Analysis of $1.38 Billion Institutional Outflow from BTC ETFs

Market Background: Why ETF Fund Flows Matter

Exchange-traded funds (ETFs) have emerged as essential tools for institutions and high-net-worth investors to access the crypto market, thanks to their transparency and ease of use. ETF inflows and outflows directly reflect market risk appetite and capital allocation, making them a key indicator for assessing bull and bear cycles.

In traditional finance, large-scale ETF net outflows typically signal that institutional investors are turning cautious or seeking safety. The same logic applies in the crypto sector, often accompanied by significant price volatility.

Bitcoin ETF Net Outflows Reach $1.38 Billion

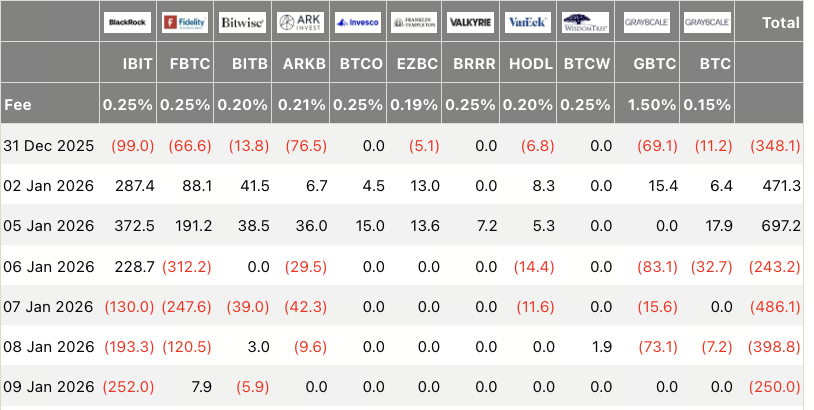

Spot Bitcoin ETFs recorded cumulative net outflows of about $1.38 billion over four trading days from January 6 to 9, 2026. Leading products—including BlackRock’s IBIT and other major Bitcoin ETFs—saw substantial capital withdrawals.

This wave of outflows reversed the earlier bullish momentum. At the start of the month, strong inflows had pushed Bitcoin prices higher, but as institutions began to take profits at elevated levels, funds started flowing out.

Data indicates that Bitcoin ETFs saw consecutive net outflows over several trading days, totaling $1.38 billion. This points to a short-term cooling in institutional appetite for risk assets.

Ethereum ETF Selling Pressure Continues

Ethereum spot ETFs are also facing ongoing capital withdrawals. According to reports, Ethereum ETFs posted several hundred million dollars in net outflows during a similar timeframe.

While Ethereum’s long-term fundamentals remain robust—driven by network upgrades and ecosystem growth—current institutional risk preferences have resulted in selling pressure for Ethereum ETFs as well.

This divergence in ETF fund flows highlights differing institutional risk assessments between Bitcoin and Ethereum.

How Fund Flows Impact Prices

Chart: https://www.gate.com/trade/BTC_USDT

Capital movement in ETFs and other institutional products directly influences spot prices. In recent weeks:

- During inflow periods, Bitcoin ETFs attracted strong capital, pushing prices to highs.

- During outflow periods, as capital exited, core prices came under pressure and volatility increased.

This further demonstrates the close link between ETF fund flows and price volatility. For traders and investors, ETF flow metrics are vital reference signals.

Why Are Institutions Withdrawing?

Institutional withdrawals are typically driven by a mix of factors:

- Profit-taking at high valuations—locking in gains on long positions

- Macroeconomic uncertainty—global inflation and interest rate expectations shaping asset allocation

- Rising crypto market volatility—short-term contraction in risk appetite

ETF investors are largely institutional in nature. When financial or risk preferences shift toward caution, these investors are more likely to reduce exposure to mitigate potential risks.

Market Outlook and Strategic Guidance

Although ETFs are currently experiencing net outflows, this does not necessarily signal the end of the bull market:

- The market may enter a consolidation phase

- Short-term capital may rotate into other asset classes

- Price corrections could offer medium- to long-term entry points

For medium- and long-term investors, monitoring inflow trends and key support levels, while aligning strategies with personal risk tolerance, remains crucial.

Conclusion

Recent sharp outflows from Bitcoin and Ethereum ETFs reflect short-term risk aversion and profit-taking at elevated levels. Fund flows remain a key gauge of market sentiment and price direction; understanding these dynamics can help investors seize opportunities. As market conditions evolve, ongoing data tracking will be critical for sound investment decisions.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Gate Alpha Launches Points System: Trade On-Chain, Earn Points, Unlock Airdrops

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?