Bitcoin in One Hand, AI Compute in the Other: Gold and Oil in the Digital Age

Recapping the Volatility of 2025 and Forecasting the Next AI Supercycle

A New Industrial Revolution: Computing Power as the Engine of Economic Growth

“Only a select few, like Edwin Drake, have inadvertently sparked an era that reshaped human history. His drill pierced not only the earth, but also the artery of modern industrial civilization.”

In 1859, on the muddy grounds of Pennsylvania, Colonel Edwin Drake was ridiculed by onlookers. At the time, the world’s lighting depended on increasingly scarce whale oil, but Drake believed that “petroleum” could be extracted at scale from underground—a notion dismissed as pure madness. Yet, when the first black liquid erupted, oil didn’t just replace whale oil as an energy source for lighting; it became the foundation of global power, geopolitics, and the competition for influence over the next two centuries. Humanity reached a turning point: Old wealth relied on trade and shipping, while new wealth rose with railroads and energy.

In 2025, we’re witnessing a similar paradigm shift. This time, the frenzy flows through silicon chips as computing power, and the new “gold” is the code engraved on blockchains. These new forms of “gold” and “oil” are redefining our understanding of productivity and store-of-value assets. Reflecting on 2025, markets saw unprecedented volatility. Trump’s aggressive tariffs forced global supply chains to relocate, triggering a sharp inflation rebound. Gold surged past $4,500 amid geopolitical uncertainty. Crypto markets were buoyed by the GENIUS Act early in the year, only to suffer painful liquidations from leverage unwinding in October.

Beyond the macro turmoil, consensus around AI computing power is rapidly taking shape: NVIDIA, the “AI water seller,” hit a $5 trillion market cap milestone in October. Google, Microsoft, and Amazon poured nearly $300 billion into AI infrastructure this year. xAI is on track to complete a million-GPU cluster by year-end, signaling an inflection point for compute. In less than six months, Musk’s xAI built the world’s largest AI data center in Memphis, aiming to expand to one million GPUs before year-end.

The Digital Intelligence Era: The Core Theme of the Next Industrial Revolution

Ray Dalio, founder of Bridgewater Associates, famously said, “The market is like a machine—you can understand how it works, but you’ll never predict its behavior with precision.” While the macro environment remains unpredictable, AI is undeniably the main long-term growth engine for US equities. Over the next decade, AI will be the most critical cog in the market’s machinery, shaping government, corporate, and personal decisions alike.

Debate over an “AI bubble” persists, with institutions warning of frothy valuations. Morgan Stanley Research noted that AI investment growth in 2025 pushed tech stock valuations higher, while productivity gains lagged—a divergence reminiscent of the 1990s internet bubble.

Yet the reality is clear: The AI-driven productivity revolution is entering a phase of tangible monetization. AI is no longer just a tech giant narrative; its efficiency gains and cost optimization are now driving profitability and productivity across non-tech sectors. This progress comes with a harsh cost—labor market disruption. AI is rapidly replacing white-collar roles, especially entry-level jobs. Routine coding, accounting, auditing, junior consulting, and legal work are all prime candidates for AI-driven replacement.

As AI applications deepen, unemployment risks are rising in healthcare, education, and retail. In US investment circles, a dark joke circulates: Software engineers may soon resemble today’s civil engineers. As Elon Musk has warned, AI may eventually replace everyone’s job. Still, this signals the dawn of a new industrial era—the “digital intelligence age.”

Looking to 2026: AI Demand Will Continue to Accelerate

The Four Stages of AI Industry Investment

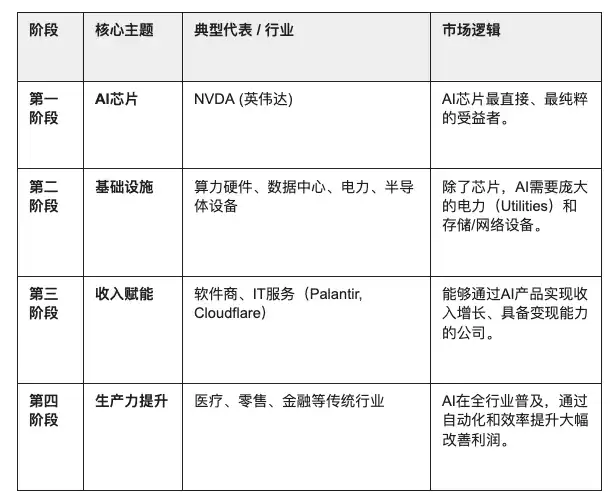

As the AI wave spreads from concept to industry-wide adoption and the market has priced in MAG7 (the seven US tech giants), where will the next surge in AI growth come from? Goldman Sachs strategist Ryan Hammond’s “four-stage AI investment model” provides a roadmap: AI investment will progress through chips, infrastructure, revenue enablement, and productivity improvement.

Four-stage AI investment model. Source: Goldman Sachs

Right now, the AI industry is transitioning from “infrastructure expansion” to “application deployment”—the shift from stage 2 to stage 3. Demand for AI infrastructure is surging:

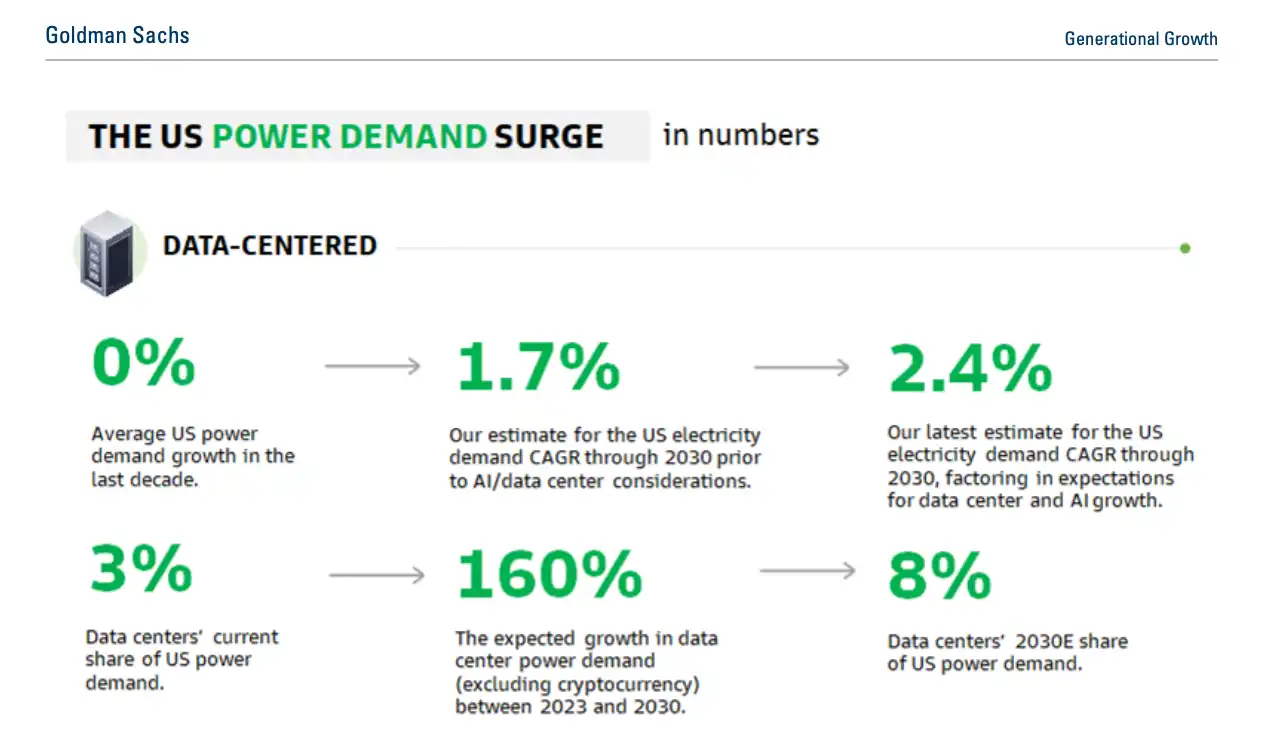

Global data center power demand is projected to increase 165% by 2030.

From 2023 to 2030, US data center power demand will grow at a 15% annual compound rate, raising data centers’ share of US electricity consumption from 3% now to 8% by 2030.

By 2028, worldwide cumulative spending on data centers and hardware will reach $3 trillion.

Goldman Sachs forecast for US data center power demand. Source: Goldman Sachs

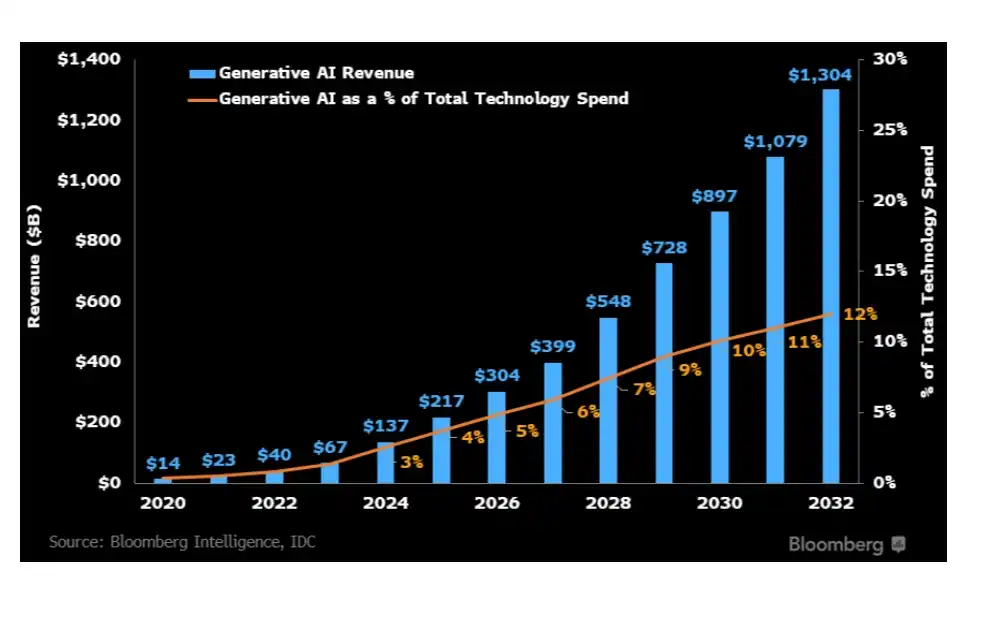

Meanwhile, the generative AI applications market is booming, expected to reach $1.3 trillion by 2032. In the short term, infrastructure for training will drive a compound annual growth rate of 42%. Over the medium and long term, growth will shift to LLM inference devices, digital advertising, specialized software, and services.

Bloomberg: Generative AI growth forecast for the next decade. Source: Bloomberg

This thesis will be tested in 2026. Goldman Sachs’ latest macro outlook calls 2026 the “year of realization” for AI investment ROI, with AI delivering significant cost reductions for 80% of non-tech S&P 500 companies. This will prove whether AI can truly shift from “potential” to “performance” on corporate balance sheets.

In the next 2–3 years, market focus will broaden beyond tech giants to include deep dives into AI infrastructure—power, hardware, data centers—and identifying companies in broader sectors that successfully convert AI into profit growth.

AI Compute Is the “New Oil,” BTC Is the “New Gold”

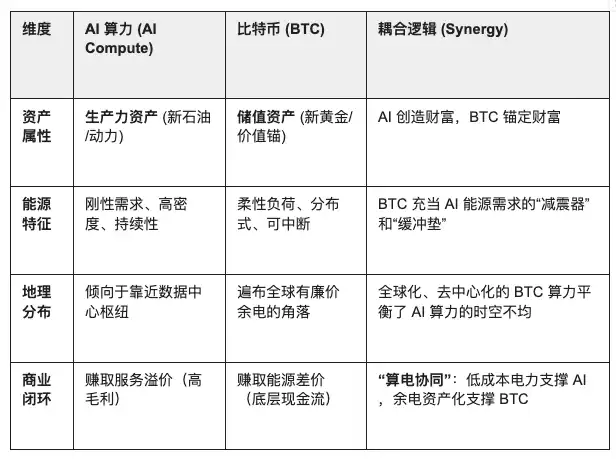

If AI compute is the “new oil” powering exponential productivity in the digital intelligence era, then BTC (Bitcoin) is the “new gold,” serving as the ultimate anchor for value and settlement.

AI, as an independent economic entity, doesn’t need the human banking system—it only needs energy. BTC is a pure “digital energy reservoir.” In the future, AI will fuel the economy, while BTC anchors its value. BTC issuance is determined by proof-of-work (PoW) based on energy consumption, perfectly aligning with AI’s essence: converting electricity into intelligence.

AI compute is a consumable productivity asset, with costs rooted in electricity and value output determined by algorithm efficiency. BTC, as a decentralized store-of-value, monetizes energy and naturally balances global compute across time and space. AI needs stable power, while BTC mining absorbs surplus grid electricity. Through “demand response,” BTC mining stabilizes the grid: When power is abundant (wind/solar peaks), compute absorbs the excess; when power is scarce (AI compute peaks), mining can shut down instantly, freeing energy for higher-value AI clusters.

GENIUS Act: The Convergence of Stablecoins, RWA, and On-Chain Compute

With the 2025 passage of the GENIUS Act in the US, the dollar is set for digital transformation—stablecoins will be regulated federally as the dollar’s “on-chain extension.” This act injects a trillion-dollar liquidity pool into on-chain US Treasuries and provides a model for stablecoin regulation in major jurisdictions, including the EU, UK, Singapore, and Hong Kong.

This compliance framework gives a powerful boost to the RWA (Real World Assets) market. Regulated stablecoins increase global liquidity and streamline cross-border settlement and trading, making RWA issuance and circulation easier. Stablecoins have become the primary payment method for on-chain investments in real estate, bonds, art, and other RWAs, supporting fast global cross-border clearing.

AI compute assets—high-cost, stable-return, heavy assets—naturally fit on-chain digital management requirements and are being standardized as RWAs. GPU cloud compute, AI inference resources, and edge compute node utilization can all be priced, leased, and measured for efficiency via smart contracts. This enables leasing, revenue sharing, transfers, and collateralization of compute to migrate to on-chain financial infrastructure for trading, settlement, and refinancing. On-chain data provides real-time operational and yield insights, ensuring transparency and verifiability. Compute supply can be flexibly scheduled, reducing capital lock-up and idle resources typical of heavy asset models, and ensuring stable, transparent returns.

Even more compelling, just as oil discoveries led to Wall Street’s oil trading platforms two centuries ago, AI compute—standardized via RWA—can be traded, collateralized, and leveraged as a financial asset, enabling on-chain financing, trading, leasing, and dynamic pricing. This new “compute capital market” will offer more efficient value transfer and limitless application potential.

New Opportunities in the Era of “Dual Consensus”

As AI becomes fully embedded in daily life, compute will be the consensus for productivity, while BTC’s extreme liquidity will redefine the consensus for store-of-value.

Companies that control either the “productivity” or “asset” end will be the most valuable in future cycles. Cloud service providers sit at the intersection of “BTC store-of-value consensus” and “AI productivity consensus.” If compute is the high-energy fuel of the digital economy, cloud services are the intelligent pipelines distributing it.

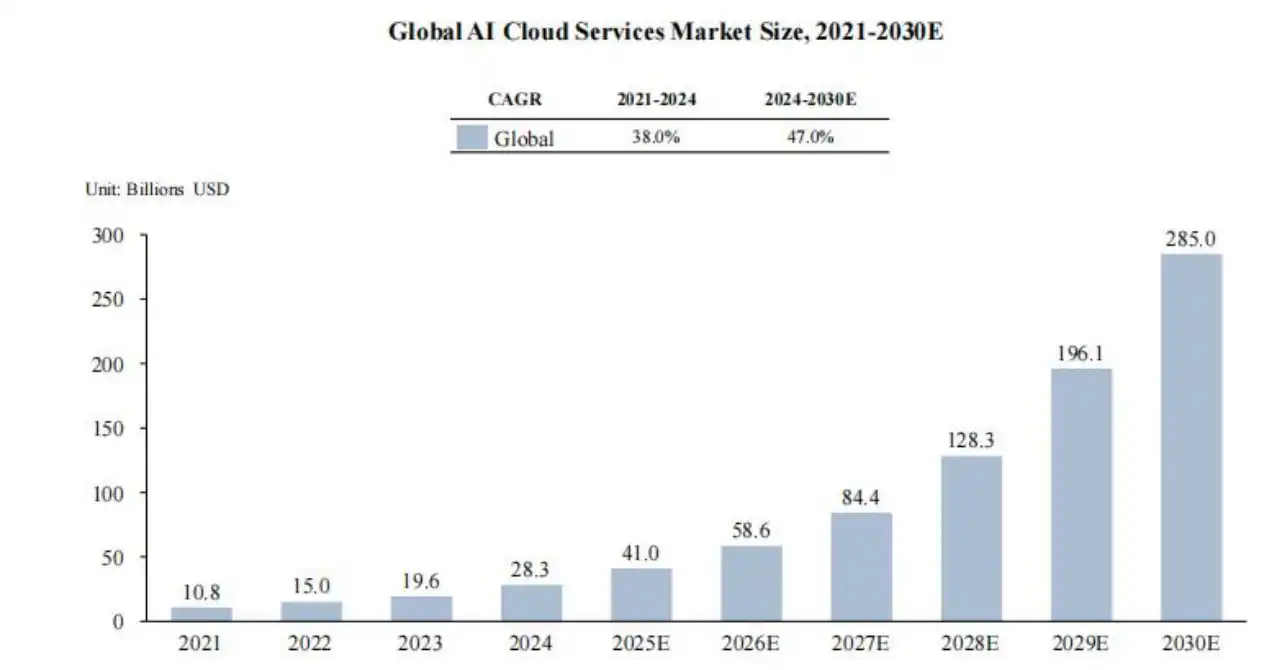

Global AI cloud services market forecast. Source: Frost & Sullivan

Major players include Microsoft, Amazon, Google, xAI, and Meta—known as “Hyperscalers.” Their main business is IAAS (Infrastructure as a Service), serving general needs. While their compute pools are vast, resource scheduling can be inefficient under peak demand. Hyperscalers dominate the upstream of AI compute services, controlling most market resources and continually expanding infrastructure:

· Microsoft: Launched the $100 billion “Stargate” initiative to build a million-GPU cluster for OpenAI’s model evolution.

· Amazon (AWS): Committed $150 billion over 15 years to deploy proprietary Trainium 3 chips, reducing compute costs and external supply dependency.

· Google: Maintains $80–90 billion in annual capex, leveraging its TPU v6 for global expansion of AI-specific cloud regions.

· Meta: Zuckerberg announced ongoing capex growth, with 2025 guidance raised to $37–40 billion. Meta is upgrading with liquid cooling and a reserve of 600,000 H100-equivalent GPUs to build the world’s largest open-source AI compute pool.

· xAI: Built the world’s largest supercomputing cluster, Colossus, in Memphis, targeting 1 million GPUs and showcasing aggressive, efficient infrastructure delivery.

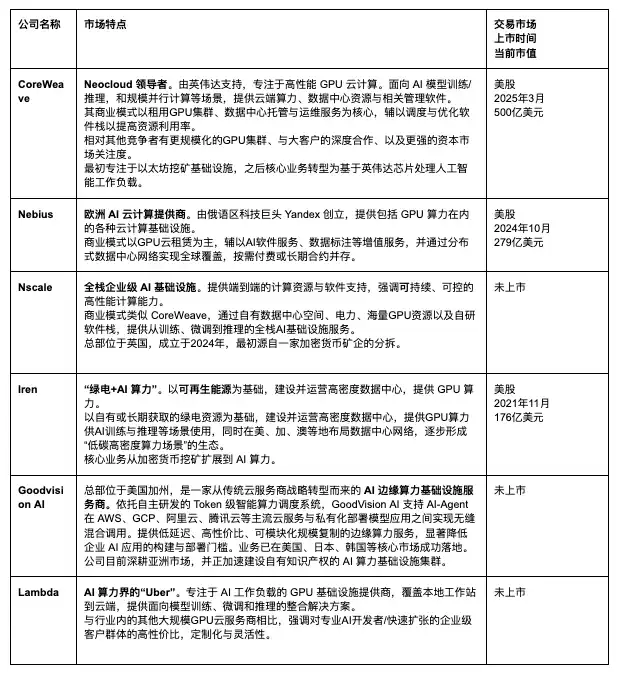

Emerging cloud providers like CoreWeave and Nebius—dubbed NeoCloud—expand into IAAS + PAAS (Platform as a Service). Unlike the giants’ general platforms, NeoCloud focuses on high-performance AI training and inference, offering flexible rental options and specialized scheduling for AI needs, with faster response and lower latency.

They stockpile top-tier GPUs (H100, B100, H200, Blackwell, etc.), build high-performance AI data centers, preinstall entire machines, liquid cooling, RDMA networks, and scheduling software, and deliver flexible machine or campus rentals charged daily for rapid customer deployment.

CoreWeave is the standout NeoCloud leader. As one of 2025’s hottest tech stocks, CoreWeave focuses on cloud and GPU-accelerated infrastructure for AI training and inference. Other contenders in compute rental include Nebius, Nscale, and Crusoe.

Unlike CoreWeave and other NeoCloud providers competing on heavy asset cluster scale in the US and Europe, GoodVision AI offers another global compute model—using intelligent scheduling and multi-user management to build fast, low-latency, cost-effective AI infrastructure in emerging markets with weaker power and infrastructure, achieving compute equity. While giants build million-GPU clusters in places like Memphis for large model training, GoodVision AI deploys modular inference nodes across emerging Asian markets to solve the “last mile” latency for AI applications.

Importantly, most top AI compute providers share a common trait—their founding teams and core architects hail from crypto mining. The shift from mining to AI compute is not a leap, but a strategic reuse of core capabilities. BTC mining and AI high-performance compute share similar foundations—large-scale power acquisition, high-power central deployment, and 24/7 operations. Their experience with cheap power and hardware management is now a premium asset in the AI boom.

As AI compute demand skyrockets, these providers naturally repurpose infrastructure from “mining store-of-value assets (BTC)” to “outputting productive compute (AI).” As “bidirectional switching” technology matures, BTC helps balance energy distribution across time and geography. In the digital intelligence era, the “fuel” for productivity shifts from oil to compute, and the underlying value anchor moves from gold to BTC.

Blockchain technology enables compute to be tokenized as RWA assets, allowing for verifiable records of source, efficiency, and yield, and cross-regional/time smart contract settlement to reduce credit risk and intermediary costs. This expands use cases in DeFi and cross-border compute leasing. Edge compute nodes, for example, can provide PoW verification for load and efficiency via smart scheduling and smart contracts, making edge inference compute a tradable, collateralized financial product—creating an “on-chain compute market.” The integration of compute and RWA will enrich on-chain asset types and unlock new liquidity for global capital markets.

Connecting Productivity and Store-of-Value: The Future of Compute Monetization

This is the real-world validation of the “dual consensus” thesis: BTC anchors the top value of energy, while AI is energy’s productive application. In this light, the era of “compute as currency” is arriving faster and more disruptively than anticipated. As we enter the digital intelligence age, the “fuel” for productivity is shifting from oil to compute, and the underlying asset for value consensus is moving from gold to BTC.

Today, we stand like the onlookers in Pennsylvania’s muddy fields in 1859, unable to imagine how a drill could launch a new era of industrial civilization. Now, fiber optic cables stretching into global data centers quietly build the arteries of a new age. Those who bet early on compute and BTC will become the new “oil barons,” redefining wealth and power in the coming cycle.

Statement:

- This article is reprinted from [BlockBeats]. Copyright belongs to the original authors [Jademont, Evan Lu, Waterdrip Capital]. For reprint concerns, contact the Gate Learn team for prompt resolution.

- Disclaimer: The views expressed are solely those of the authors and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Reproduction, dissemination, or plagiarism of translated content without mention of Gate is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?