Gate ETF Leveraged Tokens: A Powerful Tool in Trend Markets to Easily Amplify Your Crypto Gains

What Are Gate ETF Leveraged Tokens?

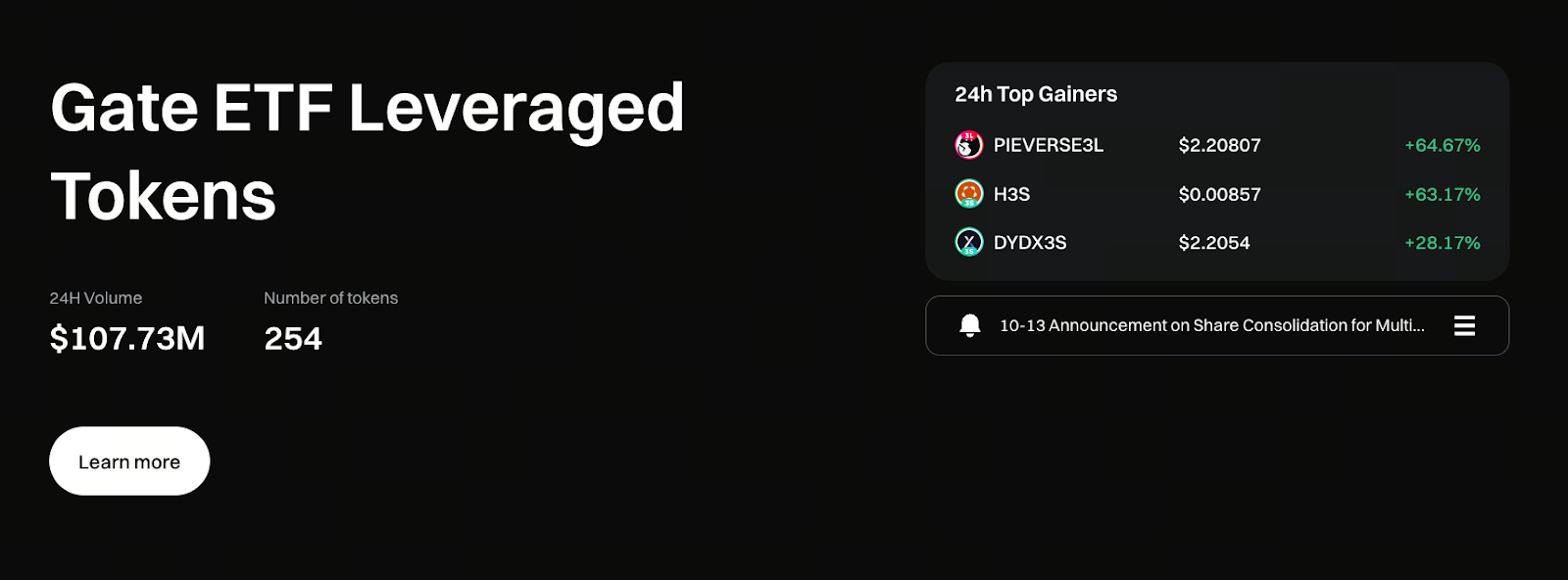

Image: https://www.gate.com/leveraged-etf

Gate ETF Leveraged Tokens are a type of crypto derivative that delivers leveraged returns without the need for margin. These tokens are backed by perpetual contracts as their underlying assets but are tokenized for ease of use. Users can buy and sell leveraged products just like any other cryptocurrency because of this structure.

For example:

- BTC3L represents a 3x long position on Bitcoin

- BTC3S represents a 3x short position on Bitcoin

If Bitcoin rises by 5%, BTC3L could rise by nearly 15%. There’s no need to open a contract, add margin, or manage positions—this is the key value proposition of Gate ETF Leveraged Tokens.

Why Are Gate ETF Leveraged Tokens Popular With Traders?

1. Exceptionally Simple to Use

ETF Leveraged Tokens can be traded directly in Gate’s standard spot market:

- No need to enable futures contracts

- No need to understand liquidation mechanisms

- No need to worry about funding rates

- No need to manually adjust leverage

This feature makes ETF Leveraged Tokens accessible to users seeking leverage without the complexity of derivatives trading.

2. No Forced Liquidation Risk—Ideal for Beginners and Swing Traders

ETF Leveraged Tokens are not subject to forced liquidation, as they don’t use margin ratios like futures contracts.

Even during extreme market volatility, your position will not be liquidated.

While the token’s net asset value will still fluctuate with market prices, the absence of forced liquidation significantly reduces stress, making these tokens especially suitable for:

- Anyone who doesn’t want to constantly monitor the market

- Anyone looking to avoid forced liquidations

- Anyone seeking leveraged returns through simple trades

3. Automatic Rebalancing Maintains Fixed Leverage

To keep ETF Leveraged Tokens at their target leverage (such as 2x or 3x), Gate automatically rebalances positions based on market movements. When the market trends strongly in one direction, this mechanism generates a compounding effect on returns.

For example, in a sustained uptrend: price increases → leverage ratio rises → automatic increase in position size → higher returns

This is why ETF Leveraged Tokens can rapidly amplify gains in trending markets.

When Should You Use Gate ETF Leveraged Tokens?

ETF Leveraged Tokens are not a one-size-fits-all solution, but in certain market conditions, they are the most effortless way to trade with leverage.

1. Clearly Trending Markets (Best Use Case)

In uptrends, use 3L tokens; in downtrends, use 3S tokens.

In trending markets, these tokens excel at amplifying returns because automatic rebalancing increases positions in the direction of the trend.

2. Swing Markets and Short-Term Trading

ETF Leveraged Tokens are ideal for:

- Intraday trading

- Short-term trends

- Breakout trades

- Sentiment-driven moves (hot topics, news catalysts)

Simply buy and sell. There is no need to manage leverage. This lets you focus on trading strategy.

3. Investors Who Want Leverage Without Understanding Contracts

ETF Leveraged Tokens are “non-contract leveraged tools,” suitable for users who:

- Want to avoid forced liquidation

- Prefer less operational complexity

- Seek higher returns from volatility

Risks to Consider When Using Gate ETF Leveraged Tokens

While there’s no forced liquidation, ETF Leveraged Tokens are not risk-free. You must understand the following before trading:

1. Sideways Markets Can Cause Net Asset Value Decay

The automatic rebalancing mechanism can repeatedly adjust positions in sideways markets, which erodes net asset value. Therefore:

Sideways markets are not suitable for holding leveraged tokens.

They are best used in uptrends, downtrends, or markets with a clear directional bias.

2. Not Suitable for Long-Term Holding

Due to daily management fees and rebalancing costs, holding these tokens long-term is often less effective than holding spot or futures directly.

ETF Leveraged Tokens serve as tactical tools rather than strategic portfolio assets.

3. Leverage Magnifies Both Risk and Return

While there’s no forced liquidation, losses can exceed those of spot trading. Make sure you understand your risk tolerance before trading.

How Can You Use Gate ETF Leveraged Tokens More Effectively?

These tips can help you achieve more stable and robust returns:

1. Focus on Trends—Avoid Trading in Sideways Markets

Only act when the trend is clear. This is the most important rule for improving your win rate with ETF Leveraged Tokens.

2. Set Clear Take-Profit and Stop-Loss Levels

While ETF Leveraged Tokens are not subject to liquidation, trend reversals can still cause significant losses. It’s best to set:

- Target returns

- Maximum drawdown

You can bring structure to your trading process by setting these levels.

3. Use Price Indices to Assess Market Sentiment

Combine:

- Major BTC/ETH trends

- Sector momentum

- Leveraged token net asset value changes

- Volume changes

to identify optimal entry points.

Summary: Why Should You Consider Gate ETF Leveraged Tokens?

Combining simple operation, no forced liquidation, automatic rebalancing, and leveraged returns, Gate ETF Leveraged Tokens are a highly efficient tool for both retail investors and trend traders. They’re ideal for:

- Anyone seeking to amplify returns in trending markets

- Anyone who wants leverage without learning contracts

- Anyone looking to avoid forced liquidation

- Anyone wanting to capture swing trades with minimal effort

When used correctly, ETF Leveraged Tokens can significantly increase returns in your crypto investment portfolio.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B