Fidelity FBTC ETF Guide 2026: Fees, Performance, and Price Prediction

FBTC: Definition and Distinctive Positioning

FBTC, officially known as the Fidelity Wise Origin Bitcoin Fund, is a spot Bitcoin ETF managed and issued by Fidelity Digital Assets . The fund tracks the spot price of Bitcoin denominated in US dollars, offering investors straightforward exposure to Bitcoin without the need to buy, custody, or trade the asset directly.

In January 2024, the US Securities and Exchange Commission (SEC) authorized the launch of 11 spot Bitcoin ETFs, including iShares Bitcoin Trust, Fidelity Wise Origin Bitcoin Fund, and Bitwise Bitcoin ETF, among others. What sets the Fidelity Bitcoin Spot ETF (FBTC) apart is that its assets are directly managed by Fidelity’s own Fidelity Digital Assets, rather than by Coinbase Custody or other third-party custodians.

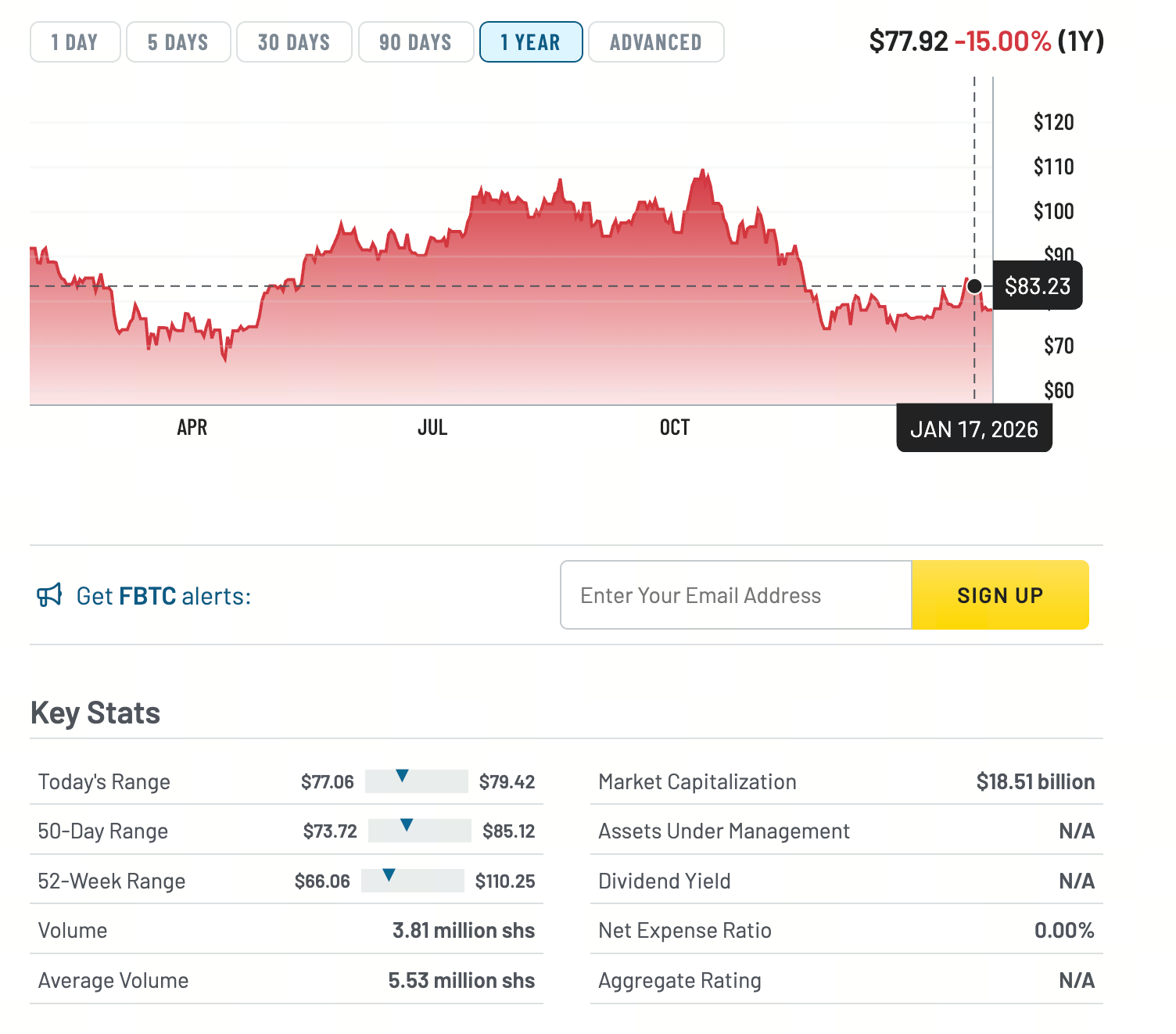

FBTC’s pricing is determined by tracking the Fidelity Bitcoin Reference Rate (PR) index, which is designed to accurately reflect Bitcoin’s dollar price by aggregating trading data from several major exchanges. As of January 26, FBTC’s market cap stands at approximately $18.5 billion, ranking second among global spot Bitcoin ETFs—just behind BlackRock’s IBIT, which has a market cap of about $70 billion. FBTC’s year-to-date return is 2.22%.

Source: MarketBeat

FBTC: Significance and Value

When evaluating FBTC’s value, it’s more meaningful to consider the broader importance of spot Bitcoin ETFs. Their impact is primarily seen in two areas: enhanced accessibility and adoption, and significantly increased market acceptance of Bitcoin as an investment following regulatory approval.

As regulated financial products, Bitcoin ETFs enable a wider range of investors to access Bitcoin. This development allows traditional financial advisors to guide clients into Bitcoin investments, and both retail and institutional investors now have easier entry points. Compared to direct Bitcoin purchases, ETFs reduce the need for investor education and lower administrative costs.

SEC-approved ETFs also ease concerns around safety and compliance by providing comprehensive risk disclosures. A robust regulatory framework attracts more capital, and regulatory clarity is essential for market participants.

However, it’s important to clarify that investing in FBTC or other spot Bitcoin ETFs is not the same as directly holding Bitcoin, for several reasons:

- Investors do not possess on-chain ownership, cannot transfer Bitcoin, and cannot redeem in Bitcoin—only USD cash is available via share sales.

- Returns may differ slightly from direct Bitcoin ownership, as issuers incur operational costs and charge fees, resulting in premiums or discounts compared to spot Bitcoin.

Spot Bitcoin ETF Scale and Fee Comparison

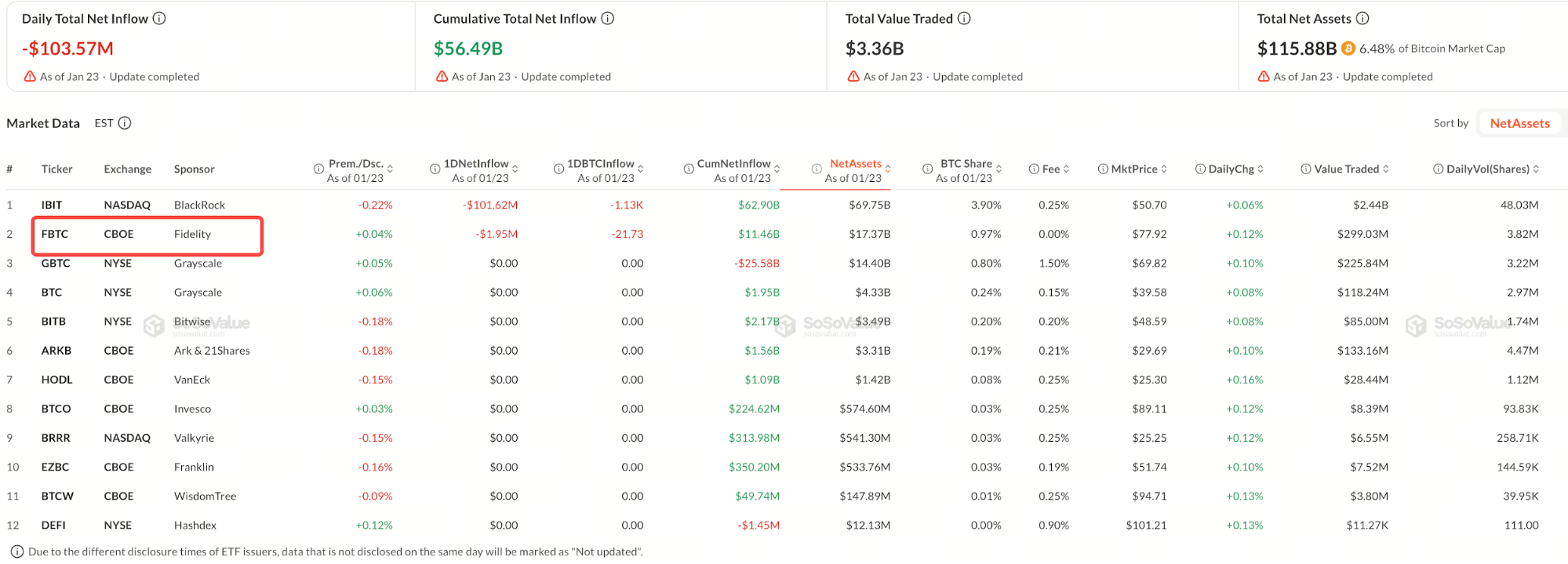

According to official data from spot Bitcoin ETF issuers and third-party platforms like SoSOValue, as of January 26, 2026, the total assets under management (AUM) for spot Bitcoin ETFs is approximately $115.8 billion, with Fidelity ranking second at over $17 billion.

Source: SoSOValue

Spot Bitcoin ETFs are now widely available and listed on major exchanges including the Chicago Board Options Exchange (CBOE), New York Stock Exchange (NYSE), and Nasdaq, giving investors a range of choices.

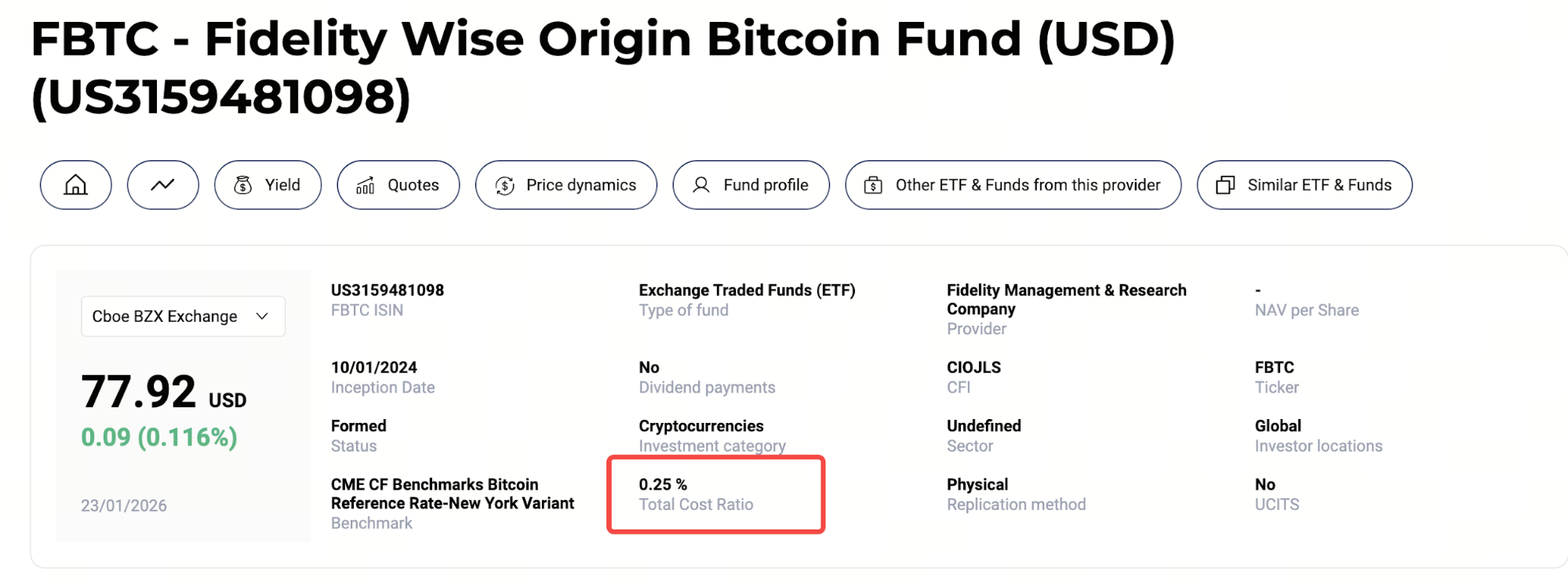

To balance management costs, issuers have set fees ranging from 0–1.5%. As of early 2026, FBTC’s management fee has moved from an initial waiver (0%) to a standard rate. The latest market data shows its fee is currently stable at around 0.25% (some Fidelity products, such as the Canadian FBTC, have even been reduced below 0.32%). Overall, FBTC’s 0.25% fee remains highly competitive.

Source: Cbonds

FBTC: Latest Developments and Bitcoin Price Outlook

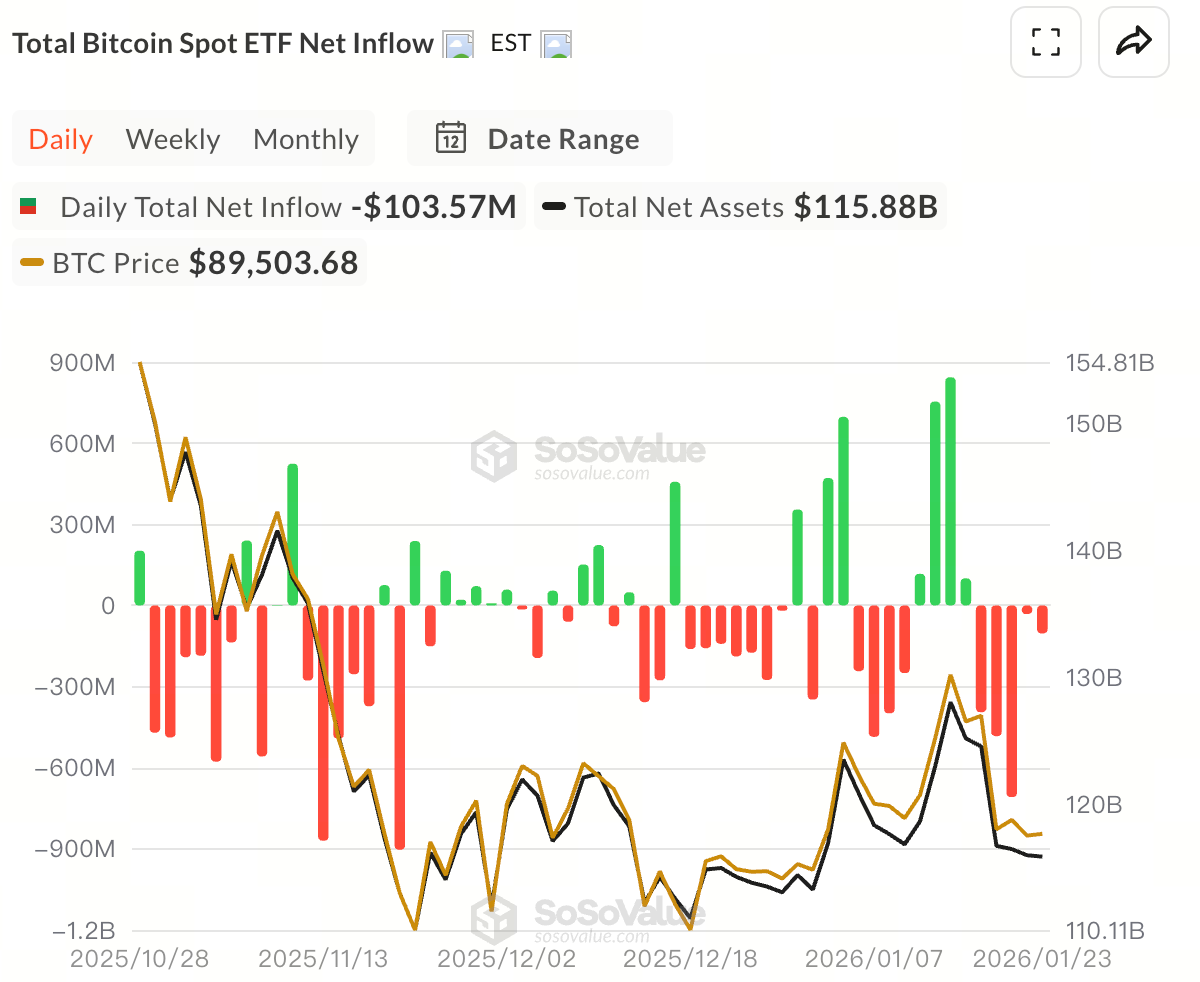

According to SoSOValue, on January 23, Fidelity’s FBTC recorded a net outflow of $1.95 million, marking a full week of consecutive outflows. This trend is consistent across the spot Bitcoin ETF sector and highlights the recent downturn in the Bitcoin market, with investors generally adopting a pessimistic stance and choosing to sell.

Source: SoSOValue

The drop in capital flows not only directly affects ETF issuers’ fee income but also serves as a clear indicator of investor sentiment.

It has been two years since spot Bitcoin ETFs launched, and the market has already absorbed the initial positive impact of these products. Today, spot Bitcoin ETF performance is primarily influenced by broader crypto market conditions—especially Bitcoin price trends—and changes in issuer management fees.

Over the past two years, capital has moved to lower-fee products during bullish periods and been broadly reduced during bearish periods.

As a key indicator for the crypto market, the performance and trends of spot Bitcoin ETFs remain highly relevant for investors.

Further Reading

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

What Is Technical Analysis?

How to Do Your Own Research (DYOR)?