Fixed-rate lending: the key to DeFi scaling success or failure

Fixed-rate lending primarily attracts institutional borrowers and users employing recursive strategies. While on-chain credit is poised for expansion, most participants currently value the flexibility to “withdraw funds at any time.” Instead of locking lenders into fixed terms, a more effective solution is to build an interest rate swap layer atop existing money markets like Aave, enabling fixed-rate borrowing without sacrificing liquidity.

Insights from Traditional Finance: Fixed Rates Originate from Borrower Demand

In private debt markets, fixed rates dominate because borrowers need certainty—not because lenders prefer them.

- Borrowers (corporations, private equity funds, real estate developers, etc.) prioritize predictable cash flow. Fixed rates help avoid the risk of rising benchmark rates, simplify budgeting, and reduce refinancing risk. This is especially critical for highly leveraged or long-term projects, where rate volatility can threaten viability.

- Lenders generally favor floating rates. Loan pricing typically follows a “benchmark rate plus credit risk premium” structure. Floating rates protect profit margins during rate increases, reduce duration risk, and provide extra yield when benchmarks rise. Lenders only offer fixed rates when they can hedge rate risk or charge an adequate premium.

Fixed-rate products respond to borrower needs—they are not the market’s default. For DeFi, this means that without clear and sustained borrower demand for rate certainty, fixed-rate lending will struggle to attract liquidity, scale, or achieve sustainable growth.

Who Borrows on Aave, Morpho & Euler—and Why?

It’s a common misconception that “traders borrow from money markets for leverage or shorting.”

In practice, directional leverage is almost exclusively executed via perpetual contracts, which offer greater capital efficiency. Money markets require overcollateralization, making them unsuitable for speculative leverage.

Still, Aave alone has approximately $8 billion in stablecoin loans. Who are these borrowers?

They fall into two main groups:

- Long-term holders, whales, and project treasuries: These users collateralize crypto assets (e.g., ETH) and borrow stablecoins for liquidity, avoiding asset sales (preserving upside and sidestepping taxable events).

- Yield loopers: They borrow to recursively leverage yield-bearing assets (such as liquid staking tokens like stETH, or yield-generating stablecoins like sUSDe), aiming for higher net yields rather than price speculation.

Is There Real On-Chain Demand for Fixed Rates?

Yes. The primary demand comes from two groups: institutional-grade crypto collateralized loans and recursive strategy users.

1. Institutional Crypto-Backed Loans Require Fixed Rates

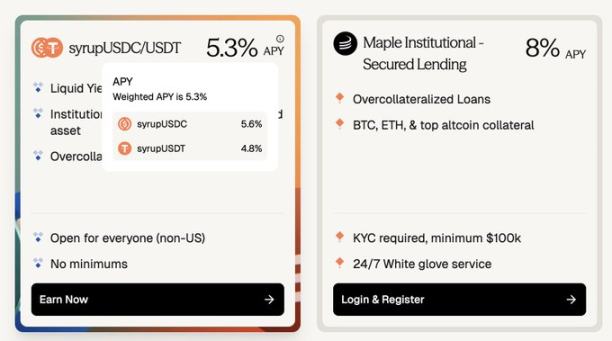

Maple Finance, for example, provides overcollateralized stablecoin loans to institutions, using blue-chip assets like BTC and ETH as collateral. Borrowers include high-net-worth individuals, family offices, and hedge funds seeking predictable, fixed-rate funding.

- Rate comparison: Borrowing USDC on Aave costs roughly 3.5% annually, while similar fixed-rate loans on Maple yield 5.3%–8%. Switching to fixed rates means borrowers pay a premium of about 180–450 basis points.

- Market size: Maple’s Syrup pool manages about $2.67 billion, comparable to Aave’s $3.75 billion in outstanding loans on Ethereum mainnet.

(Aave’s ~3.5% vs. Maple’s ~8%—fixed-rate crypto loans require a premium of roughly 180–400 basis points.)

Some borrowers choose Maple to avoid early DeFi smart contract risks. As protocols like Aave prove their security, transparency, and liquidation mechanisms, perceived risks decrease. Reliable on-chain fixed-rate options could compress the premium for off-chain fixed-rate loans.

2. Recursive Strategies Need Fixed Rates

Recursive strategies generate multi-billion-dollar demand, but volatile borrowing rates often erode profitability.

As one stablecoin yield looper put it: “As a looper/borrower, unpredictable borrowing rates can suddenly wipe out months of accrued yield, resulting in losses.”

Historical data confirms that borrowing rates on Aave and Morpho are highly volatile, with annualized fluctuations exceeding 20%.

Loopers earn fixed returns (e.g., via Pendle PT), but floating-rate loans introduce rate risk. If borrowing rates spike, profits evaporate. With both borrowing and investment returns fixed, risk is eliminated—strategies are easier to assess, positions can be held securely, and capital is deployed more efficiently.

As on-chain infrastructure (such as Pendle PT) passes five years of security testing, demand for on-chain fixed-rate loans is surging.

If demand exists, why hasn’t the market scaled? Consider the supply-side constraints.

Flexibility Is the “Priceless Asset” for On-Chain Participants

Flexibility means the ability to adjust or exit positions at any time, with no lockup period—lenders can withdraw and borrowers can repay or redeem collateral at will, without penalties.

Pendle PT holders, by contrast, sacrifice some flexibility. Even in the largest pools, Pendle’s mechanism cannot instantly unwind positions over about $1 million without significant slippage.

How much compensation do on-chain lenders get for giving up flexibility? For Pendle PT, compensation often exceeds 10% annualized, and during YT points trading frenzies (e.g., usdai on Arbitrum), it can surpass 30%.

True borrowers (not speculators) cannot absorb a 10% fixed-rate cost. This elevated rate is essentially a “premium” for surrendering flexibility, and without YT point speculation, it’s unsustainable.

While PTs add protocol and underlying asset risk beyond base lending protocols like Aave, the core takeaway remains: Fixed-rate markets that require lenders to give up flexibility will not scale if borrowers can’t afford the higher rates.

Term Finance and TermMax exemplify this: Few lenders are willing to sacrifice flexibility for marginal interest, and borrowers won’t pay 10% to lock rates when Aave rates are 4%.

The Solution: Don’t Directly Match Fixed-Rate Borrowers with Fixed-Rate Lenders

Fixed-rate borrowers should be matched with rate traders. Here’s how:

Step One: Preserve the Lender Experience

Most on-chain capital trusts only the security of Aave, Morpho, and Euler, preferring the simple “deposit and earn” experience. These are not power users chasing marginal yield across new protocols.

To scale fixed-rate markets, the lender experience must mirror Aave’s:

- Deposit anytime

- Withdraw anytime

- Minimal new trust assumptions

- No lockup period

Ideally, fixed-rate protocols should build directly on trusted money markets like Aave, leveraging their security and liquidity.

Step Two: Trade Rate Spreads, Not Principal

Fixed-rate borrowers don’t need a fully locked, full-term loan. They need capital willing to take on the risk of the “agreed fixed rate” versus “Aave floating rate” spread; the principal can still be borrowed from Aave or similar platforms.

In essence, traders exchange the expected difference between fixed and floating rates—not the full loan principal.

An interest rate swap layer enables this:

- Hedgers pay a fixed outflow to receive floating income that matches Aave’s variable rate.

- Macro traders can express rate views with high capital efficiency.

For example, to short Aave’s borrowing rate on a $10 million, 1-month loan (fixed rate at 4% annualized), a trader might only need to post about $33,300 in margin—implying 300x capital efficiency.

Given Aave rates often fluctuate between 3.5% and 6.5%, this leverage lets traders treat the rate itself as a high-volatility “token” (moving from $3.5 to $6.5), with swings far exceeding mainstream cryptocurrencies and tightly correlated with market liquidity and prices, while avoiding the liquidation risk of explicit leverage (like 40x on BTC).

Go long to profit from rate spikes, go short to profit from troughs.

Long-Term Perspective: Fixed Rates Are Essential for On-Chain Credit Growth

As on-chain credit expands, demand for fixed-rate loans will grow. Borrowers will need predictable financing costs to support larger, longer-term positions and productive capital allocation.

- Institutional credit expansion: Projects like Cap Protocol are advancing institutional on-chain credit, helping re-staking protocols insure institutional-grade stablecoin loans. Rates are currently set by utilization curves for short-term liquidity, but institutional borrowers value rate certainty. In the future, a dedicated rate swap layer will be critical for term pricing and risk transfer.

- On-chain consumer credit: Projects like 3Jane focus on consumer lending, which is almost entirely fixed-rate due to the need for certainty.

Borrowers may eventually access segmented rate markets based on credit rating or collateral type. Unlike traditional finance, on-chain rate markets may allow borrower groups to face market-driven rates directly, rather than being locked into rates set by a single lender.

Disclaimer:

- This article is republished from [Foresight News] with copyright belonging to the original author [nico pei]. If you have concerns regarding republication, please contact the Gate Learn team for prompt resolution.

- Disclaimer: The views and opinions expressed are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team and may not be copied, distributed, or plagiarized without mention of Gate.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

Dive into Hyperliquid

What Is a Yield Aggregator?

What is Stablecoin?