Aster Launches Strategic Buyback Mechanism

Strategic Buyback Reserve Officially Launched: Revenue-Driven Token Value Enhancement

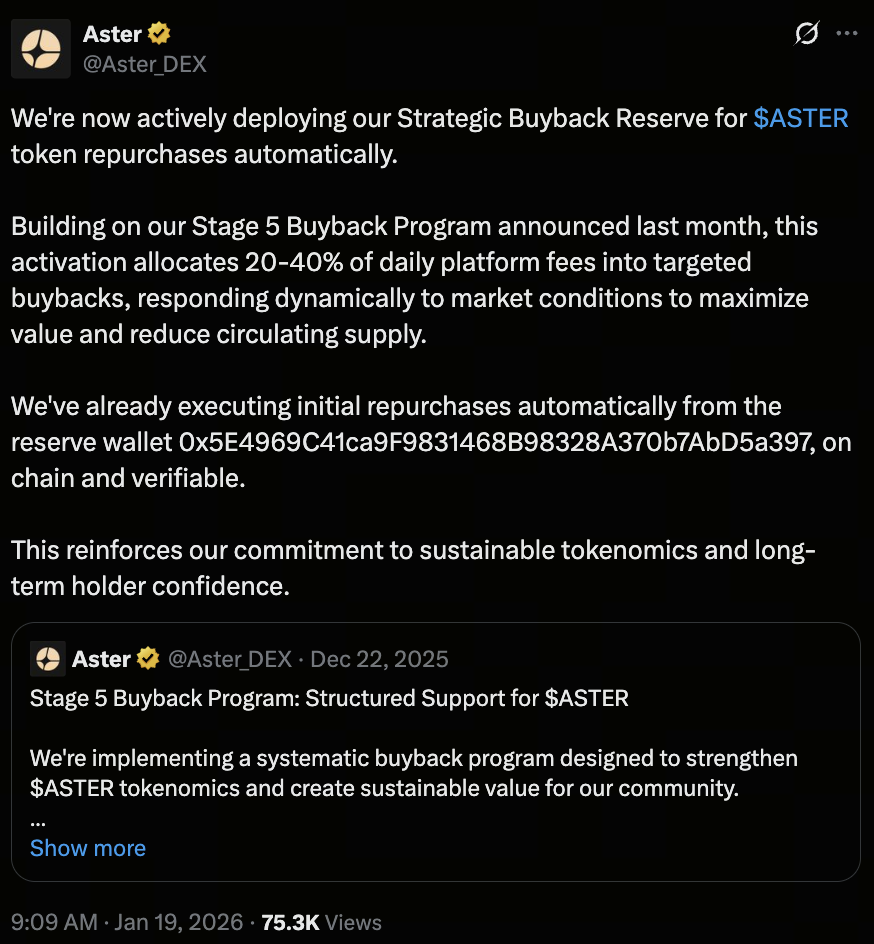

Aster has announced the official launch of its Strategic Buyback Reserve mechanism. Building on the previously released fifth phase of its token buyback plan, the platform will now automatically allocate 20%–40% of daily revenue to repurchase $ASTER tokens from the market, depositing them into a dedicated reserve pool.

(Source: Aster_DEX)

The initial buyback was executed via the on-chain address

0x5E4969C41ca9F9831468B98328A370b7AbD5a397. The process is fully verifiable on-chain, ensuring both transparency and traceability of fund usage.

Key Considerations Behind the Buyback Mechanism

The Strategic Buyback Reserve is designed as a long-term, institutionalized mechanism rather than a one-off market intervention. Its core objectives include:

- Mitigating market volatility: Dynamically adjusting buyback scale in response to actual revenue and market conditions to reduce the impact of extreme price movements

- Reducing circulating supply: Ongoing buybacks gradually decrease the amount of $ASTER available in the market

- Strengthening long-term outlook: Tying platform growth to token value to bolster holder confidence in the protocol’s future

This type of revenue-driven buyback mechanism is increasingly recognized as a hallmark of maturity among DeFi protocols.

Aster DEX: Integrated Evolution for Perp DEX

Formed by the merger of Astherus and APX Finance, Aster DEX positions itself as a next-generation decentralized perpetual contract exchange (Perp DEX). Its product design aims to balance decentralization with trading efficiency, featuring:

- Unified DeFi trading experience: Integrates spot trading, perpetual contracts, yield strategies, and cross-chain capabilities

- Multi-chain deployment: Currently live on several public chains including BNB Chain, delivering both efficiency and scalability

- Near-CEX trading depth: On-chain liquidity and matching engine provide an experience comparable to centralized exchanges

- Full asset self-custody: Users retain control of funds and private keys, eliminating centralized risks

In the increasingly competitive Perp DEX sector, Aster’s core differentiation lies in delivering a CEX-like experience while maintaining on-chain asset custody.

Buyback Mechanism and Product Strength: Building a Sustainable DeFi Ecosystem

The Strategic Buyback Reserve creates a closed loop among platform revenue, tokenomics, and user engagement. The buyback mechanism provides sustained value support for $ASTER, while the DEX’s expanding features and liquidity generate a stable cash flow for the protocol. This approach reflects Aster’s commitment to balancing short-term incentives with long-term sustainability.

To learn more about Web3, click to register: https://www.gate.com/

Summary

Aster’s Strategic Buyback Reserve is not just a bullish market narrative, but a systematic arrangement that closely links platform revenue, token supply and demand, and long-term development. With its integrated layout across perpetual contracts, spot trading, and cross-chain functionality, Aster is working to build a transparent, predictable, and resilient on-chain trading ecosystem. As DeFi continues to mature and institutionalize, such fundamentals-driven token value models may become a defining factor in the next wave of Perp DEX competition.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About