Ethereum Price Prediction Scotiabank Raises Year End Target to 7500 as Institutional Demand Drives Uptrend

Preface

(Source: StanChart)

Standard Chartered Bank has recently raised its year-end price target for Ethereum (ETH) from $4,000 to $7,500, reflecting the bank’s confidence in the growing demand for institutional capital and spot Ethereum products. The research team noted that this adjustment is primarily driven by institutional buying and the expanding real-world applications within the Ethereum ecosystem.

Bank Raises Ethereum Price Target

Standard Chartered’s digital assets team has identified two key factors supporting the next phase of Ethereum’s rally: increasing network fees and rising institutional participation. The bank also updated its long-term outlook, lifting its 2028 price target to $25,000 and projecting a potential $40,000 by 2030, mainly due to the growth of stablecoins and tokenized assets on the Ethereum blockchain.

Institutional Buying Fuels Demand

Market research indicates that since June 2025, Ethereum has seen consistent accumulation. During this period, spot ETFs and corporate treasury institutions absorbed nearly 4% of the total circulating supply, with treasury institutions alone purchasing approximately 2.3 million ETH in just over two months. Standard Chartered Bank highlighted that this pace of accumulation even surpasses certain historical periods for Bitcoin.

Ethereum Outperforms Bitcoin

According to Standard Chartered’s report, Ethereum’s strengths in architectural upgrades and practical applications position it to outperform Bitcoin in the coming months. Although Bitcoin’s recent underperformance has weighed on overall market sentiment, institutional demand continues to provide robust support for Ethereum. Analysts expect the ETH/BTC ratio could rebound to levels seen during the 2021 bull market.

Long-Term Forecast and Risk Advisory

In a more optimistic scenario, Standard Chartered projects ETH could reach $30,000 by 2029 and $40,000 by 2030. However, analyst forecasts for the year-end target still vary, highlighting that consensus among crypto market experts is typically expressed as a range rather than a precise figure. Future price performance may be influenced by market sentiment, circulating supply, and the growth rate of stablecoins and tokenized assets.

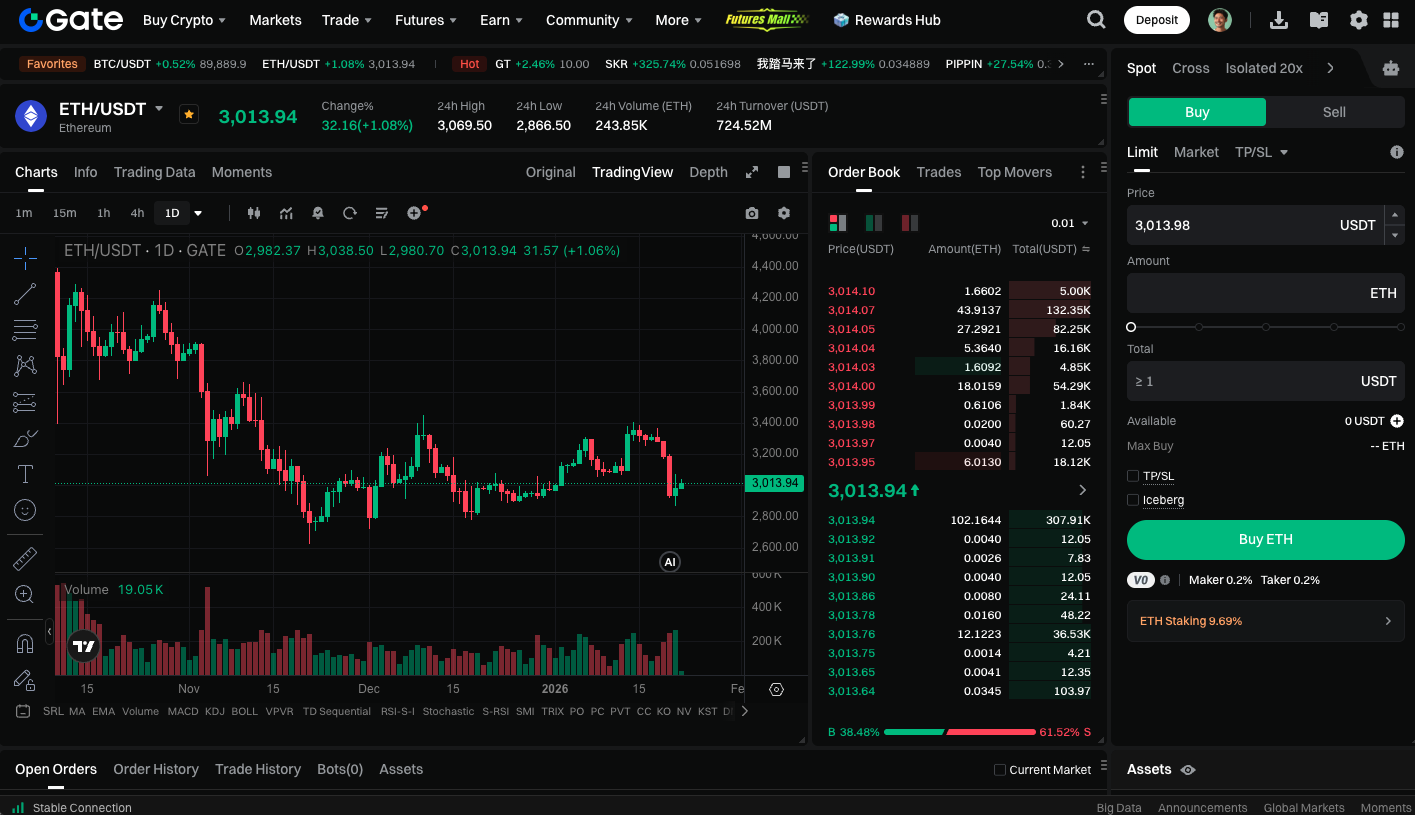

Start trading ETH spot now: https://www.gate.com/trade/ETH_USDT

Conclusion

Standard Chartered Bank’s substantial increase of Ethereum’s year-end price target to $7,500 underscores the significance of institutional demand and the expanding Ethereum ecosystem. In the short term, rising network fees and increased corporate capital inflows will continue to support ETH prices. Over the long term, the expansion of stablecoins and tokenized assets, along with greater institutional adoption, may enable ETH to outperform Bitcoin. Nevertheless, market uncertainty persists, and the differences in analyst forecasts suggest investors should remain cautious and closely monitor changes in circulating supply, regulatory developments, and market sentiment.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Gate Alpha Launches Points System: Trade On-Chain, Earn Points, Unlock Airdrops

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?