From MSTR to BMNR: How Corporate Crypto Hoarding Is Reshaping the Crypto Market Landscape

As the crypto market continued its correction in early 2026—with Bitcoin trading in the $89,000–$90,000 range and Ethereum around $3,200—enterprise-level token accumulation strategies have become one of the market’s most prominent narratives. This article analyzes the accumulation approaches of two leading companies, Strategy (formerly MicroStrategy) and Bitmine Immersion Technologies, highlighting their strategic distinctions, financial models, and multidimensional impacts on the market.

Section 1: In-Depth Analysis of Token Accumulation Behavior

1.1 Strategy (MSTR): Leveraged Conviction Injection

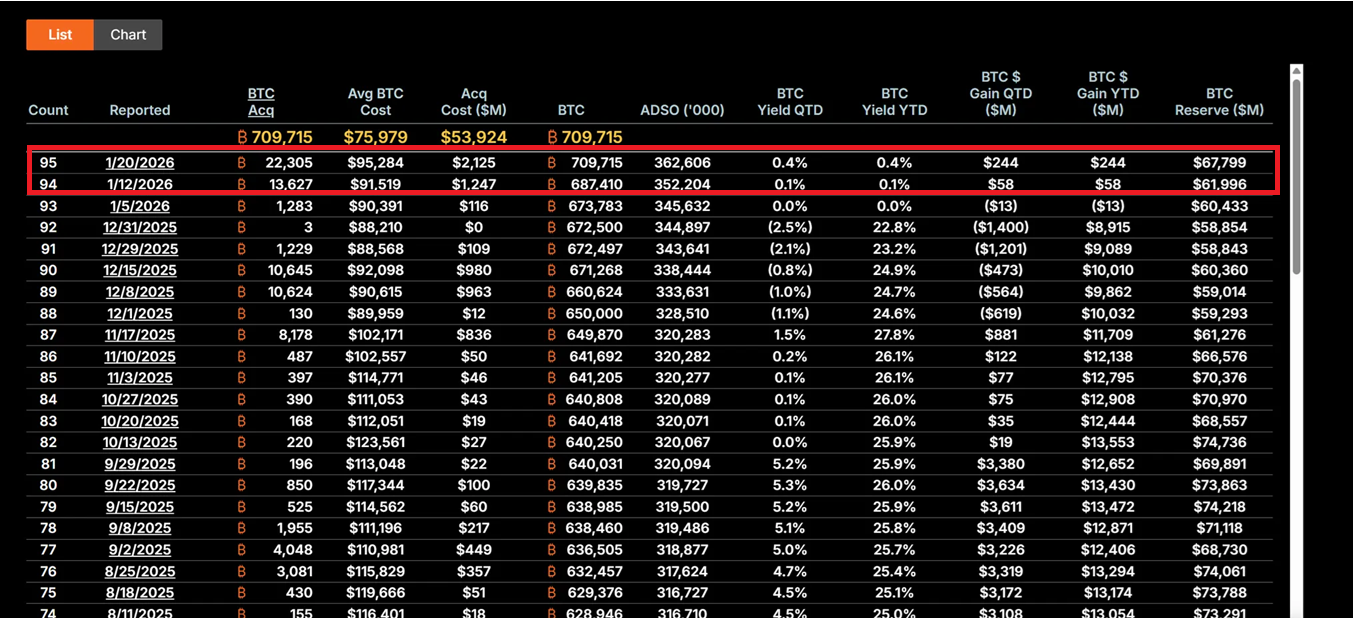

Under CEO Michael Saylor, Strategy has fully transformed into a Bitcoin holding vehicle. From January 12–19, 2026, the company acquired 22,305 BTC at an average price of approximately $95,500, totaling $2.13 billion—the largest single purchase in the past nine months. MSTR now holds 709,715 BTC, with an average cost of $75,979 and a total investment approaching $53.92 billion.

Their core approach is the “21/21 Plan”: raising $21 billion each via equity financing and fixed-income instruments to continuously purchase Bitcoin. Rather than relying on operating cash flow, this model leverages capital markets—issuing shares, convertible bonds, and ATM (At-The-Market) instruments—to convert fiat debt into deflationary digital assets. As a result, MSTR’s stock price volatility is typically 2–3 times that of Bitcoin, making it the market’s most aggressive “BTC proxy.”

Saylor’s investment philosophy is grounded in unwavering confidence in Bitcoin’s scarcity. He views BTC as “digital gold” and a hedge against inflation. In today’s macro environment—marked by Fed rate uncertainty, trade wars, and geopolitical risks—this contrarian approach demonstrates institutional-grade long-term commitment. Even after a 62% pullback from its peak, MSTR is regarded by value investors as an “extreme discount” buying opportunity.

If Bitcoin rebounds to $150,000, MSTR’s holdings would exceed $106.4 billion, and its stock price could experience 5–10x leverage-driven upside. However, risks are equally pronounced: if BTC falls below $80,000, debt costs (annualized at 5–7%) could trigger liquidity pressures, forcing the company to adjust its strategy or even face liquidation risk.

1.2 Bitmine Immersion Technologies (BMNR): Staking-Driven Productivity Model

BMNR, led by Tom Lee, has taken a distinctly different path. The company positions itself as the “world’s largest Ethereum Treasury,” holding 4.203 million ETH valued at approximately $13.45 billion as of January 19. Critically, 1,838,003 ETH are staked, generating about $590 million in annual cash flow at current 4–5% yields.

This “staking-first” strategy provides BMNR with an intrinsic value buffer. Unlike MSTR’s pure price exposure, BMNR earns continuous income through network participation—similar to holding high-yield bonds with the added benefit of Ethereum ecosystem growth. The company staked an additional 581,920 ETH between Q4 2025 and Q1 2026, demonstrating sustained commitment to long-term network value.

BMNR’s ecosystem expansion strategy is also noteworthy. The company plans to launch the MAVAN staking solution in Q1 2026, offering ETH management services for institutional clients and building an “ETH per share” growth model. Its $200 million investment in Beast Industries on January 15 and shareholder-approved share cap expansion pave the way for potential M&A, such as acquiring smaller ETH holding companies. BMNR also holds 193 BTC and $22 million in Eightco Holdings equity, bringing total crypto and cash assets to $14.5 billion.

From a risk management perspective, BMNR’s staking income provides downside protection. Even if ETH fluctuates around $3,000, staking returns help offset opportunity costs. However, if network activity remains weak and staking APY declines, or if prices fall below key support levels, the company’s NAV discount could widen further (current stock price is about $28.85, down over 50% from its peak).

1.3 Strategy Comparison and Evolution

These two companies exemplify distinct paradigms of enterprise token accumulation. MSTR operates an aggressive, high-risk, high-reward leveraged model, relying entirely on Bitcoin price appreciation to deliver shareholder value. Its strategy is built on belief in BTC’s long-term scarcity and macro monetary depreciation. BMNR, by contrast, employs a defensive, yield-focused ecosystem model, diversifying income through staking and services to reduce dependence on single asset price movements.

Importantly, both firms have learned from 2025, shifting toward more sustainable financing models. MSTR avoids excessive equity dilution, while BMNR reduces reliance on external financing via staking income. This evolution signals a shift from “experimental allocation” to “core financial strategy” and marks the arrival of the “institutional-led, not retail FOMO” era in 2026.

Section 2: Multifaceted Market Impact

2.1 Short-Term Impact: Bottom Signals and Sentiment Recovery

MSTR’s large-scale purchases are often seen as confirmation signals for Bitcoin’s market bottom. The $2.13 billion buy in mid-January drove single-day inflows to Bitcoin ETFs to $8.44 billion, showing that institutional capital is following the lead of corporate accumulation. This “corporate anchoring” effect is especially vital when retail sentiment is fragile—when fear and greed indices signal “extreme fear,” MSTR’s continued buying provides psychological support to the market.

BMNR’s Ethereum accumulation also acts as a catalyst. Its strategy aligns with the optimism of traditional financial giants like BlackRock regarding Ethereum’s dominance in real-world asset tokenization (RWA). This could spark a “second wave of ETH Treasury,” as companies like SharpLink Gaming and Bit Digital begin to follow suit, accelerating staking adoption and ecosystem M&A.

Investor sentiment is shifting from panic to cautious optimism. This self-reinforcing sentiment recovery could lay the foundation for the next market upcycle.

2.2 Medium-Term Impact: Volatility Amplification and Narrative Divergence

However, the leverage inherent in enterprise accumulation also heightens market risk. MSTR’s high-leverage model could trigger chain reactions if Bitcoin corrects further. With a stock price beta more than double that of BTC, any decline is magnified, potentially leading to forced selling or liquidity crises. This “leverage transmission” effect caused similar liquidation waves in 2025, as leveraged holders were forced to unwind during rapid downturns.

BMNR, while buffered by staking income, faces its own challenges. Weak Ethereum network activity could depress staking APY, undermining its “productive asset” advantage. Prolonged weakness in the ETH/BTC ratio could further widen BMNR’s NAV discount, creating a negative feedback loop.

The deeper impact is narrative divergence. MSTR reinforces Bitcoin’s role as a “scarce safe-haven asset,” attracting conservative investors seeking macro hedges. BMNR advances Ethereum’s “productive platform” narrative, emphasizing its value in DeFi, staking, and tokenization. This split could cause BTC and ETH to decouple in different macro scenarios—for example, in liquidity-tightening environments, BTC may outperform due to its “digital gold” properties; in tech innovation cycles, ETH may gain premiums from ecosystem growth.

2.3 Long-Term Impact: Financial Paradigm Reshaping and Regulatory Adaptation

Over the long term, MSTR and BMNR’s actions could reshape corporate financial management paradigms. If the US CLARITY Act is enacted, clarifying accounting and regulatory treatment of digital assets, it would dramatically lower compliance costs for corporate crypto allocations. This could prompt Fortune 500 companies to allocate over $1 trillion to digital assets, shifting balance sheets from “cash + bonds” toward “digital productive assets.”

MSTR stands as the classic “BTC proxy” case, with its market cap and NAV premium mechanism known as the “reflexive flywheel”—issuing shares at a premium to buy more Bitcoin, boosting BTC per share, driving up stock price, and fueling a positive feedback loop. BMNR offers a replicable template for ETH Treasury, demonstrating how staking yields can deliver sustained shareholder value.

This may also trigger consolidation across the sector. BMNR’s shareholder-approved share expansion for M&A could lead to acquisitions of smaller ETH holding firms, forming a “Treasury giant.” Weaker accumulation companies may be forced to sell or merge under macro pressure, driving a “survival of the fittest” market structure. This marks a shift from retail-driven to institutionally led crypto markets.

Yet, this transition is not without risk. If regulatory conditions worsen (e.g., the SEC takes a tougher stance on digital asset classification) or the macro environment deteriorates unexpectedly (such as the Fed hiking rates in response to inflation), enterprise accumulation could turn from “paradigm shift” to “leverage trap.” Historically, similar financial innovations have triggered systemic crises under regulatory crackdowns or market reversals.

Section 3: Key Issues Exploration

3.1 Enterprise Token Accumulation: New Golden Age or Leverage Bubble?

The answer depends on perspective and time frame. For institutional investors, enterprise accumulation reflects rational capital allocation evolution. Amid global debt expansion and intensifying currency depreciation concerns, allocating assets to scarce digital assets is strategically sound. MSTR’s “smart leverage” is not mere speculation—it utilizes capital market tools to convert equity premiums into digital asset holdings, which is sustainable as long as the equity market supports the strategy.

BMNR’s staking model further demonstrates the “productive” nature of digital assets. Its $590 million annualized staking income not only provides cash flow but also enables financial resilience amid price volatility. This is akin to holding high-yield bonds with network growth dividends, illustrating crypto assets’ potential beyond pure speculation.

Yet, critics’ concerns are not baseless. Current enterprise accumulation leverage ratios are historically high, with $9.48 billion in debt and $3.35 billion in preferred equity financing potentially becoming burdensome in a macro downturn. The lessons of the 2021 retail bubble remain vivid—many leveraged participants suffered heavy losses during rapid deleveraging. If today’s enterprise accumulation wave simply shifts leverage from retail to corporate hands without fundamentally changing risk structure, the outcome could be equally severe.

A more balanced perspective sees enterprise accumulation in an “institutional transition period.” It is neither a simple bubble—with fundamental and long-term logic—nor an immediate golden age, as regulatory, macro, and technological risks persist. Execution is key: can sufficient market recognition be established before regulatory clarity? Can financial discipline hold under macro pressure? Can technological and ecosystem innovation prove digital assets’ long-term value?

Conclusion and Outlook

The accumulation strategies of MSTR and BMNR mark a new phase for the crypto market. This is no longer a retail-driven speculative mania, but a rational, institutionally led allocation based on long-term strategy. While the two companies have chosen distinctly different paths—MSTR’s leveraged conviction injection and BMNR’s staking-driven productivity model—both demonstrate a commitment to the long-term value of digital assets.

Enterprise accumulation is fundamentally a wager on “time.” It bets that regulatory clarity will arrive before liquidity dries up, that price appreciation will precede debt maturity, and that market conviction will outweigh macro headwinds. There is no middle ground—either digital asset allocation proves to be a paradigm revolution in 21st-century corporate finance, or it becomes another cautionary tale of excess financialization.

The market stands at a crossroads. To the left is a mature, institutionally led market; to the right, the liquidation abyss of leverage collapse. The answer will emerge over the next 12–24 months, and we are all witnesses to this experiment.

This report’s data was compiled and edited by WolfDAO. For questions or updates, please contact us.

Disclaimer:

- This article is reprinted from [Medium], and copyright belongs to the original author [Nikka / WolfDAO (X: @10xWolfdao)]. If you have any objections to this reprint, please contact the Gate Learn team, and the team will process your request promptly.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is referenced, do not copy, distribute, or plagiarize the translated article.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?