ETHGas: Transforming Ethereum Block Space into a Commodity to Build an Instant-Settlement Gas Market

Why Gas Is a Structural Bottleneck for Web3

(Source: ETHGasOfficial)

On today’s Ethereum network, every transaction involves significant uncertainty. Users struggle to predict actual costs, wait times, or whether their transaction will succeed. The real-time volatility of gas prices turns transactions into a high-stakes gamble. This instability affects not only everyday users but also restricts the ability of traders, protocols, and applications to make real-time, on-chain decisions. As a result, it stands as a major barrier to Web3’s large-scale adoption. ETHGas was developed to address this persistent structural challenge.

ETHGas Core Concept: Rebuilding Ethereum’s Economic Foundation

ETHGas breaks down Ethereum’s blockspace into tradable, priceable units and establishes a real-time settlement market. Rather than modifying the protocol itself, ETHGas creates a more orderly economic layer for blockspace outside the protocol. This approach transforms what was once highly volatile gas and blockspace into structured, predictable market resources.

Blockspace Commitments: Redefining Transaction Finality

ETHGas introduces “Blockspace Commitments” as a key innovation. Users can choose their desired level of transaction finality, rather than being forced to endure network congestion passively.

There are currently three types of commitments:

Whole Block Commitment

The buyer secures the right to order and include transactions for an entire block, with up to approximately 36 million gas available. This right can be subdivided and sold, or specific positions within the block (such as the top or bottom) can be reserved. The market opens up to 64 slots in advance.

Inclusion Preconfirmations

Transactions are guaranteed inclusion in a future block within a specified gas limit. Validators initially issue these commitments, which can then be traded on secondary markets. The market opens up to 32 slots in advance.

Execution Preconfirmations (In Development)

Beyond inclusion guarantees, these commitments ensure transactions achieve specific on-chain outcomes. This market will use a progressive auction mechanism and remains under active development.

Through this structure, ETHGas makes blockspace a precisely configurable resource.

Gas Rebates and Hedging: Enhancing User Experience

ETHGas addresses both transaction finality and the opacity of gas costs by offering supporting tools. Through the “Open Gas Initiative,” partner dApps can subsidize gas fees for users in the background. Users continue to pay fees as usual, but can view and claim accumulated gas rebates on the ETHGas dashboard. In the future, dApps will also be able to use gas hedging products to convert volatile gas costs into predictable operating expenses, delivering a simpler and more stable user experience.

ETHGas as a Blockspace Market

ETHGas functions as a dual market for blockspace and base fee, operating through a hybrid architecture:

Centralized Limit Order Book (CLOB) for matching buyers and sellers

Non-custodial smart contracts to hold collateral, ensuring validators fulfill their commitments

ETHGas acts as a neutral intermediary, providing end-to-end privacy protection and connecting validators with all types of blockspace demand—including builders, traders, searchers, wallets, and end users.

Protocol Architecture Positioning

ETHGas is an out-of-protocol system that coordinates gas market products offered by validators (proposers) and delivers them to market participants who require customized transaction ordering and throughput. This design allows Ethereum to evolve its real-time block economics without modifying the consensus layer.

$GWEI: Governance and Long-Term Decision Tool

$GWEI is the governance token of the ETHGas Foundation, designed to guide the commoditization of blockspace and the long-term development of the real-time Ethereum engine. By staking $GWEI, participants receive $veGWEI (voting-escrowed tokens) and can participate in the following decisions:

Protocol parameter and fee rate adjustments

Emissions and fund utilization strategies

Smart contract upgrades and integration decisions

Voting power scales with both the amount and duration of tokens locked, ensuring that governance is concentrated among long-term stakeholders.

Token Model Overview

$GWEI is an ERC-20 token deployed on Ethereum mainnet, with a total supply of 10 billion. Distribution is structured over a 10-year cycle, focusing on ecosystem growth and long-term protocol stability. Community emissions and airdrops use separate mechanisms, with airdrops exempt from linear vesting rules.

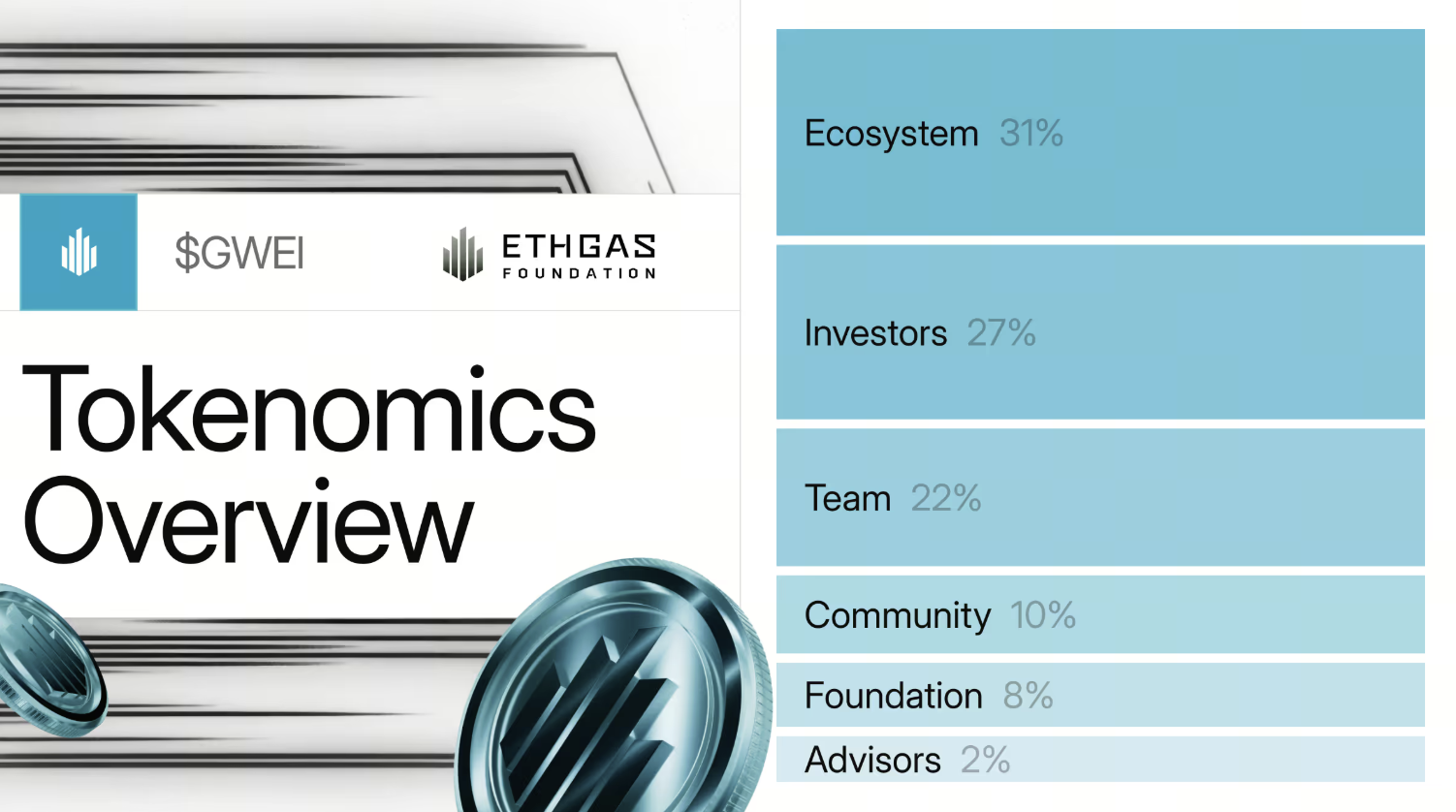

Token Distribution

ETHGas uses a distribution structure centered on long-term ecosystem development. The ecosystem receives 31% of the total supply, mainly to support protocol operations, ecosystem incentives, and market expansion. Investors receive 27%, reflecting early capital contributions for infrastructure and market launch. The team receives 22%, ensuring long-term alignment for core development and operations. The community receives 10% for participation, airdrops, and governance initiatives. Finally, the foundation and advisors receive 8% and 2%, respectively, for governance support, strategic planning, and professional advisory resources. This allocation aims to balance growth momentum with long-term stability.

(Source: ETHGasOfficial)

Decentralized Governance Mechanism

$veGWEI holders can propose and vote on the following issues:

Protocol fees and incentive structure

Treasury fund allocation (grants, partnerships, developer support)

Protocol upgrades and emergency measures

A vote delegation mechanism is also supported, allowing holders to delegate voting rights to trusted parties without transferring token ownership.

If you want to learn more about Web3, click to register: https://www.gate.com/

Conclusion

ETHGas does not seek to rewrite Ethereum’s consensus or protocol rules. Instead, it reorganizes the economic structure of blockspace and gas through out-of-protocol market mechanisms. By clearly separating and commoditizing transaction finality, cost predictability, and governance rights, ETHGas delivers a scalable solution for real-time settlement on Ethereum. As on-chain applications demand greater stability and efficiency, the maturation of these foundational market mechanisms will be critical for Ethereum’s next stage of usability.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About