Bitcoin Price Prediction Potential 50 Percent Pullback Could Push Price to 50000 USD

Preface

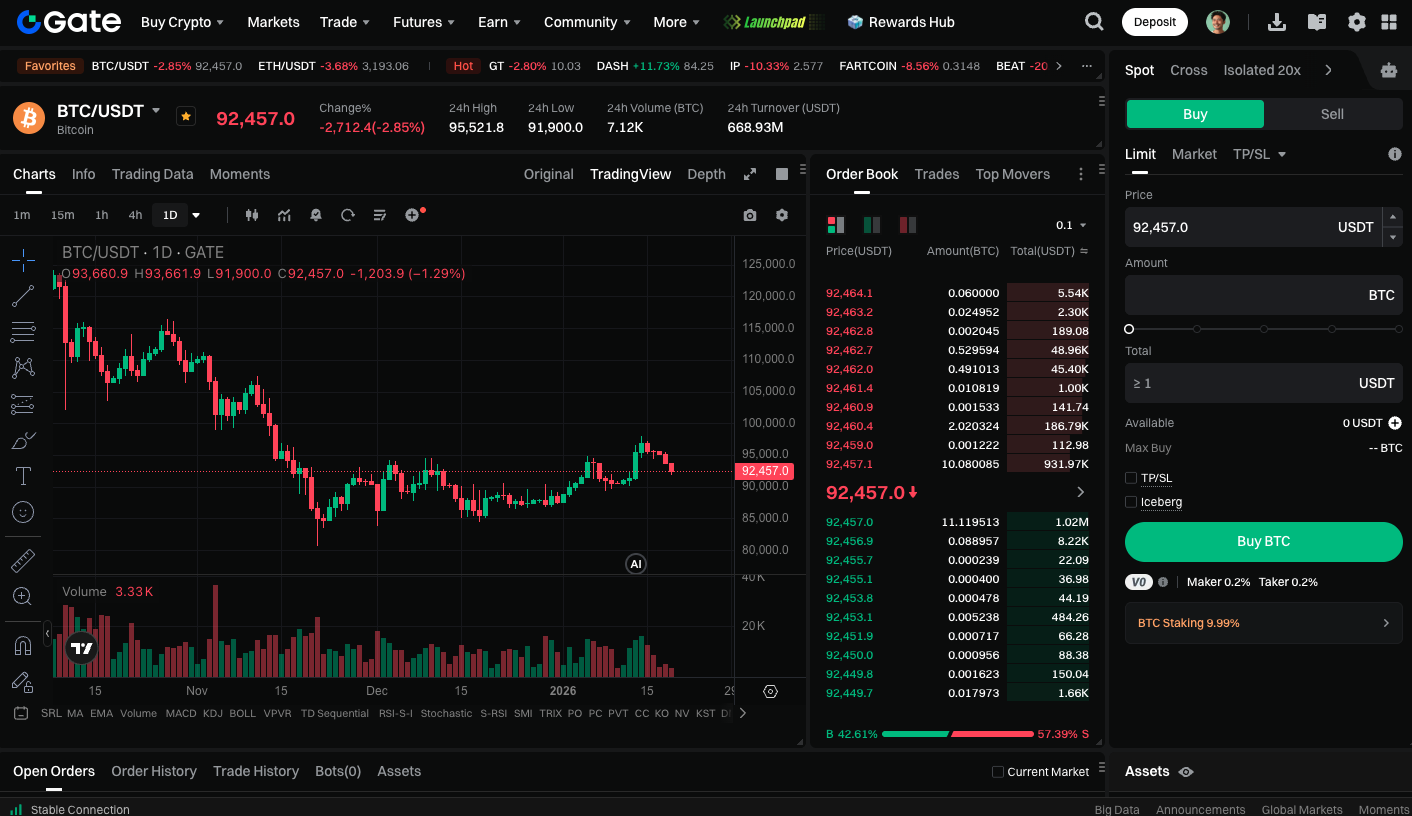

Following a sharp rally in early 2026, Bitcoin (BTC) has seen its upward momentum slow, while market structure remains largely unchanged. Analyst Ali Martinez highlights that Bitcoin has closed below its 50-week Simple Moving Average (SMA) for nine straight weeks. This long-term technical indicator is considered a key tool for identifying bullish or bearish market trends.

The 50-week SMA represents the average closing price over the past 50 weeks. In bull markets, it typically provides support, while in bear markets, it acts as resistance. When BTC trades below this indicator for an extended period, it suggests fading bullish momentum and increases the risk of a significant pullback.

Historical Data Signals Caution

Reviewing past cycles, BTC has often remained below the 50-week SMA for prolonged periods, which usually triggered major corrections between 50% and 70%. Importantly, these corrections did not reverse Bitcoin’s long-term upward trend—they served as reset phases, reducing excessive leverage and setting the stage for future rallies.

Current market conditions are similar to previous instances, so investors should be alert to the possibility of a correction. If history repeats, Bitcoin could fall toward the $50,000 level, with a potential decline approaching 50%.

Market Outlook

In the near term, Bitcoin’s price momentum faces resistance from the 50-week SMA, which remains a key barrier. Long-term investors may view this adjustment as a possible accumulation phase, preparing for the next trend extension. Watching market liquidity, leverage ratios, and global macro factors will be crucial for evaluating the depth and duration of any correction.

Start trading BTC spot now: https://www.gate.com/trade/BTC_USDT

Summary

Bitcoin is currently under technical pressure below the 50-week SMA, with a short-term correction of up to 50% possible, potentially testing the $50,000 level. Historical data indicates these correction phases are typically market reset periods that clear excessive leverage, without affecting Bitcoin’s long-term growth trajectory. Investors should monitor market sentiment, leverage ratios, and macro trends to gauge the extent of any correction and the potential for subsequent rebounds.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Gate Alpha Launches Points System: Trade On-Chain, Earn Points, Unlock Airdrops

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?