Gate ETF Leveraged Tokens Explained: How to Trade Efficiently in a Volatile Market

Image: https://www.gate.com/leveraged-etf

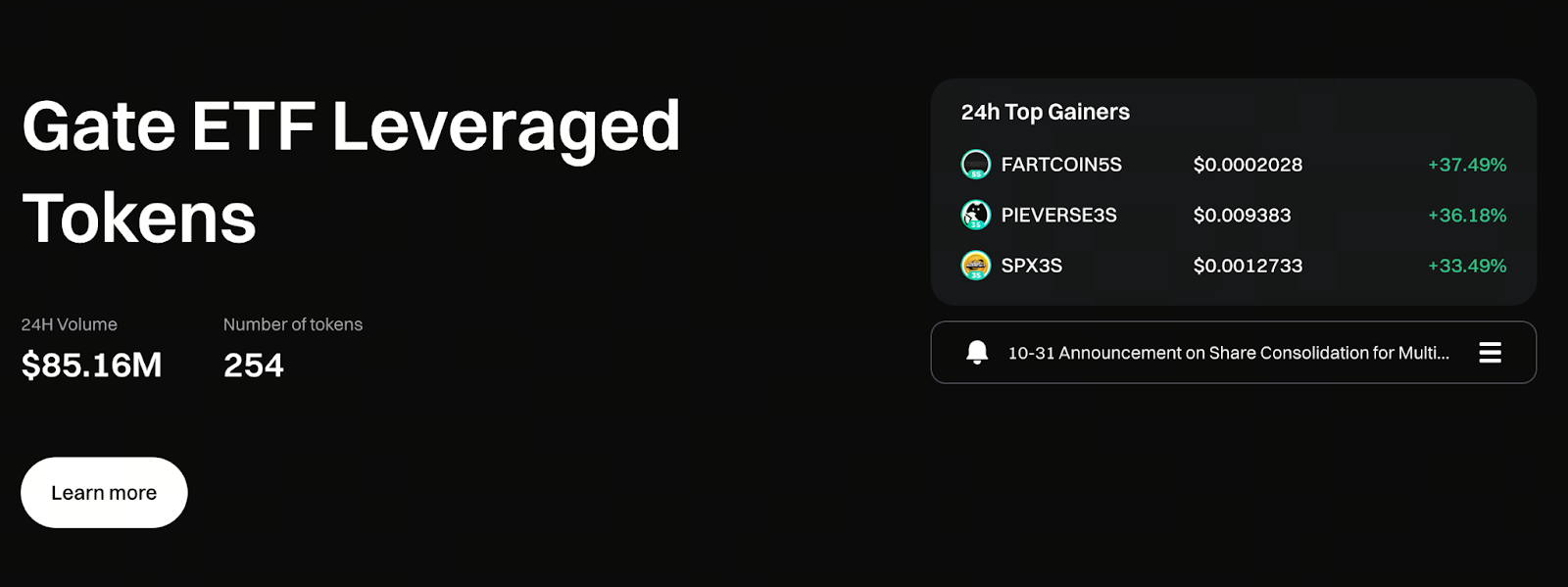

As the cryptocurrency sector continues to mature, an increasing number of traders are seeking more efficient and accessible leveraged products. Among the available instruments, Gate’s ETF Leveraged Tokens have emerged as a preferred solution for users navigating trending markets. These tokens eliminate the need for margin, remove liquidation risk, and incorporate daily automatic rebalancing, providing investors with a streamlined and safer alternative to traditional leverage.

What Are Gate ETF Leveraged Tokens?

ETF Leveraged Tokens are tokenized products designed to track the price movements of an underlying asset and amplify those fluctuations with built-in leverage. For example:

- BTC3L: Bitcoin 3x Long

- BTC3S: Bitcoin 3x Short

Gate’s ETF Leveraged Tokens offer a transparent structure. Investors can trade these tokens directly on the spot market, without the need to understand complex leverage mechanics or participate in borrowing.

Put simply, users are buying “spot tokens with fixed leverage.” The trading process mirrors that of standard tokens, but the potential returns are multiplied and the operational complexity is reduced.

Key Advantages of Gate ETF

Compared to conventional leveraged trading, Gate ETF Leveraged Tokens deliver three primary benefits:

1. No Margin Requirement, No Liquidation Risk

Unlike traditional leverage, which can trigger liquidations, ETF Leveraged Tokens do not.

Your maximum loss is limited to your initial investment. There are no margin calls or sudden liquidations.

2. Automatic Rebalancing Maintains Target Leverage

The Gate platform rebalances positions at a set time each day, ensuring the token maintains its intended leverage ratio.

For instance, BTC3L consistently maintains 3x long exposure, so investors do not need to manage positions manually.

3. Exceptionally User-Friendly for All Trader Levels

No need to enable leverage, borrow assets, or configure margin settings. Users simply purchase ETF tokens as they would spot tokens to achieve leveraged exposure.

How Does Automatic Rebalancing Enhance Efficiency for ETF Leveraged Tokens?

Gate’s ETF products are popular because their automatic rebalancing mechanism harnesses the power of compounding in strong, unidirectional markets.

The Stronger the Trend, the Greater the Benefits of Rebalancing

During pronounced upward trends:

- Price rises → Leverage ratio drifts downward

- System rebalances → Position size increases

- → Effectively adds to the position automatically

This mechanism enables ETF Leveraged Tokens to outperform traditional leverage in terms of returns.

Likewise, during downward trends, short ETF tokens such as BTC3S magnify returns, making it easier for users to capitalize on bearish movements.

Ideal Market Conditions for Trading Gate ETF

Gate recommends using ETF Leveraged Tokens in markets with clear directional trends, rather than in highly volatile or sideways conditions.

The following three scenarios are particularly well suited:

1. Going Long in Strong Uptrends

When Bitcoin breaks through key resistance levels or enters a rapid growth phase, BTC3L often delivers substantially higher returns than standard spot trading.

2. Shorting for Hedging During Downtrends

In times of macroeconomic weakness or significant on-chain outflows, products like BTC3S or ETH3S can help users lock in profits more quickly during bear cycles.

3. Medium-Term Trading Strategies (2–10 Days)

ETF tokens are not intended for long-term holding, but they excel at capturing short- and medium-term trend moves.

Risk Notice: How to Avoid Losses from Market Volatility?

While Gate ETF tokens offer fixed leverage and eliminate liquidation risk, traders should remain aware of the following risks:

- Highly volatile, non-trending markets (sharp swings without a clear direction) can result in losses

- Holding positions for extended periods (more than two weeks) may reduce return efficiency

- Daily rebalancing can cause leverage drift

Traders should closely monitor market direction and consider reducing positions or taking profits during periods of increased volatility.

Gate ETF Product Line and Popular Trading Pairs

Gate currently offers the most comprehensive ETF Leveraged Token product lineup in the crypto industry, including:

- Mainstream coins: BTC3L/3S, ETH3L/3S, SOL3L/3S

- Popular sector tokens: AI, Layer2, MEME, and other long/short tokens

- High-liquidity trading pairs: USDT-denominated spot trading for direct transactions

Whether users are pursuing trending sectors or trading major assets, Gate’s ETF products provide suitable leveraged options.

Conclusion: Why Is Gate ETF an Essential Tool for Trend Traders?

Gate’s ETF Leveraged Tokens combine ease of use, no liquidation risk, and automatic rebalancing, making them the go-to instrument for traders in both bullish and bearish markets. Their primary advantage is enabling users to amplify returns rapidly with fixed leverage, without adding operational complexity.

Whether you are a day trader or a medium-term trend follower, leveraging Gate ETF allows you to capture returns more efficiently in clearly trending markets.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B