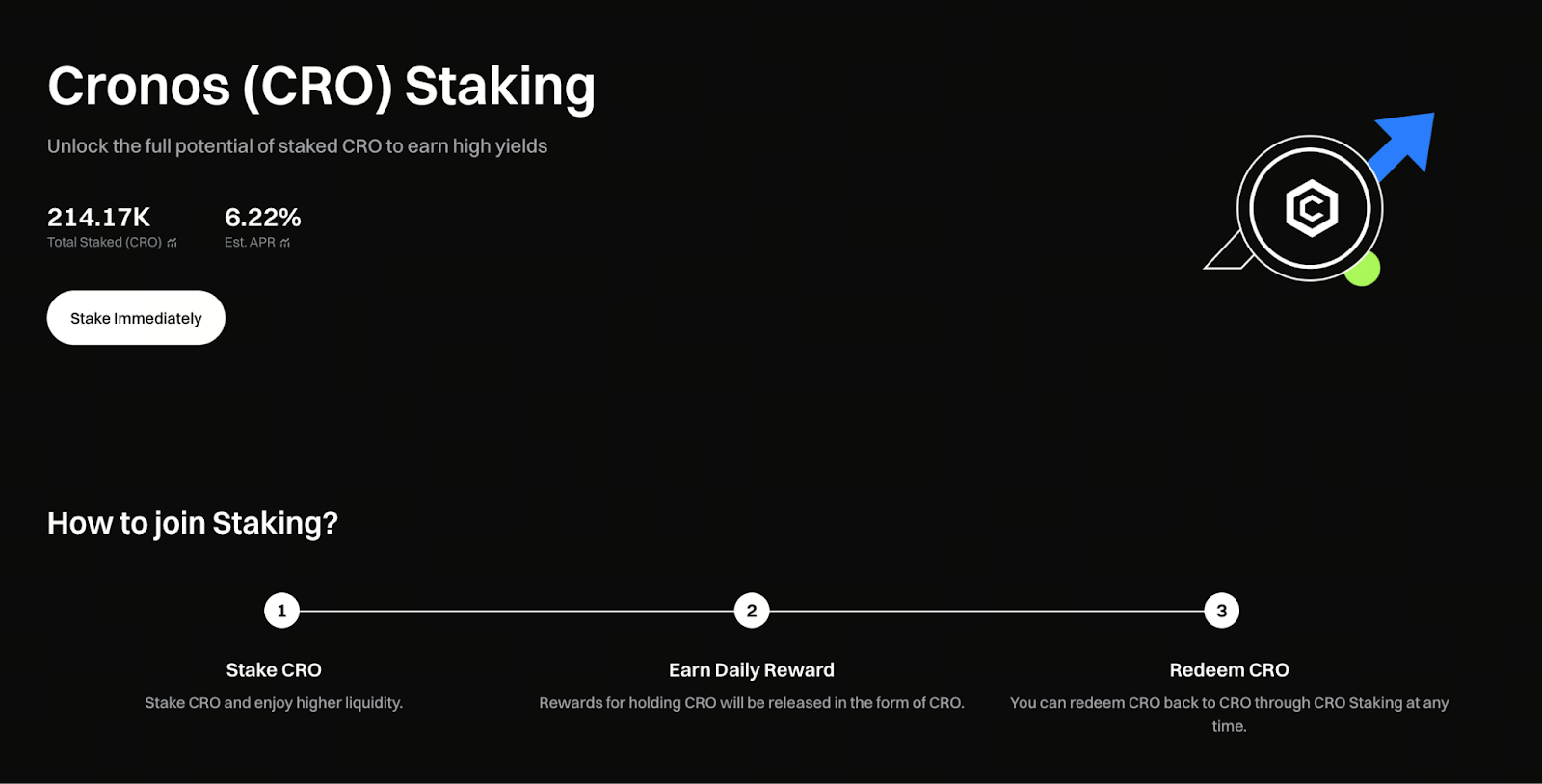

Gate Introduces CRO Staking as a New Savings Option: Earn 6.22% APY with Rational Participation in Cronos On-Chain Yields

What Is CRO Staking? How Gate Wealth Management Streamlines Participation

Image: https://www.gate.com/staking/CRO

CRO staking leverages the Proof-of-Stake (PoS) consensus mechanism of the Cronos blockchain. By staking CRO, users help secure and operate the network, earning on-chain rewards in return. Gate Wealth Management has simplified this process: users can stake directly through the Gate platform without needing to manually authorize wallets or select validator nodes. This significantly lowers the entry barrier for earning on-chain rewards, making it especially accessible for newcomers who may not be familiar with on-chain operations.

How Is the 6.22% Annualized Yield Calculated?

According to the Gate Wealth Management platform, as of December 24, 2025, the reference annualized yield for CRO staking stands at 6.22%. This rate is variable and reflects current network-wide staking ratios and changes in on-chain rewards; actual yields may fluctuate and are determined by the real-time rate displayed on the subscription page. For interest calculation, staking completed on Day D begins accruing interest on Day D+1, with payouts starting on Day D+2. Earnings are automatically credited to user accounts daily in CRO.

Redemption Rules and Investor Suitability

CRO staking adheres to the native redemption mechanism of the Cronos chain. Once a redemption request is submitted, principal funds are credited on Day D+29, and no additional rewards accrue during the redemption period. This structure makes the product well-suited for users with a defined investment horizon who favor medium- to long-term asset allocation, rather than those seeking short-term liquidity.

In general, Gate Wealth Management CRO staking is ideal for investors planning to hold CRO for the long term, looking to minimize operational complexity, and aiming to capture genuine on-chain yields.

Conclusion

Overall, Gate Wealth Management CRO staking offers a transparent, low-barrier, and long-term oriented on-chain investment solution. With a current reference annualized yield of 6.22%, it provides CRO holders with a relatively stable path to asset growth. As long as users understand the redemption cycle and associated market risks, this product can serve as a reliable component in a diversified asset allocation strategy.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About