Bitcoin Price Prediction: 12-Year-Old Whale Emerges Selling BTC – Can It Hold 100K?

Long-Dormant Whale Returns to the Market

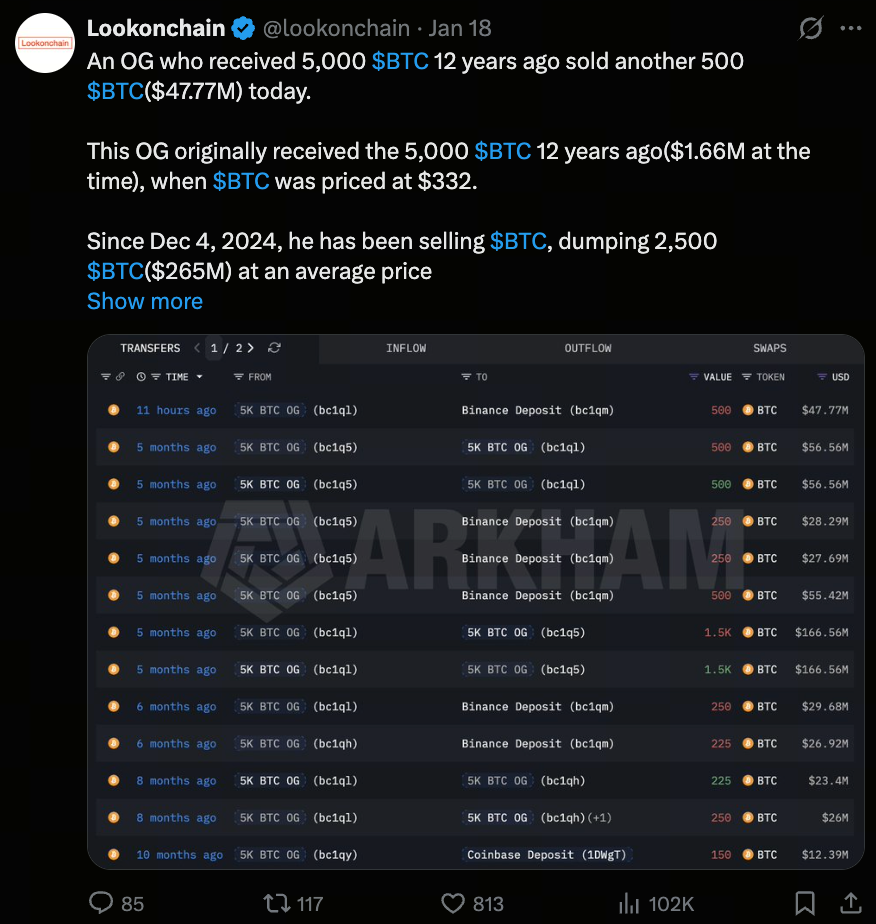

Recently, a Bitcoin (BTC) whale that had been inactive for years resurfaced, capturing the attention of traders. According to Arkham, the wallet identified as “5K BTC OG” received 5,000 BTC in 2012 at $332 per coin, totaling just $1.66 million at the time. Today, that holding is worth nearly $500 million, and the whale has already sold half of its assets.

Strategic Selling Activity

Lookonchain and Arkham data show that this wallet began systematic selling on December 4, 2024. So far, it has sold 2,500 BTC in several batches, with an average exit price of $106,164, generating approximately $265 million. The latest transaction shows 500 BTC recently transferred to Binance, valued at about $47.77 million.

(Source: lookonchain)

This selling appears deliberate rather than a one-off liquidation. Each transfer ranged between 250 and 500 BTC, spread across at least 10 transactions over five months. This approach likely aims to blend with market liquidity, minimize slippage risk, and avoid detection by automated market-making systems.

Market Impact and Risk

While half has been sold, the wallet still holds 2,500 BTC—worth about $237.5 million. If these assets are sold as BTC approaches $100,000, they could create a new resistance zone.

For long-term holders, this “HODL to exit” journey has been highly successful, yielding profits over $500 million. However, for short-term traders, this activity introduces uncertainty: a whale dormant for 12 years has become active and is now liquidating assets. Whether the market can absorb another 500 BTC sale remains uncertain.

To explore more Web3 content, click to register: https://www.gate.com/

Summary

This sell-off by a Bitcoin whale after 12 years of inactivity highlights the significant impact that long-term holders can have on BTC prices. While the market currently has sufficient liquidity, the release of the remaining 2,500 BTC could put renewed pressure on BTC. Investors should monitor whale movements and price trends closely to inform sound risk management strategies.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Gate Alpha Launches Points System: Trade On-Chain, Earn Points, Unlock Airdrops

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?