Crypto IPOs to Watch in 2026

In 2025, crypto companies raised $3.4 billion on the US stock market.

Circle and Bullish each secured over $1 billion, while Gemini jumped 14% on its first day trading on Nasdaq. By January 2026, BitGo rang the NYSE opening bell, gaining 24.6% on debut and reaching a $2.6 billion market cap.

These trailblazers have demonstrated one thing: Wall Street is willing to invest in compliant crypto infrastructure.

The pipeline for 2026 is even larger. Kraken, Consensys, and Ledger are all preparing to go public, with valuations ranging from several billion to $20 billion. Even CertiK, a security audit firm, announced its IPO plans at Davos.

Exchanges, wallets, custody, security—the crypto industry’s “water sellers” are moving en masse to the public markets.

When will these companies list, what will their valuations be, and where do the risks lie? Let’s break it down, one by one.

1. Kraken: The $20 Billion Compliance Standard

Estimated Market Cap: $20 billion

Estimated Timeline: First half of 2026

Kraken is one of the oldest crypto exchanges, founded in 2011—a year before Coinbase. Yet its IPO comes five years after Coinbase’s. In the interim, Kraken faced SEC litigation, settlement negotiations, and business restructuring, ultimately securing an SEC lawsuit withdrawal in March 2025.

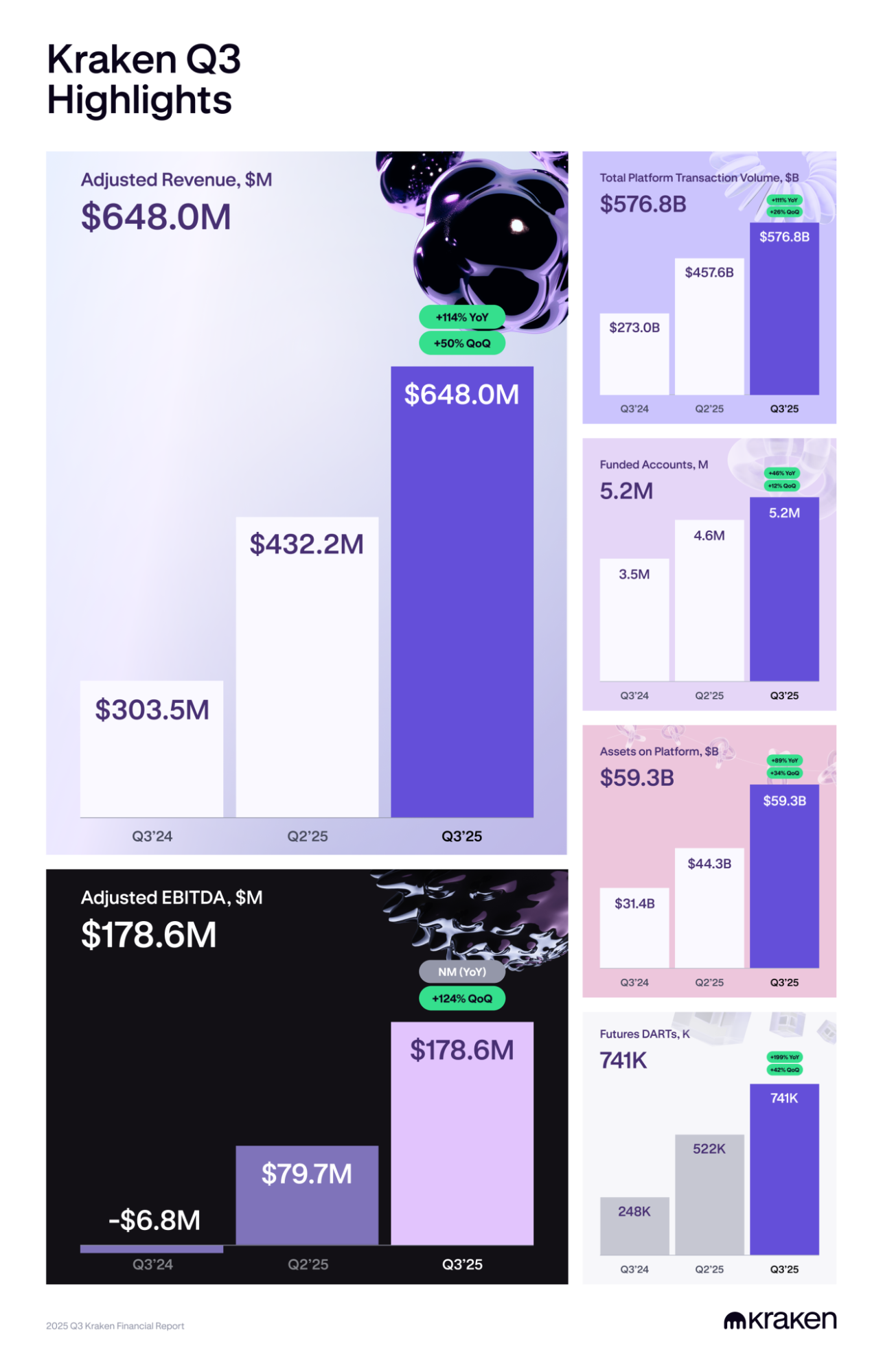

Its financials are robust:

2024 revenue reached $1.5 billion, with adjusted EBITDA exceeding $400 million. In Q3 2025 alone, revenue hit $648 million, up 50% year-over-year. The platform manages $59.3 billion in assets and posted $576.8 billion in quarterly trading volume.

In November 2025, Kraken completed an $800 million pre-IPO round at a $20 billion valuation. Investors included Citadel Securities, Jane Street, and DRW—top traditional finance market makers betting that crypto exchanges will become part of the financial infrastructure.

That same month, Kraken confidentially filed its S-1, targeting a first-half 2026 IPO.

If successful, Kraken will become the second major crypto exchange to list in the US after Coinbase, and the first to complete the full IPO process in the “post-Gensler era.”

2. Consensys: MetaMask’s Parent Company Aims for IPO

Estimated Market Cap: $7 billion (2022 valuation)

Estimated Timeline: Mid-2026

Consensys owns several of crypto’s most valuable products: MetaMask wallet with 30 million monthly active users, Infura node services supporting most Ethereum dApps, and the Linea L2 network. As the “plumber” of the Ethereum ecosystem, nearly all developers use its tools.

Founded by Ethereum co-founder Joseph Lubin, Consensys was valued at $7 billion after a $450 million raise in 2022. The company is now working with JPMorgan and Goldman Sachs to prepare for its IPO, targeting mid-2026.

The prospectus will likely spotlight MetaMask Swaps revenue. This feature lets users trade tokens directly in-wallet, charging a 0.875% fee per transaction. In 2025, MetaMask added native Bitcoin support, expanding from an EVM-only wallet to a multi-chain platform, aiming to keep users within its ecosystem.

The big question for Consensys’s IPO: it’s pursuing both the MASK token and an IPO simultaneously. How will these two initiatives align? Will token holders and shareholders have conflicting interests? This could become a new case study in crypto corporate governance.

3. Ledger: Hardware Wallet Maker Telling a Software Story

Estimated Market Cap: $4 billion

Estimated Timeline: 2026

Ledger has sold over six million hardware wallets, safeguarding more than $100 billion in Bitcoin. But it doesn’t want to be just a “device seller.”

Recently, CEO Pascal Gauthier has made frequent trips to New York, pitching Ledger’s vision to become “the Apple of self-custody.”

The transformation centers on Ledger Live, an app integrating hardware wallets, software wallets, staking, and DeFi. Ledger is shifting from hardware sales to subscription services, moving from one-off to recurring revenue.

Wall Street is buying the story.

On January 23, the Financial Times reported Ledger is in talks with Goldman Sachs, Jefferies, and Barclays for a NYSE IPO, targeting a valuation above $4 billion—almost triple its $1.5 billion valuation in 2023.

This valuation is supported by strong performance.

In 2025, Ledger’s revenue reached several hundred million dollars, which Gauthier called “a record year.” After the FTX collapse, “Not your keys, not your coins” became popular again, with institutions and retail investors shifting to self-custody.

Last year, crypto theft hit a record $1.7 billion, ironically strengthening Ledger’s appeal.

Still, hardware wallets remain too complex for most users. Ledger’s growth ceiling depends on lowering that barrier.

4. Bithumb: Korea’s Veteran Exchange Makes a Comeback

Estimated Market Cap: Undisclosed

Estimated Timeline: 2026

Listing Location: Korea KOSDAQ (Nasdaq also considered)

Bithumb was once Korea’s largest exchange, until Upbit overtook it. Now, Upbit controls over 80% of the market, while Bithumb holds just 15–20%.

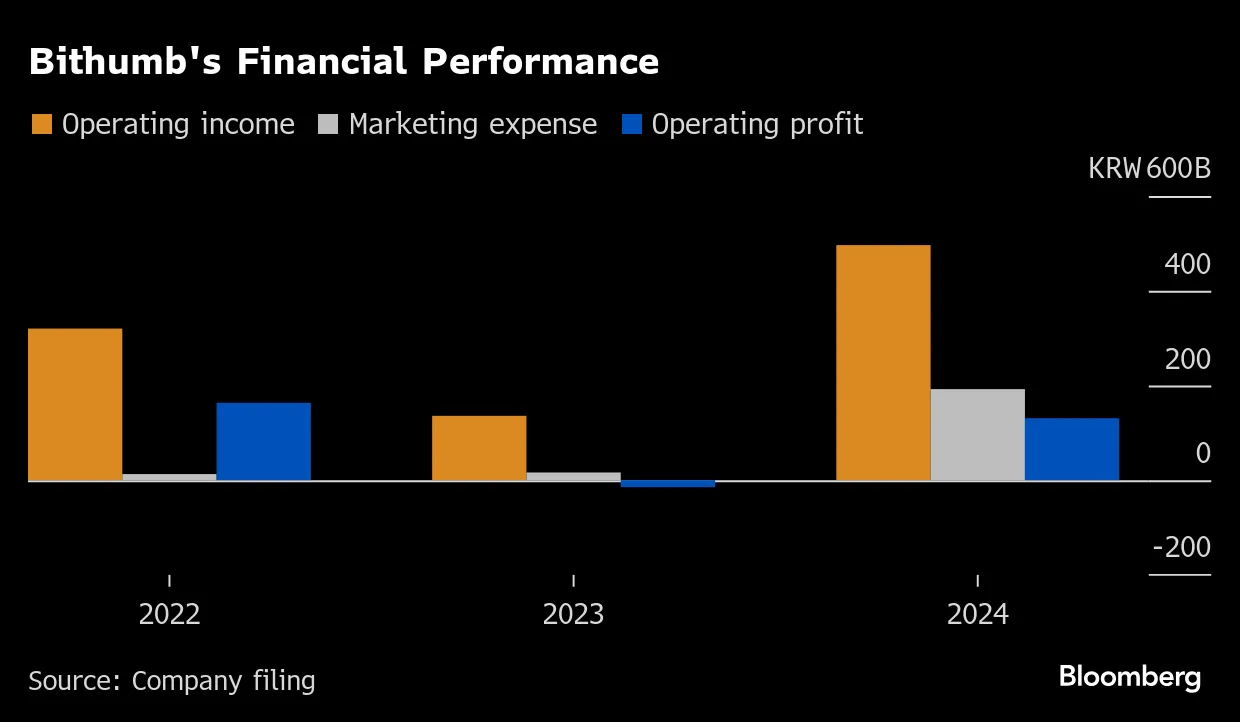

In 2024, Bithumb launched a zero-fee campaign, reclaiming about 25% market share. This costly user acquisition push could be a prelude to its IPO.

Samsung Securities is the underwriter, with initial plans for a late-2025 KOSDAQ listing and Nasdaq as a backup. The timeline now appears pushed to 2026.

Bithumb claims this IPO isn’t about raising funds. The company holds over KRW 400 billion (about $300 million) in financial assets and is well capitalized. The goal is to “build market trust” through public governance and financial audits.

This comes after years of trouble for Bithumb.

In 2023, Korean tax authorities raided Bithumb over suspected fraud. Several executives were investigated for listing-related bribery, and former CEO Lee Sang-Jun resigned. A six-year lawsuit over a 2017 service outage ended with Bithumb ordered to compensate users.

To prepare for IPO, Bithumb made management changes. Former chairman Lee Jung-Hoon returned to the board after being acquitted of acquisition-related fraud charges. The new CEO is a close associate.

Korea has 18 million crypto users, and daily trading volumes often exceed those of the stock market.

Bithumb’s IPO signals the institutionalization of Korea’s crypto market. But given its history, investors will closely scrutinize its governance practices.

5. CertiK: Security Audit Giant Under Scrutiny

Estimated Market Cap: $2 billion

Estimated Timeline: Late 2026–Early 2027

On January 23 at Davos, CertiK CEO Ronghui Gu announced the company is moving forward with an IPO.

CertiK is the largest security audit firm in crypto, founded in 2018 and headquartered in New York. It has served over 5,000 clients, with audited code protecting assets worth about $60 billion.

Its investor roster is impressive—Binance was the earliest and largest backer, joined by SoftBank Vision Fund, Tiger Global, Sequoia, and Goldman Sachs. In its 2022 Series B3 round, CertiK hit a $2 billion valuation.

But CertiK is also one of crypto’s most controversial companies.

Last year, the Kraken incident was widely discussed. CertiK discovered a vulnerability allowing arbitrary account credits and, during testing, transferred about $3 million. CertiK called it a “white hat operation”; Kraken called it extortion. The dispute played out in public, the funds were returned, but CertiK’s reputation suffered.

Previously, CertiK audited Cambodia’s Huione Guarantee, a platform used for money laundering, trading hacking tools and personal data, and even selling stun guns to Southeast Asian scam compounds. CertiK later apologized, but the episode highlighted risk management issues for security firms themselves.

Gu says going public is “the natural next step for continued product and technology expansion.”

But once the IPO prospectus is public, these controversies will be repeatedly questioned by investors. Whether CertiK can rebuild trust is its biggest challenge ahead.

Overall, the 2026 IPO wave among crypto companies is likely no coincidence.

The regulatory environment is shifting. SEC Chairman Gensler is gone, and the new chair is more crypto-friendly, leading to lawsuit withdrawals against Kraken and Consensys. The window is open, and companies are seizing the opportunity.

Capital structure is also at its limit. After multiple private rounds, these companies have many shareholders and increasingly illiquid employee options. Coinbase’s five-year track record proves crypto firms can survive in public markets. Those in line have no reason to keep waiting.

Still, retail investors should differentiate among these IPOs.

Kraken and Ledger have real revenue and clear business models; Consensys controls MetaMask, a gateway product, but is also launching a token with unresolved relationships between shareholders and token holders. CertiK has a strong brand but faces controversy, while Bithumb is a purely Korean story.

When these stocks become available, make sure you know what you’re buying.

For these companies, going public is just the beginning.

Whether they can succeed in public markets depends on their ability to shed the “crypto” label and become “financial infrastructure.” It took Coinbase five years to convince Wall Street it’s more than a trading platform.

For those next in line, the journey is just beginning.

Statement:

- This article is republished from [TechFlow]. Copyright belongs to the original author [David]. If you have any objections to this republication, please contact the Gate Learn team, and the team will promptly process according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team and may not be copied, distributed, or plagiarized without mention of Gate.

Related Articles

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market

The Impact of Token Unlocking on Prices

Detailed Analysis of the FIT21 "Financial Innovation and Technology for the 21st Century Act"

Gate Research: Web3 Industry Funding Report - November 2024