Bitcoin Whales Return to Drive Market Momentum: A Break Above the Key $88,500 Close Signals the Next Price Trend

Whale Activity Resumes: On-Chain Data Analysis

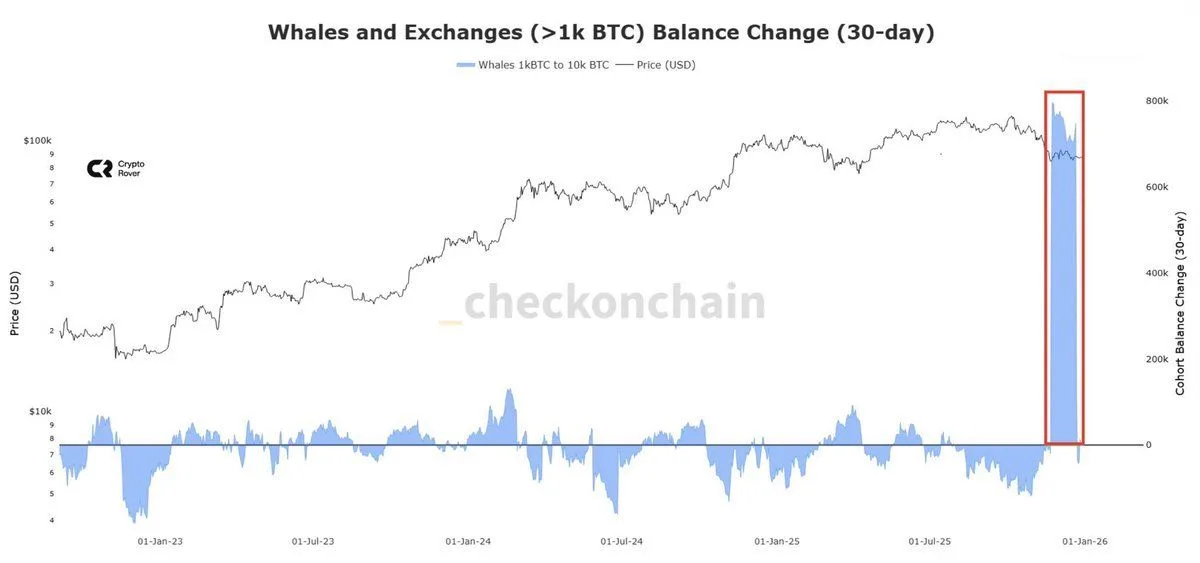

Recent on-chain data reveals that Bitcoin whales—large holders with 1,000 to 10,000 BTC—have significantly increased their balances over the past 30 days. This trend typically signals that major investors are accumulating Bitcoin rather than executing large-scale sell-offs. Data from Crypto Rover shows whale balances have reversed from previous lows to clear upward growth, indicating these large holders are raising their BTC exposure.

In terms of market sentiment and capital flows, whales are among the most influential players in the market. Their asset allocation shifts often foreshadow future price trends. Rising whale balances may reflect a strategic bullish stance on Bitcoin’s outlook. This accumulation also reduces BTC supply on exchanges, providing structural support for the price.

$88,500 Weekly Close: Why It Matters

Chart: https://www.gate.com/trade/BTC_USDT

From a technical analysis standpoint, industry analysts note that if Bitcoin closes above $88,500 (approximately 88.5K USD) on the weekly chart, it would likely confirm a breakout from its eight-week consolidation range. This price level serves as both a key psychological threshold and a focal point for the battle between bulls and bears.

In sideways markets, the weekly closing price carries more weight than intraday moves. A close above a major resistance level typically confirms market strength, which draws in more short-term and institutional traders and accelerates trend development. If BTC posts a weekly close above $88,500, it would confirm an upward breakout and could fuel the next rally.

Technical charts also highlight potential upside targets for Bitcoin once the range is broken, such as $97,600, $104,300, and beyond. These targets represent higher resistance zones for bulls. A confirmed breakout above these levels would further reinforce bullish market signals.

Technical Outlook and Bull-Bear Dynamics

Currently, Bitcoin’s price is fluctuating within a consolidation range, with bulls and bears locked in a clear standoff. On the bullish side, whale accumulation and price stability near key support levels suggest a potential market bottom. However, some reports note that certain whales are still reducing their positions, which could add short-term volatility.

Technically, Bitcoin faces pressure on its medium- and long-term moving averages. Short-term price action depends more on macro sentiment and liquidity conditions. If the weekly chart holds its upward support, Bitcoin could test higher resistance levels and establish an uptrend. If prices fall and fail to hold key support, short-term correction risks remain elevated.

This analysis focuses on whale position retention and changes in market trading volume, as these factors reflect the real impact of capital flows on price. Accumulation often precedes price increases, but strategic adjustments by whales at different times can also trigger short-term pullbacks.

Macro Environment and Risk Considerations

In today’s global economic climate, macro factors continue to drive significant volatility in Bitcoin prices. Shifts in interest rates, ETF capital flows, and macro risk events can all trigger chain reactions in trading behavior. For instance, recent market commentary points to some whales reducing positions, which puts pressure on short-term prices.

Beyond on-chain and technical signals, macro risks such as central bank policy changes, stock market volatility, and global economic data releases can disrupt market sentiment in the short term. Investors must stay vigilant about the broader market environment while monitoring key price triggers.

Trend Summary and Investor Insights

In summary, the Bitcoin market stands at a critical inflection point:

- The rebound in whale balances signals a medium- to long-term bullish outlook;

- A weekly close above $88,500 is the key trigger confirming a strengthening trend;

- The market still faces two-way volatility risks, making it essential to monitor both macro and on-chain signals as they evolve.

For investors, focusing on key price levels and on-chain behavior provides a more comprehensive view of market dynamics. No single technical indicator or news event can fully determine price trends.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About