Gate ETF Leveraged Tokens Make a Strong Comeback: A Low-Barrier Return Amplifier in 2026 Trend Markets

Image: https://www.gate.com/leveraged-etf

The crypto market is set for a structural recovery in 2026. After spot Bitcoin and Ethereum ETFs gained approval in multiple countries, institutional inflows accelerated and on-chain activity surged. As trending markets return, traders are seeking more efficient ways to maximize returns.

Within this environment, Gate ETF leveraged tokens are once again in the spotlight for trend traders. Their advantages stand out in a market where users want to amplify profits without taking on the high risks associated with derivatives contracts.

I. Why Are ETF Leveraged Tokens Booming Again in 2026?

Over the past year, the rise of crypto ETFs has made it much easier for traditional finance users to grasp concepts like “index,” “leverage,” and “rebalancing.” As a result, the market has never been more receptive to ETF leveraged tokens.

Trending markets combined with ETF investing habits are driving rapid growth in demand for leveraged tokens.

Key advantages of ETF leveraged tokens include:

- No need to open a derivatives account—just as easy as spot trading

- No liquidation threshold—no risk of sudden forced liquidation

- Automatic rebalancing—maintains stable 2–5x leverage

- Best suited for riding upward trends, not high-frequency trading

This makes them the ideal “light leverage tool” for new and intermediate users in the 2026 market landscape.

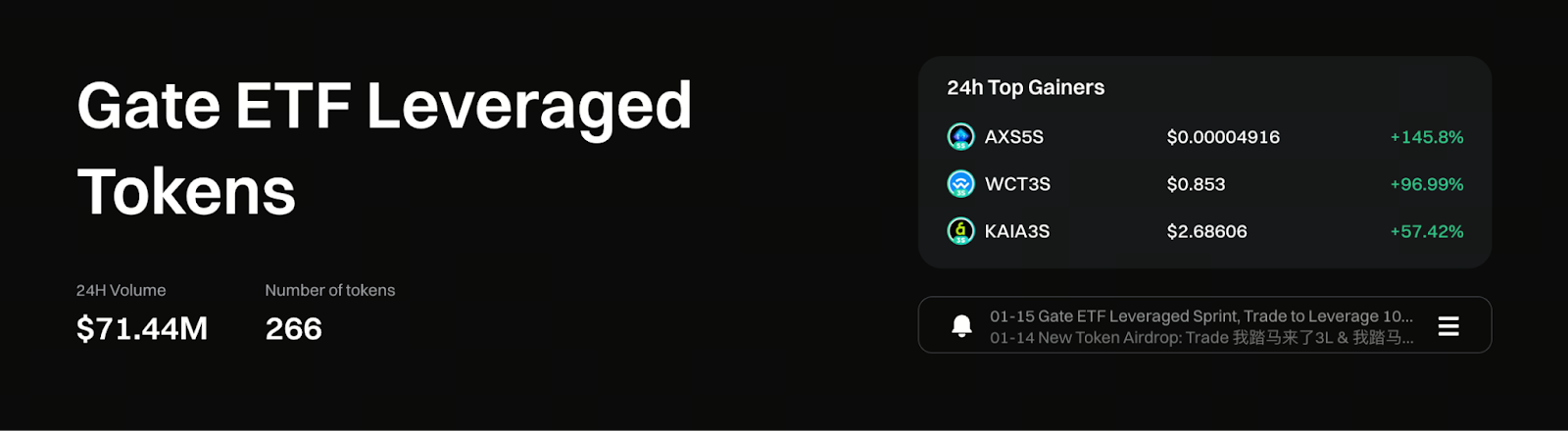

II. Gate ETF Leveraged Tokens: The Leading Choice for Trend Trading

As one of the first exchanges to launch leveraged tokens, Gate offers clear advantages in product maturity, token selection, and trading experience.

1. Comprehensive Product Range, Rapidly Tracks Market Trends

Whether it’s long-term trend assets like BTC and ETH, or sector hotspots like SOL, AI, and Meme, Gate can quickly list corresponding L (long) and S (short) leveraged tokens.

Typical examples include:

- BTC3L / BTC3S

- ETH5L / ETH3S

- SOL3L

- TON3L

- MEME3L and other thematic leveraged tokens

Broad coverage means users can seize narrative cycles as soon as they emerge.

2. Automatic Rebalancing Delivers Compounding in Uptrends

The biggest advantage of ETF leveraged tokens is that users don’t need to manually adjust positions—the system automatically maintains the leverage ratio.

In strong uptrends:

- Position sizes grow as prices rise

- Profits are locked in

- Leverage ratio stays stable

- Overall, returns exhibit a near-compounding effect

As a result, during the sustained strength of BTC and ETH in 2026, Gate’s BTC3L and ETH5L products have consistently outperformed spot trading over the long term.

3. High Liquidity, Ideal for Intraday and Trend Traders

Gate ETF leveraged tokens offer:

- Deep, stable order books

- Smoother price tracking

- Minimal slippage

This makes them a strong fit for:

- Intraday trading

- Swing trading

- Medium-term trend following

They are especially friendly for traders who require quick entry and exit.

4. No Liquidation Mechanism Means Lower Stress

The most valued feature of ETF leveraged tokens is that even in extreme volatility, you won’t face forced liquidation.

Compared to derivatives:

- No risk of being liquidated by a short-term price swing

- No need to monitor margin

- No worries about price wicks

- Better suited for regular users sticking to trend-following strategies long term

This is why many spot traders are now turning to Gate’s leveraged tokens.

III. Which Market Conditions in 2026 Are Best for Using Gate ETF Leveraged Tokens?

Clear Unilateral Uptrends (Ideal Scenario)

For example:

- BTC breaks above key moving averages

- ETH demand continues to rise due to ETF activity

- Overall market “risk appetite returns”

The stronger the uptrend, the more pronounced the compounding effect of leveraged tokens.

Sector Breakout Phases

Examples include:

- AI narratives

- Meme sectors

- SOL ecosystem

- New chain stories

These markets are often “sustained and high-momentum,” making leveraged tokens a perfect fit.

Bullish Event-Driven Markets

For example:

- Institutional accumulation disclosures

- ETF expansions

- Regulatory tailwinds

- New projects launching mainnets

Short-term bullish catalysts can be quickly amplified by leveraged tokens.

IV. Important Risk Warnings When Using Gate ETF Leveraged Tokens

While there is no liquidation risk, you should still be aware of the following:

1. Sideways Markets Cause Value Decay

The wider and more frequent the sideways swings, the more the token’s net asset value can be impacted.

2. Not Suitable for Long-Term Holding

ETF leveraged tokens are designed for trending markets, not for passive long-term holding.

3. Losses Are Magnified if Your Direction Is Wrong

These products also feature “multiplied losses,” so clear directional judgment is crucial.

Gate offers comprehensive educational content explaining these mechanisms. Studying the basics before trading can significantly reduce your risk.

V. Gate: The Best “Leverage Gateway” for Trend Investing in 2026

Gate stands out in the ETF leveraged token space with the following strengths:

- Extensive product coverage and rapid updates

- Deep liquidity and low slippage

- Mature automatic rebalancing mechanism

- Comprehensive educational resources, ideal for beginners

- Provides regular users with a low-barrier, high-efficiency way to amplify returns

When trending markets return in 2026, these products will become essential tools for many users to enhance profitability.

Conclusion: If You’re Looking for Efficient Ways to Amplify Trend Returns, ETF Leveraged Tokens Deserve Your Attention

The crypto market in 2026 is entering a more mature and sustainable growth phase. The ETF boom and institutional participation will only further strengthen these trends.

In this context:

- If you want higher returns than spot trading

- If you don’t want to face forced liquidation risk in derivatives

- If you want a simpler trading experience

Gate ETF leveraged tokens remain one of the most direct, effective, and accessible ways to achieve these goals.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B