Gate Futures Trading Explained: From Risk Control to Practical Execution — A Beginner’s Guide

I. What Is the Contract Trading Feature? Why Beginners Often Misinterpret It

In the cryptocurrency market, contract trading is often associated with “high risk” and “speculation.” However, from a product design standpoint, contract trading isn’t about amplifying risk-taking—it’s about delivering more flexible trading tools.

Unlike spot trading, which only lets you “buy low and sell high,” contract trading allows users to:

- Trade in both bullish and bearish market conditions

- Leverage margin to maximize capital efficiency

- Proactively manage risk using systematic tools

Gate’s contract trading module is built and optimized around these three core aspects.

II. Gate Contract Trading: Core Functional Structure

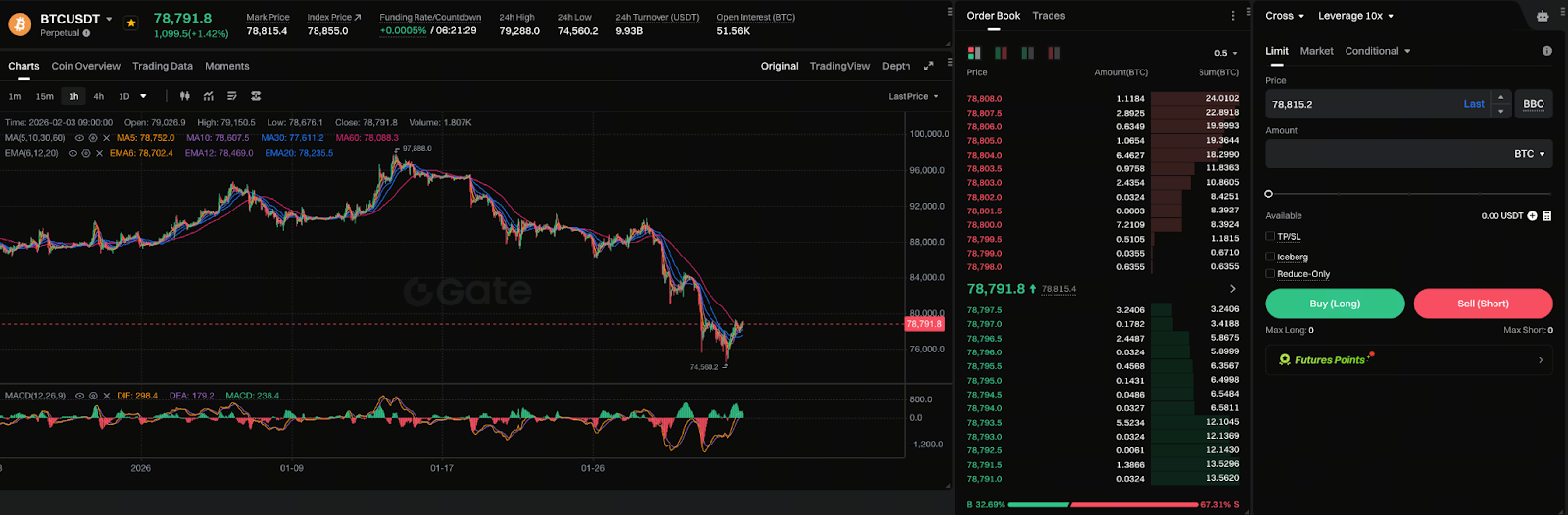

Image: https://www.gate.com/futures/USDT/BTC_USDT

On Gate, the contract trading feature is organized into the following main modules:

- Contract type selection (USDT-margined, coin-margined, etc.)

- Leverage and margin configuration

- Position management dashboard

- Risk control and liquidation alert system

This modular structure allows users to clearly assess potential risks and account status changes before placing an order, rather than reacting passively during periods of high volatility.

III. Margin Modes: Using Isolated and Cross Margin on Gate

Margin mode is one of the most fundamental and crucial features in contract trading.

Gate offers two primary margin modes:

Isolated Margin

- Each position’s risk is calculated independently

- Maximum loss is limited to the margin of that position

- Ideal for beginners or short-term strategies

Cross Margin

- All positions share the account’s margin balance

- Provides greater resilience against market volatility

- Well-suited for trend trading or managing multiple positions

Gate’s interface clearly indicates liquidation price changes for each mode, minimizing operational errors caused by incorrect selections.

IV. Gate’s Liquidation and Risk Control Mechanisms

Liquidation mechanisms can trigger strong emotional reactions in contract trading, but they are fundamentally system-level risk protection tools.

Gate’s contract system implements risk control logic that includes:

- Tiered maintenance margin rates

- Risk alerts before liquidation triggers

- Partial liquidation to avoid full position clearance

These mechanisms are not designed to “punish traders,” but to prevent uncontrollable losses during extreme market conditions.

For beginners, understanding how liquidation works is far more important than chasing high returns.

V. Key Auxiliary Features in Contract Trading

Many users focus solely on opening positions and overlook several critical auxiliary features in Gate contract trading:

- Take-profit and stop-loss: Set simultaneously when placing orders to minimize emotional decision-making

- Planned orders: Strategically target key price ranges in advance

- Position data visualization: Real-time display of unrealized P&L and liquidation prices

Together, these features form a disciplined trading system that encourages proactive decision-making instead of reactive measures.

VI. Practical Tips for Beginners Using Gate Contract Trading

If you’re new to contract trading, consider the following best practices:

- Start with low leverage to get familiar with the platform’s features rather than chasing profits

- Begin with isolated margin mode to clearly define risk for each trade

- Set a stop-loss for every order—don’t leave it to last-minute decisions

- Monitor liquidation price changes instead of focusing on short-term profit and loss

The contract trading feature itself isn’t inherently dangerous; the real risk comes from misunderstanding or misusing its functions.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About