Gate ETF Leveraged Tokens Advanced Beginner’s Guide: A Low-Threshold, High-Multiple Yield Tool in the Crypto Market

Image: https://www.gate.com/leveraged-etf

Why Are More Crypto Investors Opting for ETF Leveraged Tokens?

Leverage trading has traditionally centered on perpetual contracts, which have a high entry barrier. Understanding concepts like liquidation, funding rates, and position management is essential, and newcomers can easily suffer losses due to market volatility or operational errors.

Gate’s ETF leveraged tokens solve this by making leverage intuitive, tokenized, and simple—enabling everyday users to easily access leveraged returns.

The key benefits of ETF leveraged tokens include:

- Trading is identical to spot transactions

- No margin maintenance required

- No forced liquidations

- Automatic leverage maintenance

- Clear performance, ideal for trend trading

Because of these features, ETF leveraged tokens have become the go-to tool for many short-term and swing traders.

How Do Gate ETF Leveraged Tokens Work?

Gate’s leveraged tokens are essentially bundles of perpetual contract positions, managed by a professional rebalancing system to maintain a constant leverage ratio (such as 2× or 3×).

For example:

- BTC3L = Long Bitcoin with 3x leverage

- BTC3S = Short Bitcoin with 3x leverage

- ETH5L = Long Ethereum with 5x leverage

In practice, if Bitcoin rises by 1%, BTC3L may rise by about 3%. If Bitcoin drops by 1%, BTC3S may increase by about 3%. There’s no need to use contracts, worry about liquidation, or manage leverage operations yourself.

Three Core Advantages of Gate ETF Leveraged Tokens

Advantage 1: No Liquidation Risk, Less Psychological Pressure

ETF leveraged tokens can’t be forcibly liquidated since there’s no margin involved. Losses are reflected in the token’s price, not from forced position closure.

This provides strong peace of mind for users who are wary of contract volatility.

Advantage 2: Automatic Rebalancing Keeps Leverage on Target

Automatic rebalancing means:

- Positions increase automatically in favorable trends, compounding returns faster

- Positions decrease in reversals or sharp drops, helping limit drawdowns

This allows users to benefit from leverage without manually maintaining the leverage ratio.

Advantage 3: Flexible for Short-Term and Trend Trading, Sell Anytime

As tokens, ETF leveraged products offer:

- Buy and sell at any time

- Instant redemption

- No mandatory holding period

- No need to manage funding rates

This flexibility is ideal for swing traders.

What Market Conditions Best Suit Gate ETF Leveraged Tokens?

1. Strong Trending Markets (Ideal Scenario)

- Use 3L tokens in uptrends

- Use 3S tokens in downtrends

ETF leveraged tokens deliver maximum value in clear trends. Automatic rebalancing increases position size with the trend, compounding returns. For example, if Bitcoin rises from 50,000 to 55,000 in a week (+10%), BTC3L could gain +30% or more.

2. Sector Hotspots and Breakout Phases

Examples include:

- AI sector surges

- Meme sector sentiment spikes

- Public chain sector reversals

- Major industry news driving price action

In these scenarios, ETF leveraged tokens help short-term traders capture bigger market moves.

3. Event-Driven and Sentiment-Driven Trends

Such as:

- Major positive announcements

- Regulatory easing

- Institutional accumulation news

- Strengthening mainstream sentiment

At these points, market direction is usually clear, making leveraged tokens ideal for amplifying gains.

How Can You Use Gate ETF Leveraged Tokens Safely?

While there’s no liquidation risk, ETF leveraged tokens still require prudent use.

Rule 1: Avoid Long-Term Holding in Sideways Markets

Sideways markets can erode net asset value. The best approach is:

- Buy when a trend starts

- Sell when the trend ends

Rule 2: Set Clear Stop-Loss and Take-Profit Levels

Recommendations:

- Take-profit: 10%–30%

- Stop-loss: 5%–10%

ETF leveraged tokens are more volatile, so strict discipline is vital.

Rule 3: Use Primarily for Short-Term, Clear-Trend Trades

ETF leveraged tokens are not designed for long-term investing. They are:

- Powerful short-term trading tools

- Most effective during trends

- Well-suited for swing trading

- Not for long-term holding

- Not for enduring sideways markets

Use them as intended to maximize their benefits.

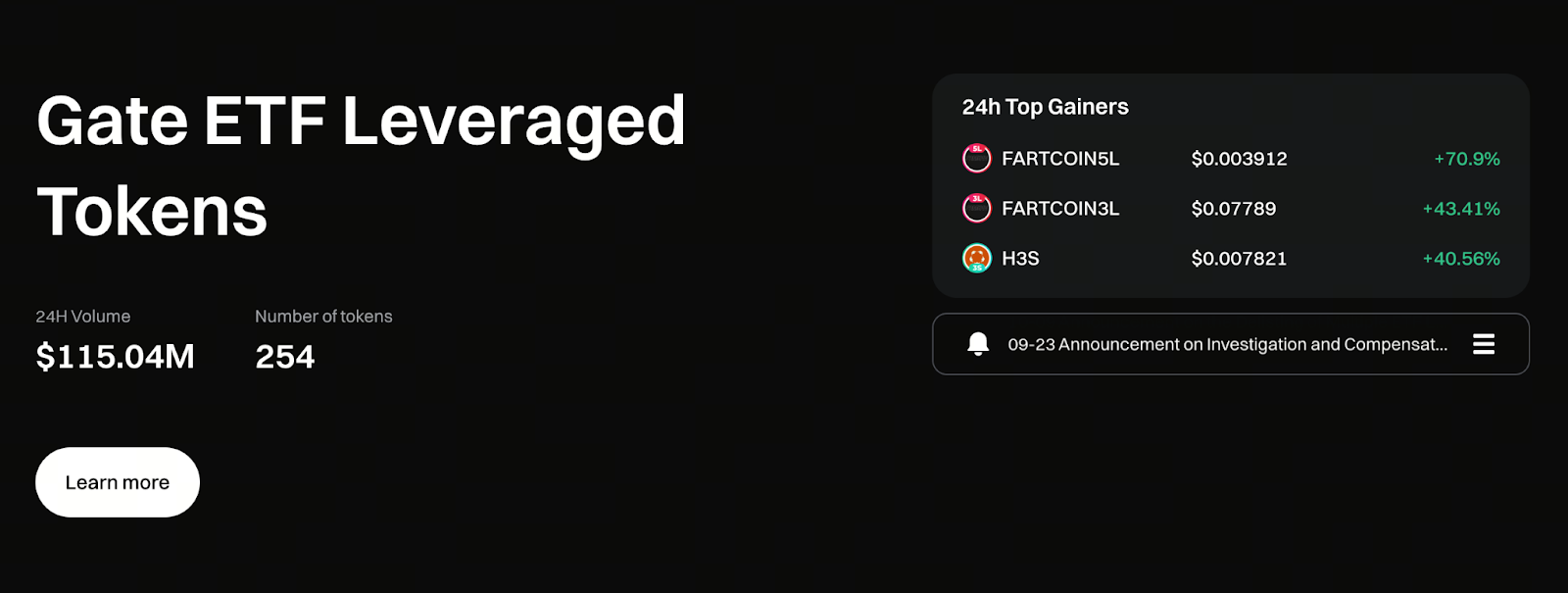

Why Are Gate ETF Leveraged Tokens More Popular Than Those on Other Platforms?

Gate’s leveraged token ecosystem is highly advanced because:

- Extensive range of supported assets

- Multiple leverage ratios (2×, 3×, 5×)

- Deep liquidity and minimal slippage

- Stable rebalancing mechanism

- Suitable for both beginners and high-frequency traders

During hot markets, Gate’s leveraged token trading volume is exceptionally high, ensuring strong liquidity and smooth execution.

Summary: Gate ETF Leveraged Tokens—A Powerful Trend Trading Tool

For crypto investors seeking the simplest way to benefit from leverage, Gate ETF leveraged tokens are an essential tool. Their advantages include:

- As easy to use as spot trading

- No liquidation risk and low psychological stress

- Automatic rebalancing to maintain leverage

- Explosive returns during trends

- Ideal for swing traders who understand the market

As trends become more frequent, mastering Gate ETF leveraged tokens means you can capture high-multiple returns in both bull and bear markets.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B