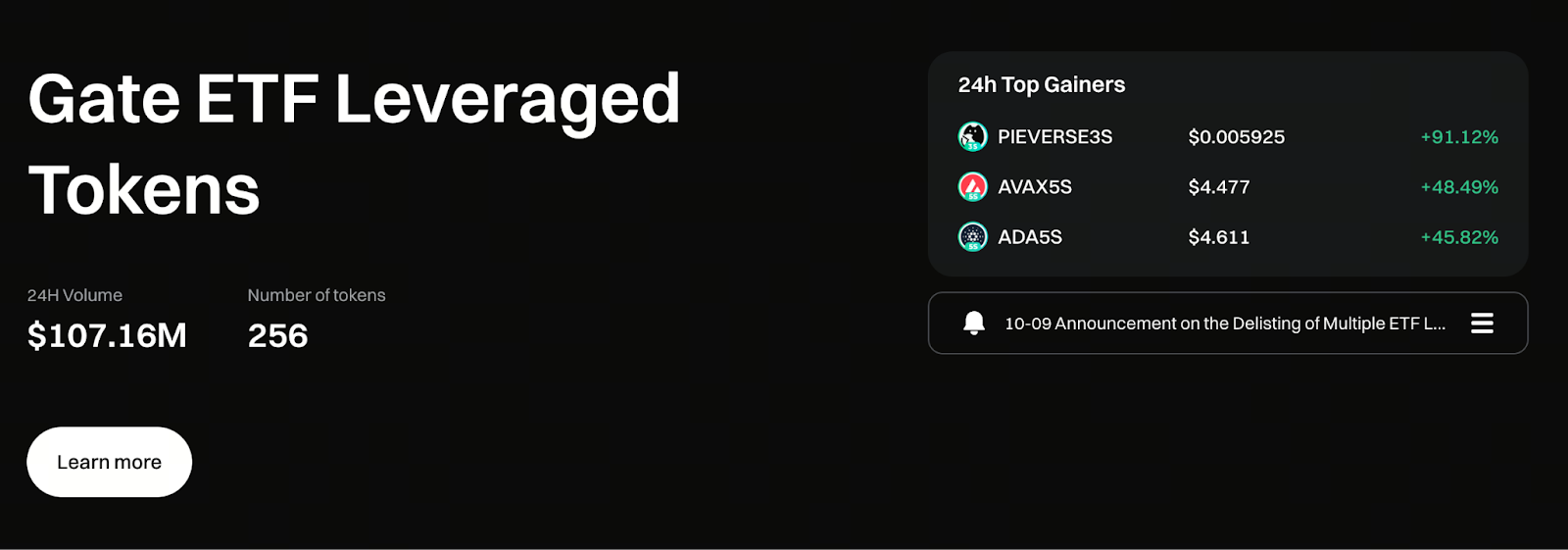

Gate ETF Leveraged Tokens: A Trend-Enhancing Tool Even Beginners Can Easily Master

Image: https://www.gate.com/leveraged-etf

Why Are ETF Leveraged Tokens Becoming Increasingly Popular in the Crypto Market?

Volatility in the cryptocurrency market brings both opportunities and risks. While traditional leveraged trading—such as futures contracts—can amplify gains, it also introduces challenges like funding fees, high liquidation risk, and complex operations, keeping many users on the sidelines.

Tools that can magnify returns while eliminating liquidation risk are in high demand. That’s exactly where Gate ETF Leveraged Tokens come in—making it easier for more users to access trending markets with lower barriers.

What Are Gate ETF Leveraged Tokens?

Gate ETF Leveraged Tokens are tokenized products designed to deliver a target leverage multiple. For example:

- BTC3L: 3x long Bitcoin

- ETH5L: 5x long Ethereum

- BTC3S: 3x short Bitcoin

These tokens directly track the underlying asset’s price and amplify its movements, allowing users to benefit from leveraged returns without the complexity of managing futures contracts.

Core Advantages: Why Are More Traders Choosing Gate ETF Leveraged Tokens?

1. No Margin Required, No Liquidation Risk

The most notable benefit of ETF Leveraged Tokens is the absence of forced liquidation.

Users don’t have to worry about overnight liquidations or constantly topping up margin, making these products especially suitable for beginners following market trends.

2. Automatic Rebalancing Maintains Fixed Leverage

The Gate platform automatically maintains target leverage (2x, 3x, 5x), so users never have to manually adjust their positions.

This offers two major advantages:

- No need for constant monitoring like with futures contracts

- Leverage remains stable and doesn’t decrease due to losses

This design is especially friendly for users who can’t watch the market around the clock.

3. Ideal for Short-Term and Trending Markets, High Potential Returns

When the market trends clearly, ETF Leveraged Tokens often outperform spot trading.

For example, if Bitcoin rises 8%, BTC3L may gain close to 24% or more.

In trending conditions, ETF Leveraged Tokens can deliver a compounding effect, making them especially attractive for swing traders.

When Should You Use Gate ETF Leveraged Tokens?

ETF Leveraged Tokens aren’t suitable for every market scenario. They work best in the following situations:

1. Strong Uptrend Markets

Examples include:

- Positive macroeconomic data

- Bitcoin breaking key price levels

- Industry news driving prices higher

In these cases, long products like BTC3L and ETH3L can accelerate returns.

2. Clear Downtrend Markets

Examples include:

- Market panic

- Technical breakdowns

- Black swan events causing sharp declines

Short tokens such as BTC3S and ETH3S offer strong hedging capabilities for users.

3. When Swing Trading Opportunities Are Clear

For traders skilled at identifying support and resistance levels, ETF Leveraged Tokens provide greater return flexibility than spot trading.

What Should You Watch Out for When Using Gate ETF Leveraged Tokens?

Although ETF Leveraged Tokens eliminate liquidation risk, they still have unique characteristics that users should understand:

1. Not Suitable for Long-Term Holding

In sideways markets, automatic rebalancing can lead to net asset value erosion. Therefore, ETF Leveraged Tokens are better for short-term or trending trades—not long-term investments.

2. Following the Trend Is More Important Than Timing Tops and Bottoms

ETF Leveraged Tokens amplify volatility, so trading with the trend means amplified gains, while going against it means amplified losses.

Take-profit and stop-loss strategies remain essential.

3. Monitor Net Asset Value During High Volatility

In highly volatile markets, rebalancing may occur more frequently. Users should keep an eye on price changes.

Why Are Gate ETF Leveraged Tokens Especially Popular?

Gate is one of the industry’s earliest and most professional platforms to offer leveraged tokens, with key advantages including:

- Wide product variety: BTC, ETH, SOL, DOGE, and more

- Multiple leverage options: 2x, 3x, 4x, 5x

- Transparent, traceable automatic rebalancing

- High liquidity for smoother trading

As a result, Gate ETF Leveraged Tokens have become go-to tools for many short-term traders and trend investors.

Conclusion: In Trending Markets, ETF Leveraged Tokens Are Powerful Yield Tools

In the highly volatile crypto market, Gate ETF Leveraged Tokens offer users a trading solution that is:

- Easy to use

- Risk-transparent

- Free from forced liquidation

- Effective at amplifying returns

For users seeking higher returns in trending markets but unwilling to take on the risks of traditional leveraged products, ETF Leveraged Tokens are certainly worth considering.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B