Bitcoin Price Prediction: Bitwise Signals Potential Cyclical Bottom

Preface

Amid price pressures and weakening sentiment, Bitwise Asset Management offers a perspective that challenges prevailing market assumptions: the current crypto market pullback may be nearing a cyclical low. The firm notes that a combination of falling prices alongside improving on-chain activity and business fundamentals has only occurred at a handful of pivotal moments in the past—the most recent being the first quarter of 2023.

Clear Divergence Between Price and Fundamentals

In its Q4 2025 Crypto Market Review, Bitwise highlights that the market is currently experiencing a disconnect in signals. During Q4 2025, Ethereum’s price dropped nearly 29% for the quarter. However, transaction counts on both the Ethereum mainnet and Layer 2 networks reached all-time highs, with a quarterly increase of 24.5%. This divergence also appeared in crypto-related equities. Even though crypto stocks fell about 20% in Q4, Bitwise points out that these companies’ revenue growth rates still significantly outpaced those in other sectors of the traditional stock market, indicating that enterprise demand has not cooled in step with prices.

Stablecoins Emerge as the Strongest Growth Signal

Bitwise places particular emphasis on stablecoin data, viewing it as the most compelling positive indicator at present. The report shows that both the total value and transaction volume of stablecoins set new records in 2025, with annual transaction volume reaching $32 trillion—a 73% year-over-year increase—even surpassing Visa’s total transaction volume for the first three quarters. According to Bitwise, this indicates that stablecoins are steadily evolving into payment infrastructure independent of price swings, rather than serving solely as trading instruments.

Bitwise Identifies Four Major Potential Catalysts for 2026

Looking ahead to 2026, Bitwise expects market movement to be driven more by concrete events than by short-lived narratives, highlighting four key variables:

- Progress in US Regulatory Legislation: The CLARITY Act is seen as a potentially pivotal bill for establishing a clear industry market structure, though its outcome remains uncertain.

- Stablecoin Supercycle: Growth in payment-oriented stablecoin adoption could become the primary driver of the next adoption wave.

- Federal Reserve Leadership Changes: Powell is expected to step down in May. If the new chair takes a more dovish stance, expectations for rate cuts could rise, supporting risk assets.

- Major US Wealth Platforms Adding ETFs: Beginning in Q4, several major US brokerages have enabled advisors to access crypto ETFs, unlocking potential access to $16 trillion in assets.

Market Bottom Depends on Sustained Data Improvement

Bitwise does not claim the market has officially bottomed, but emphasizes that if on-chain activity, stablecoin usage, and corporate revenue fundamentals continue to improve, prices will ultimately follow. Notably, shortly after the report was written, the crypto market experienced a clear rebound at the start of the year, with total market capitalization climbing back above $3 trillion.

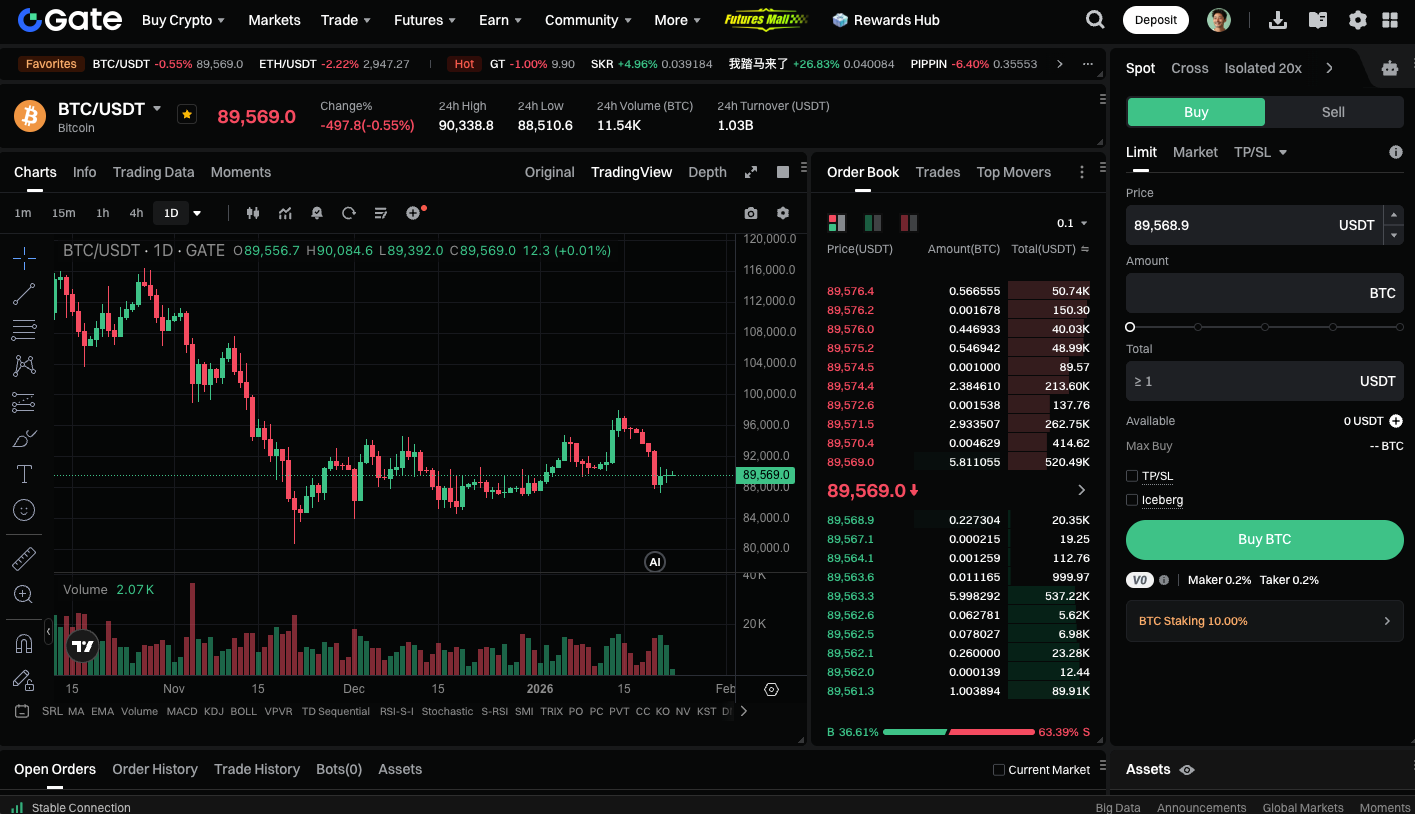

Start trading BTC spot now: https://www.gate.com/trade/BTC_USDT

Conclusion

In summary, Bitwise suggests that the crypto market may be at a critical juncture where weak prices coincide with improving fundamentals. Historical patterns show that such divergences often precede major trend reversals rather than mark the end of a cycle. As stablecoins become mainstream payment infrastructure, regulatory frameworks take shape, and traditional financial channels continue to open, the next phase of crypto market momentum may already be quietly building. For investors, rather than focusing solely on short-term price swings, it is more important to monitor whether underlying data continues to support this structural shift.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Gate Alpha Launches Points System: Trade On-Chain, Earn Points, Unlock Airdrops

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?