As BTC Pulls Back, Can GTBTC Become a Reliable “Earn While Holding” Option?

Current Market Overview: Pullback Magnitude and Primary Triggers

Chart: https://www.gate.com/trade/BTC_USDT

Bitcoin has recently retreated from its highs, with pronounced short-term volatility. As of February 2, 2026, BTC traded around $78,000. Recent media coverage points to sharp declines driven by shifts in market sentiment, policy and macroeconomic news, and concentrated liquidation events. These factors have collectively intensified short-term downward pressure.

Why is this significant for holders? In declining and turbulent markets, simply “holding without action” leaves capital idle with zero yield while waiting for recovery. Meanwhile, sentiment shifts and forced liquidations amplify psychological stress and downside risk.

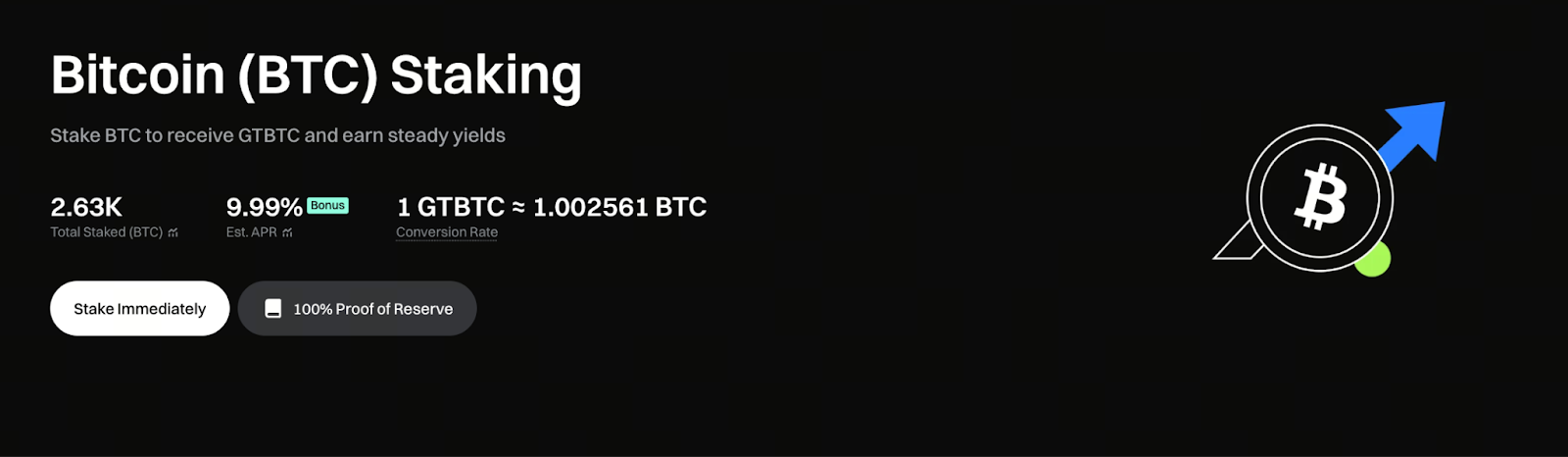

GTBTC’s Value Proposition During Market Pullbacks

Chart: https://www.gate.com/staking/BTC?pid=24

GTBTC does not promise principal protection. Instead, it delivers ongoing yield while maintaining BTC exposure. GTBTC aims to convert the time value of passive holding into visible returns—when BTC prices consolidate or decline, this yield helps moderate the pace of total return drawdown (though it cannot fully offset price declines).

To summarize:

- Direct holding: Asset value is entirely subject to price volatility.

- GTBTC: Retain price exposure while earning staking or strategy-driven yield during the holding period (reflected in net asset value).

In today’s pullback environment, this “yield on holdings” feature is especially attractive for those seeking to reduce emotional interference and boost long-term compound returns.

GTBTC: Core Operating Mechanism

- Deposit BTC into Gate’s staking or on-chain earning pool. The platform allocates these BTC to compliant yield strategies—such as regulated staking, liquidity provision, or lending—with platform-level risk management.

- The platform represents your entitlements with GTBTC tokens or a net asset value model. As yield accrues, GTBTC’s net value increases (or holders can redeem a greater amount of underlying BTC per GTBTC).

- You can use GTBTC within the Gate ecosystem, or redeem it for BTC or other products according to platform rules.

For users, the two most important points are: yield compounds automatically, requiring no daily intervention; and in most cases, you retain BTC price exposure (your principal rises or falls with BTC price). (Note: Refer to the Gate platform page for specific procedures and redemption rules.)

Practical Recommendations: Rational Use of GTBTC During Market Pullbacks

Here are actionable steps and considerations (not investment advice):

- Set your strategy before acting—define your objective: Are you seeking long-term holding and reduced time cost, or do you want to lock in yield temporarily and decide later? GTBTC is better suited for long-term holding.

- Start with small batches—avoid converting all BTC to GTBTC at once. Begin with a modest allocation (such as 10%–30% of your total BTC) to test yield accrual, redemption speed, and overall experience.

- Monitor net asset value and redemption rules—as yield is reflected in net value, tracking its growth curve helps gauge strategy stability. Also, familiarize yourself with redemption timelines.

- Maintain liquidity—during volatile or declining markets, avoid locking up all liquidity. Keep emergency funds available for urgent needs or better entry opportunities.

- Hedge and diversify—use GTBTC as part of your core position, complemented by spot holdings, stablecoins, or other low-correlation assets for diversification.

These steps help you gradually capture the buffer effect of staking yields while managing BTC downside risk.

Risk Disclosure

- Price risk remains: GTBTC does not guarantee principal, and a sharp BTC decline will directly affect your total asset value.

- Platform and strategy risks: Yields depend on Gate’s operations and external strategies. Strategy failure, counterparty default, or platform errors can impact returns.

- Liquidity and redemption rules: In certain scenarios, redemptions may be limited or delayed, especially under extreme market stress.

- Yield is not guaranteed: Reference annualized returns are based on historical or current strategy estimates and fluctuate with market conditions (not a fixed commitment).

Therefore, GTBTC is best positioned as part of a long-term portfolio—not as a one-size-fits-all solution for your entire holdings.

Summary

- BTC has recently seen a significant pullback, driven by market sentiment and leverage liquidations. Short-term volatility remains elevated.

- GTBTC’s value lies in generating yield while retaining BTC exposure, making it suitable for long-term holders seeking greater capital efficiency.

- Before using GTBTC, understand redemption rules, net asset value logic, and platform terms. Treat GTBTC as part of a diversified portfolio, not as an all-in approach.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About