Gate Deepens Its TradFi Strategy as CFD Trading Drives a Multi-Asset Platform Upgrade

Growing Multi-Asset Trading Demand Positions TradFi as a New Platform Growth Engine

Global financial markets have become increasingly interconnected in recent years, with cryptocurrency prices showing stronger correlations to traditional financial markets. A rising number of traders now focus on cross-market price movements, seeking to manage risk and execute multi-asset trades on a single platform. In this environment, TradFi products have emerged as a key area of expansion for crypto trading platforms.

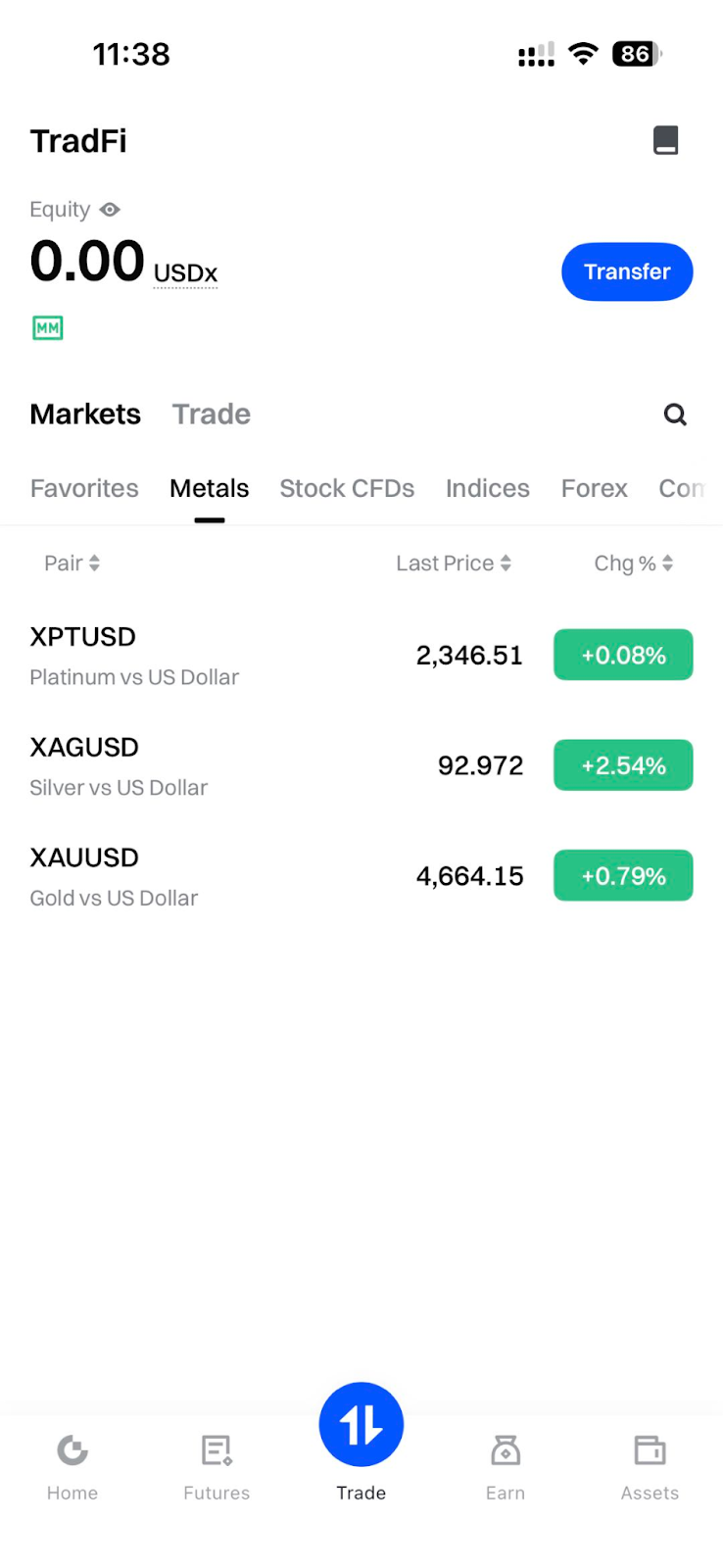

Gate has officially launched TradFi Contract for Difference (CFD) trading, opening access to price trading for traditional financial assets—including gold, forex, global indices, commodities, and select popular stocks—further strengthening its multi-asset trading portfolio.

CFD Model: Focusing Directly on Price Volatility

Gate TradFi adopts the Contract for Difference (CFD) trading model, enabling users to speculate on asset price movements without owning the underlying assets. Widely used in traditional finance, this approach is ideal for short- and medium-term trading as well as hedging strategies.

CFDs allow users to concentrate on price analysis and capital management, with no need for asset settlement. This model gives TradFi products greater operational flexibility within the crypto trading platform environment.

USDx Account System: Bridging Crypto and TradFi

Gate TradFi uses USDx as the margin and account display unit for account and fund management. USDx is Gate’s internal pricing unit for TradFi scenarios, pegged 1:1 to USDT and not a standalone asset.

Users simply transfer USDT to their TradFi account, and the system automatically displays the balance in USDx—no extra conversion or fees required. All funds remain fully backed by USDT, enabling crypto users to trade traditional financial assets within a familiar funding structure.

Clear Trading Rules Lower the Barrier to Entry

Gate TradFi contracts feature distinct trading mechanisms compared to crypto perpetual contracts. TradFi contracts follow traditional market rules, including fixed trading hours and scheduled closures, with overnight fees incurred during market breaks.

TradFi contracts also use fixed leverage multiples, which users cannot manually adjust; the margin system is cross-margin, and long/short positions in the same pair can be hedged by position size. This structure reduces complex parameter settings and helps users intuitively understand risk profiles.

Leverage and Fees Reflect Traditional Market Standards

Gate TradFi offers up to 500x leverage for highly liquid assets such as forex and indices, while stock CFDs support up to 5x leverage—matching the risk profiles of each asset class.

Gate TradFi also provides a transparent fee structure, with single trade commissions as low as $0.018. This helps lower trading costs and gives users flexibility for frequent trades or strategy testing.

MT5 System Integration Boosts Stability and Transparency

Gate TradFi runs on the MT5 (MetaTrader 5) system—an industry-standard trading platform in traditional finance known for robust market display, order execution, and stability.

Users can trade via the Gate App or the MT5 client, with account balances, positions, and trade history synchronized across all devices. The platform uses a margin ratio-based forced liquidation mechanism: when the account margin ratio falls to 50% or below, the system triggers stepwise liquidation to manage overall risk exposure.

Experience Incentives Lower the Cost of Entry

To help users explore TradFi trading, Gate is launching a TradFi experience campaign. After signing up, users can earn up to 110 USDT in experience rewards and, by meeting specified trading criteria, unlock up to 3,000 USDT in staged incentives.

This incentive system gives crypto users a user-friendly starting point for traditional financial asset trading, helping them get acquainted with TradFi product logic in a low-risk setting.

Strategic Implications of TradFi Expansion

Gate TradFi’s launch not only diversifies the platform’s trading offerings, but also signals a shift as crypto trading platforms adopt product and risk management structures aligned with mature financial markets. By integrating crypto and traditional asset price trading within a single platform, Gate delivers a more complete trading ecosystem.

As crypto and traditional financial markets continue to converge, multi-asset and cross-market trading capabilities are likely to become core competitive advantages for platforms. Gate’s ongoing investment in TradFi also sets a new direction for the industry’s development of integrated trading infrastructure.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Bitcoin's Future & TradFi (3,3)

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?