Conclusion

The core value of Gate leveraged ETFs lies not in promising higher returns, but in enabling traders to rapidly translate market views into action. Without entering the derivatives market, users can still access leverage and participate in market dynamics. For those skilled in risk management, leveraged ETFs bridge the gap between spot trading and advanced strategies. Since the structure amplifies effects, understanding its limitations and appropriate use cases is always a crucial prerequisite.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B