Bitcoin Price Prediction: Satoshi’s Wallets Lose Over $5B in 24 Hours as BTC Risks Drop Toward $88,000 Support

17th Anniversary of the Bitcoin Whitepaper

As the 17th anniversary of the Bitcoin whitepaper approaches, the cryptocurrency market is experiencing heightened uncertainty. Arkham Intelligence’s latest report reveals that wallets associated with Satoshi Nakamoto saw more than $5 billion in assets wiped out within 24 hours, unsettling investors and signaling a clear bearish trend in the market.

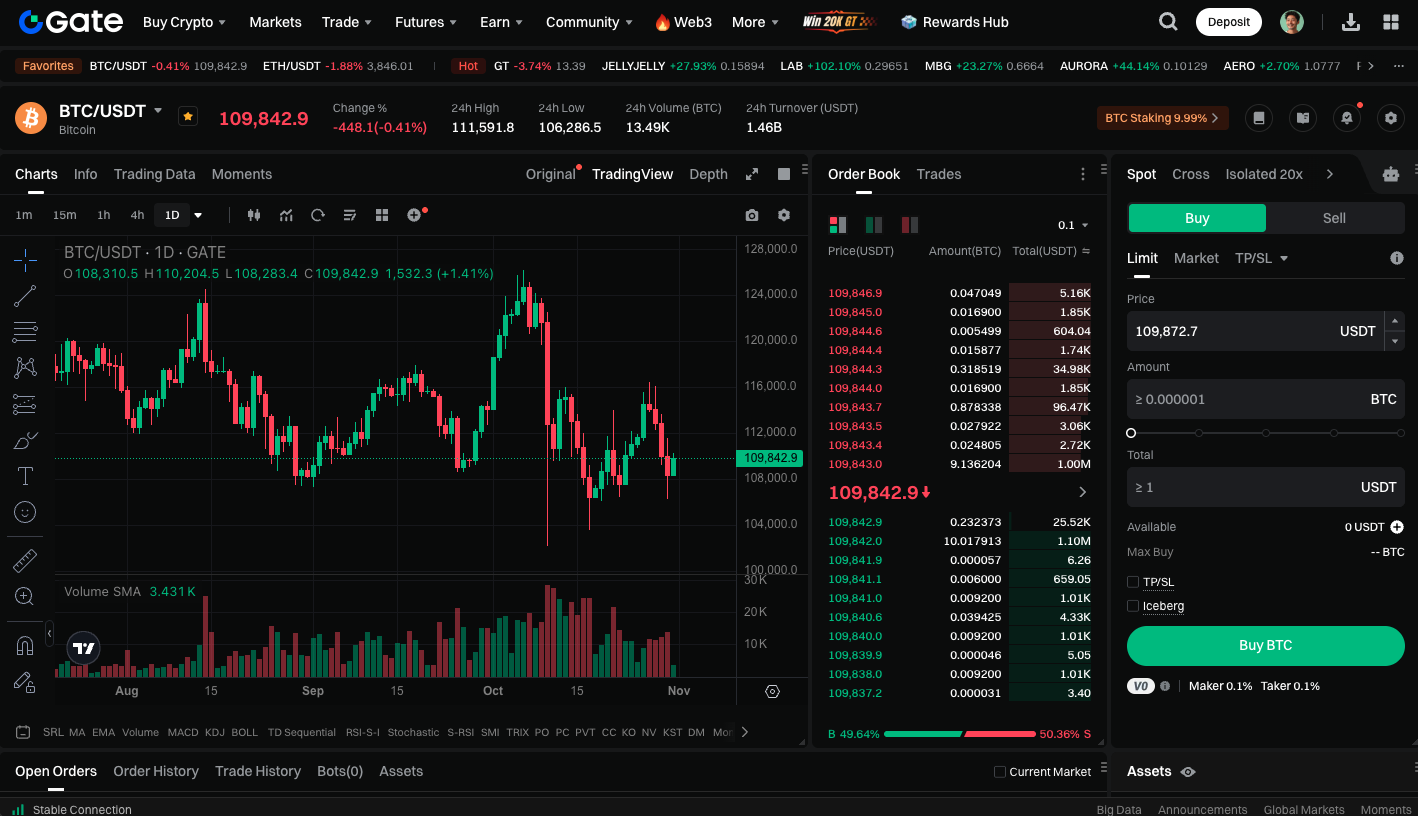

BTC prices continue to show weakness, falling below $110,000, with both retail and institutional investor confidence declining in parallel. While some analysts still anticipate a short-term rebound, the broader market sentiment has turned cautious—and in some cases, pessimistic.

Satoshi Nakamoto Wallet Activity Triggers Market Speculation

Arkham data indicates that Satoshi Nakamoto’s wallets suffered significant losses even while Bitcoin was still priced at $108,000, and the subsequent price drop only intensified the market impact. It remains unclear whether the losses stem from actual transfers or price volatility. However, the timing is highly symbolic: a sharp reduction in the founder’s holdings on the eve of Bitcoin’s anniversary heightens market sentiment. Analysts note that such events often spark a sequence of events driven by prevailing market narratives, with investor sentiment often influenced by symbolic developments, potentially increasing market volatility.

Key Bitcoin Technical Indicators

Glassnode’s latest on-chain data shows Bitcoin has once again dipped below the Short-Term Holder (STH) cost basis at $113,100.

This level is widely seen as the dividing line between bull and bear markets. When BTC trades below this threshold, most short-term investors are underwater, which may trigger additional selling pressure.

Glassnode reports that Bitcoin has closed below this level for two consecutive weeks, suggesting persistent short-term weakness. If prices continue to decline, the next key support sits at $88,000 (Realized Price), a zone regarded as a key on-chain support level.

Start trading BTC on the spot market now: https://www.gate.com/trade/BTC_USDT

Summary

On the 17th anniversary of the Bitcoin whitepaper, the crypto market remains tense, investor confidence is shaken, and Satoshi Nakamoto’s wallets have lost more than $5 billion in assets within 24 hours, fueling market unease. With BTC falling below $110,000 and confidence dropping among both retail and institutional investors, the overall market sentiment has shifted toward caution and growing pessimism, while some analysts anticipate a possible short-term rebound.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Gate Alpha Launches Points System: Trade On-Chain, Earn Points, Unlock Airdrops

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?