From Store of Value to Yield Asset: How GTBTC Is Reshaping the Way Bitcoin Is Used

1. The Evolving Role of BTC

For a long time, BTC’s core identity was well-defined: a hedge against inflation, decentralized, and a long-term store of value.

However, as the crypto market’s infrastructure has matured, BTC’s role is expanding. It’s no longer just something you hold and wait to appreciate. Instead, BTC is increasingly capable of participating in yield management. This shift has driven the emergence of yield-focused BTC products.

2. Why Yield Generation Is the New Direction for BTC

Unlike newer assets, BTC’s greatest advantage is its predictability. Yet, it also has a clear limitation: BTC doesn’t continuously appreciate over time. During periods of market volatility or consolidation, a significant portion of BTC assets remain underutilized. In this context, generating steady returns from BTC becomes a natural demand.

GTBTC was specifically designed to meet this need.

3. GTBTC’s Core Positioning: An Upgrade, Not a Replacement for BTC

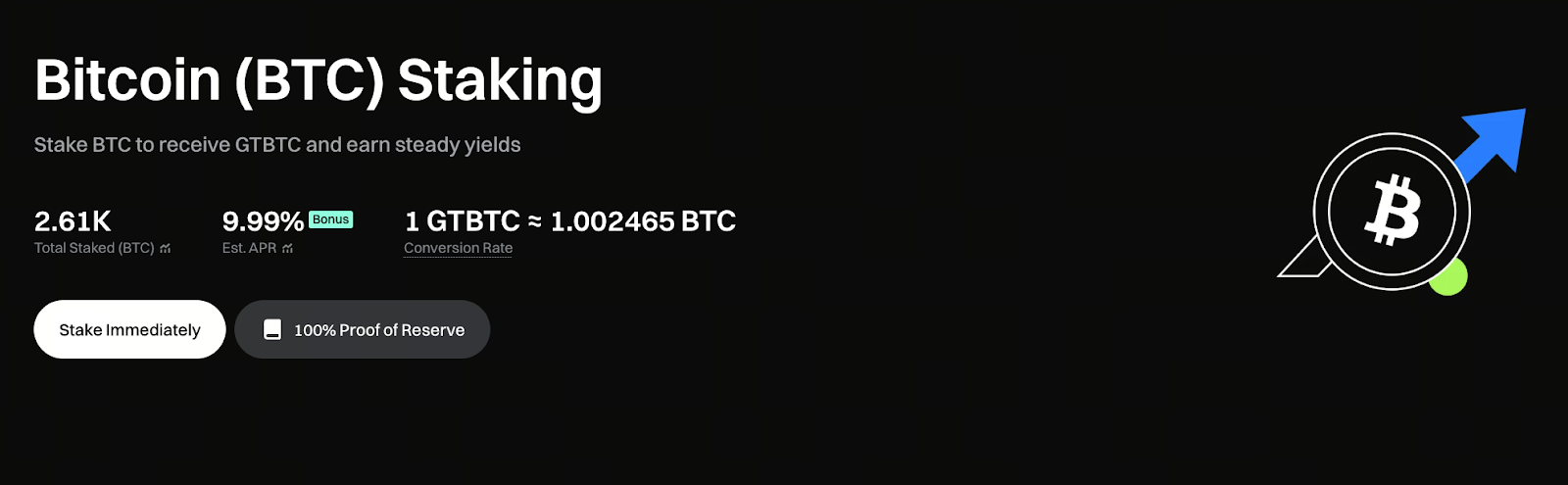

Image: https://www.gate.com/staking/BTC?pid=24

GTBTC isn’t a new standalone asset. It’s a yield-oriented wrapper built on BTC. Through Gate’s asset management and yield structure, users who convert BTC into GTBTC maintain exposure to BTC’s price while earning an additional 9.99% annualized return.

This approach makes GTBTC more of an “enhanced version” of BTC rather than a higher-risk substitute.

4. How GTBTC Transforms the Holding Experience

In the traditional BTC holding model, user engagement is minimal. Unless users actively trade, their assets remain largely idle.

GTBTC introduces a new dynamic: even without frequent action, your assets continue to grow. This shift reduces the psychological burden of simply “holding and waiting,” making long-term holding more sustainable.

5. GTBTC Is Not Designed for Short-Term Thrills

It’s important to clarify that GTBTC isn’t intended for short-term traders. It doesn’t leverage, amplify volatility, or chase ultra-high annual yields.

GTBTC is better suited for users who believe in BTC’s long-term value and want to earn additional returns while holding. Its yield structure focuses on stability and predictability.

6. GTBTC’s Role in Asset Allocation

From a portfolio perspective, GTBTC sits between spot BTC and active strategies. It preserves BTC’s fundamental attributes as the underlying asset while introducing yield, helping to offset the opportunity cost of simply holding BTC over time.

For users with a long-term allocation strategy, this type of asset is closer to a “core position.”

7. GTBTC’s Value Goes Beyond Yield Figures

The 9.99% annualized yield is GTBTC’s most obvious attraction, but it’s not the full story. More importantly, GTBTC introduces a new way to use BTC: instead of passively waiting for price changes, BTC can now actively participate in value growth.

This approach is increasingly becoming mainstream in today’s market environment.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About