Gate ETF Leveraged Tokens Explained: An Efficient Trading Tool to Amplify Returns in Trending Markets

Why Are Markets Focusing More on ETF Leveraged Tokens?

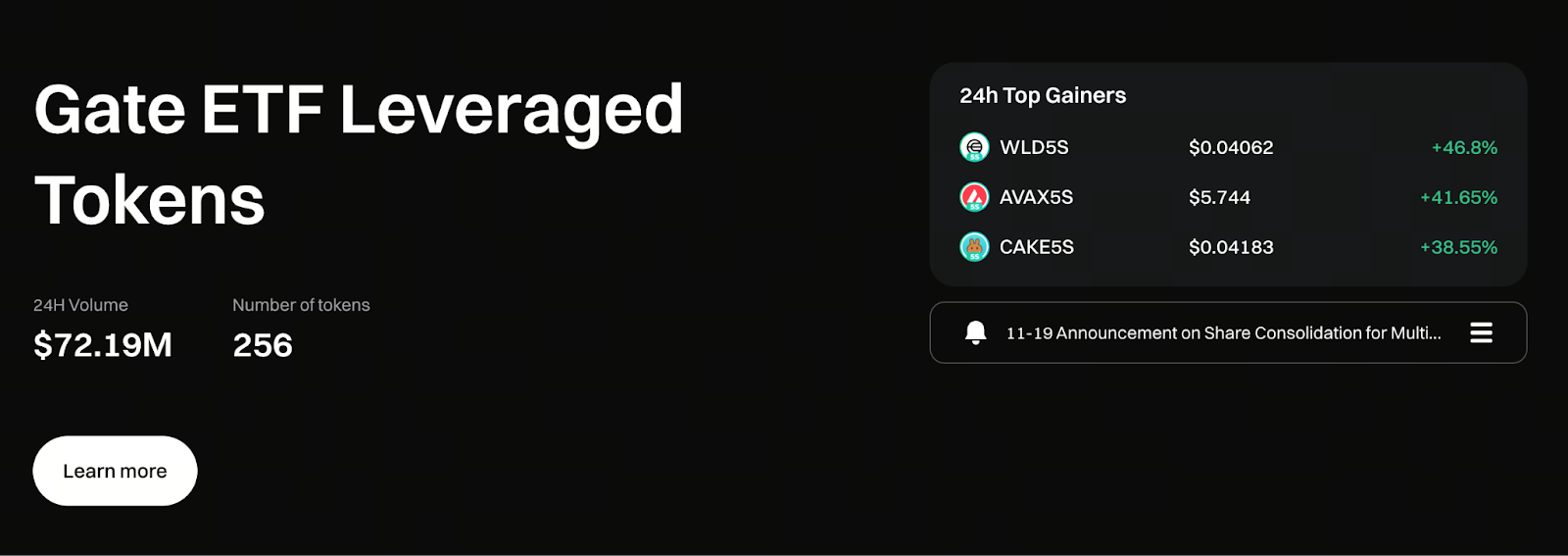

Source: https://www.gate.com/leveraged-etf

In the crypto market, many traders aim to amplify their returns from market trends without the hassle of constantly managing contract positions, margin requirements, or the risk of liquidation. This demand has driven ETF leveraged tokens to become a widely adopted derivative product.

Gate’s ETF leveraged tokens are, at their core, tokenized versions of leveraged contract strategies. Users can gain leveraged exposure simply by buying and selling these tokens, just like any other digital asset, without directly engaging in perpetual contract trading.

These products are especially appealing to:

- Traders interested in capitalizing on trends but unfamiliar with contract mechanics

- Users seeking short-term leveraged gains without the threat of forced liquidation

- Investors pursuing swing trades, event-driven strategies, or short-term trend opportunities

How Gate ETF Leveraged Tokens Work

Gate ETF leveraged tokens deliver leverage through underlying contract positions managed on the backend. Each token maintains a fixed target leverage, such as 3x or 5x.

When the price of the underlying asset moves, the token’s net asset value changes in proportion to the set leverage. For example:

- During uptrends, long ETF leveraged tokens typically outperform spot assets by a significant margin.

- During downtrends, short ETF leveraged tokens magnify downside returns in much the same way.

To keep the leverage stable, Gate automatically rebalances the underlying positions. Users do not need to manually adjust positions or monitor margin ratios.

No Forced Liquidation: A Defining Feature of ETF Leveraged Tokens

The most significant distinction between Gate ETF leveraged tokens and traditional contract trading is the absence of forced liquidation (margin call) mechanisms.

In contract trading, sharp price swings and insufficient margin can trigger forced liquidations. By contrast, ETF leveraged tokens use net asset value management and automated rebalancing, avoiding the risk of sudden wipeouts.

However, “no forced liquidation” does not mean “no risk.” In choppy or frequently reversing markets, the net asset value of ETF leveraged tokens can be steadily eroded.

As a result, these products are not intended for long-term holding and are best used in clear trending markets.

The Power of Compounding in Trending Markets

In strong directional markets, Gate ETF leveraged tokens often exhibit a pronounced compounding effect.

When prices rise or fall consecutively, the automated rebalancing mechanism continually adjusts the underlying positions, amplifying returns over successive moves. That’s why many traders consider ETF leveraged tokens to be effective “trend amplifiers.”

This advantage is particularly evident in scenarios such as:

- Clear directional breakouts in the crypto market

- Sustained rallies driven by macro or sector-wide bullish news

- Prolonged corrections triggered by negative headlines

Conversely, in sideways or highly volatile markets, frequent rebalancing can erode net asset value.

Management Fees and Value Decay: Costs to Manage Rationally

Gate ETF leveraged tokens apply a daily management fee to support ongoing operations. This fee is reflected in the token’s net asset value, rather than deducted separately.

For long-term holders, consider two key points:

- Management fees will continuously reduce net asset value over time.

- In non-trending or volatile markets, value decay from price swings can further amplify costs.

Therefore, ETF leveraged tokens are best used as trading instruments, not as long-term investment vehicles.

How to Use Gate ETF Leveraged Tokens More Effectively?

Prudent use of ETF leveraged tokens is essential in practice.

Best practices include:

- Entering at the start of a trend or after trend confirmation

- Using take-profit and stop-loss strategies for swing trading

- Leveraging them as a supplement to spot positions or other strategies

It is not recommended to trade frequently in uncertain or extremely volatile markets, nor to allocate all capital to a single leveraged token.

Gate ETF Leveraged Tokens’ Role in Today’s Market

As regulatory scrutiny of high-leverage crypto ETFs increases, platform-based ETF leveraged tokens have become a key alternative for traders seeking leveraged exposure.

Gate’s ETF leveraged tokens are engineered to balance trading efficiency with risk control. They offer the benefits of leveraged returns while reducing operational complexity.

In today’s volatile and rapidly shifting crypto market, these products will continue to serve as short-term trend trading tools.

Conclusion

Gate ETF leveraged tokens are not suitable for every investor, but in trending markets, they are a highly efficient way to amplify returns.

Understanding how they work, knowing when to use them, and managing your position sizes are all essential. Only by fully recognizing the risks can you unlock the true value of leveraged products.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B