Fidelity’s 2026 Crypto Market Outlook

TL;DR:

Investors seeking short-term profits should proceed with caution. However, those planning to hold long term may still have time. This year, more governments and corporations worldwide are adding digital assets to their balance sheets. This new demand has led some investors to believe the traditional four-year cycle for cryptocurrencies may be over.

In March, President Trump signed an executive order to establish a strategic Bitcoin reserve for the U.S. government. The order officially designates all Bitcoin and several other cryptocurrencies currently held by the government as reserve assets.

While the full impact of this executive order is yet to be seen, 2025 has made one thing clear: cryptocurrencies are achieving mainstream acceptance. No longer are they viewed solely as a volatile speculative vehicle for “degens” (short for “degenerate”—a term crypto traders use self-referentially due to the market’s extreme volatility and the mindset required to navigate it). Now, the U.S. government recognizes crypto as a legitimate store of value.

So what does this mean for the crypto market as we head into 2026? Do the current sharp price corrections signal the end of the bull market? Is it too late to invest in crypto? Here are several key trends to watch.

Will More Countries Adopt Crypto Reserves?

Many countries now hold some cryptocurrency, but few have formally established crypto reserves—officially designating their holdings as financial assets serving national strategic interests.

This started to change in 2025, most notably with President Trump’s March executive order, and could accelerate in 2026.

For example, in September, Kyrgyzstan passed a bill to establish its own crypto reserves. Elsewhere, more countries are exploring this path. Brazil’s Congress recently advanced a bill that would allow up to 5% of the country’s international reserves to be held in Bitcoin, though it’s not yet clear if the bill will become law.

“Fidelity Digital Assets believes more countries may buy Bitcoin in the future, driven by game theory,” said Chris Kuiper, Vice President of Research at Fidelity Digital Assets. “If more countries hold Bitcoin as part of their foreign exchange reserves, others could feel competitive pressure to follow suit.”

What does this mean for prices? “From a basic supply and demand perspective, any additional demand for Bitcoin could drive prices higher,” Kuiper said. “Of course, the key is the magnitude of incremental demand and whether other investors are selling or holding.”

Will Corporations Keep Buying Crypto?

Governments aren’t the only potential new source of demand in 2026. Corporations may ramp up their participation—some began adding Bitcoin and other cryptocurrencies to their balance sheets in 2025. One of the most prominent examples is software and analytics company Strategy (formerly MicroStrategy, ticker: MSTR), which has been steadily buying Bitcoin since 2020. This year, more companies have followed suit, turning it into a trend. As of November, well over 100 publicly traded companies—both domestic and international—hold crypto. About 50 of them currently hold over 1 million Bitcoin each.

“There are clear arbitrage opportunities, where some firms can leverage their market position or financing channels to raise capital for Bitcoin purchases,” Kuiper said. “Some of this is driven by investment mandates and by geographic and regulatory factors. For example, investors unable to buy Bitcoin directly may choose to gain exposure through these companies or their issued securities.”

On the surface, corporate crypto purchases boost market demand and help drive asset prices higher. But investors should also recognize the risks. “If these companies choose or are forced to sell part of their digital assets—such as during a bear market—that could certainly put downward pressure on the price of Bitcoin or other digital assets they hold,” Kuiper noted.

Source: Fidelity Investments. Past performance does not guarantee future results.

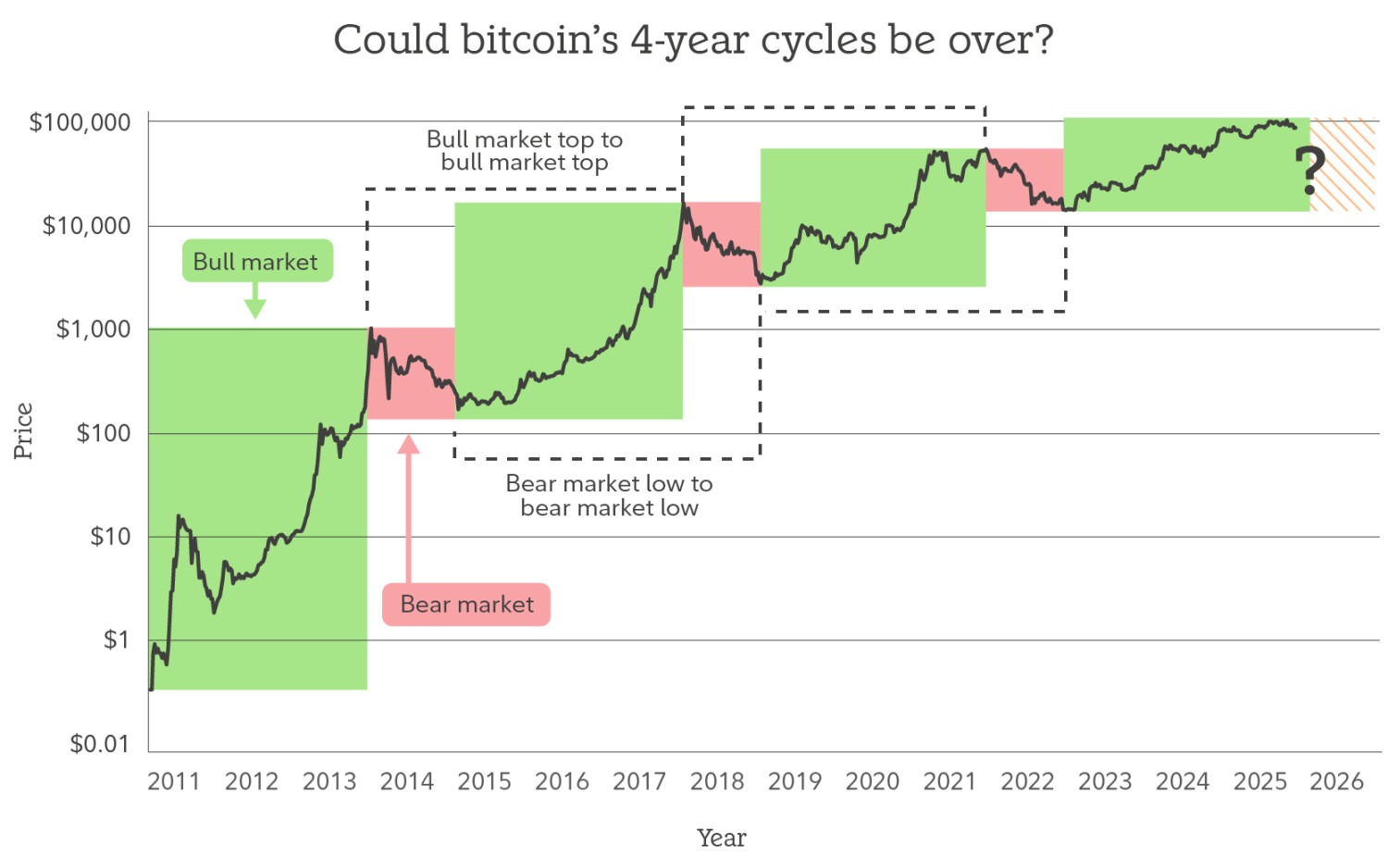

Is the Four-Year Cycle Ending?

Bitcoin’s history is short compared to traditional assets like stocks and bonds, but its price has generally followed a four-year cycle—from bull market peak to peak, or bear market bottom to bottom. Peaks occurred in November 2013, December 2017, and November 2021, with bottoms in January 2015, December 2018, and November 2022. These cycles saw dramatic swings: the first cycle fell from $1,150 to $152, the second from $19,800 to $3,200, and the third from $69,000 to $15,500.

Bitcoin’s price moves often lead the entire crypto market, which can be even more volatile.

We’re now roughly four years into the current cycle, since the last bull market peaked in November 2021. Over the past month, crypto prices have continued to slide. Has this bull market already peaked?

If the four-year cycle repeats, we may be at or near the end of the current Bitcoin bull market. However, some crypto investors believe this historical pattern is breaking down, and the current pullback is just a temporary correction before the market resumes its climb.

What does this mean in practice? Some investors believe price corrections will still happen, but with much lower volatility than in the past—so mild that they don’t feel like full bear markets. Others think we may be entering a supercycle, with the bull market running for years. For context, the commodity supercycle in the 2000s lasted nearly a decade.

Kuiper doesn’t think these cycles will disappear entirely, as the fear and greed that drive them haven’t vanished. But he notes that if the four-year cycle repeats, we should have already set a new all-time high and entered a full bear market. While the correction since November has been significant, he says it may take until 2026 to confirm whether the four-year cycle is intact. The current decline could mark the start of a new bear market, or it could just be a correction within a bull market—with new highs ahead, as we’ve already seen several times this cycle.

Whether these predictions come true remains to be seen. We may not know for certain until mid-2026.

Is It Still Too Late to Buy Bitcoin?

Despite ongoing uncertainty in the crypto market, one thing is becoming clear: the industry is entering a new paradigm. “We’re seeing a fundamental shift in the types and structure of investors, and I think that will continue into 2026,” Kuiper said. “Traditional fund managers and investors have started buying Bitcoin and other digital assets, but in terms of the capital they could bring, we’re only scratching the surface.”

Given this, investors who haven’t entered the market may wonder: Is it still a good time to buy Bitcoin?

For Kuiper, it depends on your investment horizon. If you’re hoping for short- or medium-term gains (four to five years or less), you may already be too late—especially if this cycle ultimately follows historical patterns.

“However, from a very long-term perspective, I personally believe that if you view Bitcoin as a store of value, it’s never truly ‘too late,’” Kuiper said. “As long as the hard supply cap remains, I believe every Bitcoin purchase is a way to put your labor or savings into something that won’t be devalued by government monetary policy and inflation.”

Disclaimer:

- This article is reprinted from [Foresight News]. Copyright belongs to the original author [Fidelity Investments]. If you have concerns about the reprint, please contact the Gate Learn team, which will address the issue promptly according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Do not copy, distribute, or plagiarize the translated article without attribution to Gate.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market

NFTs and Memecoins in Last vs Current Bull Markets