Amid Rising Volatility in Gold and Silver Markets, How Gate’s Metals Zone Provides Robust Tools for Traders

Recent Volatility Patterns in the Metals Market

In January 2026, metals like gold and silver experienced a marked increase in both intraday and short-term volatility, with rapid price surges and sharp pullbacks. Analysts note that this volatility is driven by a combination of macroeconomic and geopolitical factors, amplified by speculative capital and retail sentiment. As a result, prices have seen dramatic swings over brief periods. Market institutions and media broadly caution that metals have entered a period of heightened volatility, with a pattern of repeated shocks likely to persist.

Why Platforms Like Gate Are Essential During High-Volatility Periods

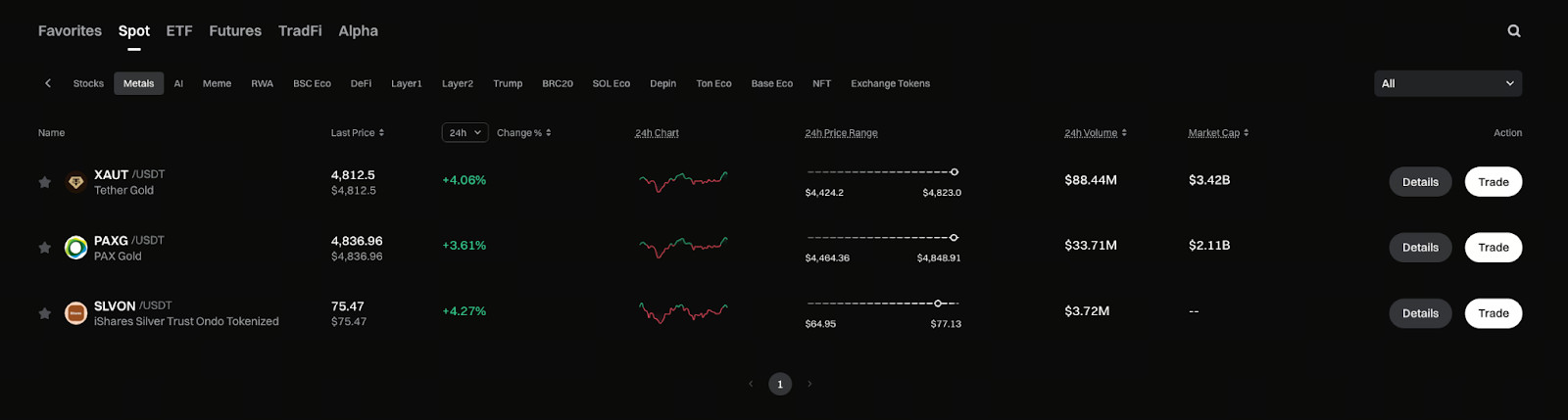

Chart: https://www.gate.com/price/category-metals

High-volatility markets create trading opportunities but also raise the bar for operational complexity and execution speed. Traditional spot or OTC metals trading is limited by trading hours, settlement, and delivery processes. During extreme volatility, failure to enter or exit positions promptly can directly increase losses. Traders need a platform that enables instant entry and exit, unified settlement, clear risk management rules, and ample liquidity. Gate’s metals section is purpose-built for these demands, transforming the hedging and risk management features of traditional metals into more flexible trading tools.

Key Features and Design Highlights of Gate’s Metals Section

- 24/7 Perpetual Contract Trading — Volatility-driving news and events can break at any time. Around-the-clock trading lets users execute stop-loss/take-profit orders and adjust positions whenever needed, enabling timely responses to market shifts.

- USDT-Settled Contracts — Unified stablecoin settlement streamlines fund management and currency conversion, making settlements faster and more intuitive.

- Indexed Pricing from Multiple Markets — By referencing prices from several major markets to form the contract index, the system reduces the impact of anomalies in any single market or exchange, improving price transparency.

- Advanced Contract Risk Management and Clearing — Margin requirements, tiered risk limits, insurance funds, and dynamic liquidation mechanisms give users clear risk boundaries, even in extreme volatility.

- Diverse Trading Tools — Leverage trading, hedged positions, and cross-asset arbitrage access support a wide range of trading strategies.

Together, these features deliver higher execution efficiency and clearer risk parameters for users navigating highly volatile market conditions.

Practical Trading and Risk Management Strategies on Gate

- Beginner/Conservative: Limit position sizes and use low or no leverage for short-term hedging or swing trading. Always set clear stop-losses and position caps.

- Intermediate/Arbitrage: Leverage price differences between spot and contracts, or between metals and crypto assets, for cross-market arbitrage—while carefully evaluating funding rates, slippage, and fees.

- Advanced/Trend Trading: Once a trend is confirmed, build positions in stages and use trailing stop-losses to avoid taking full risk exposure at once during high volatility.

- Hedged Portfolio Strategies: Use metal contracts as hedging tools within a crypto asset portfolio to reduce overall volatility (while monitoring funding rates and holding costs for long-term positions).

Regardless of strategy, be mindful that liquidity can temporarily tighten during high volatility, and slippage or execution delays may increase actual trading costs. Prudent position sizing and use of platform risk management tools are especially critical.

Risk Warning and Conclusion

High volatility in metal markets brings both opportunities and greater operational risk. Platform tools can reduce execution and settlement friction, but cannot eliminate market risk itself. When trading in Gate’s metals section, users should fully understand the leverage features of perpetual contracts, funding rate mechanisms, and platform liquidation rules, and manage positions and stop-losses appropriately. Gate will continue to enhance its risk management and price reference mechanisms to support users in executing sound trading decisions in complex market environments.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About