All Wealth Myths Are the Result of Non-Consensus and the Compounding of Time

In 2017, Black Ant Capital made its initial investment in Pop Mart and continued to increase its stake in the following years. By December 2020, Pop Mart went public in Hong Kong, with its market capitalization surpassing HK$100 billion on the first day. Black Ant Capital achieved a return of over 100 times its original investment, setting a classic example in China’s consumer investment sector.

In 2010, Sequoia Capital China Fund invested in Meituan and participated in multiple follow-on rounds, ultimately earning a return of more than 100 times when Meituan went public. This investment established Sequoia China as one of the most successful institutions in the history of China’s internet investment.

In venture capital, a 10x return is already outstanding; a 100x return is legendary.

Yet in Europe, a venture capital firm achieved nearly a 1,400x return on a single investment.

The firm is Balderton Capital. In 2015, Balderton led the seed round for Revolut—known as “Europe’s Alipay”—with a £1 million investment. Over the next decade, they participated in several additional rounds, bringing their total investment to about £3 million.

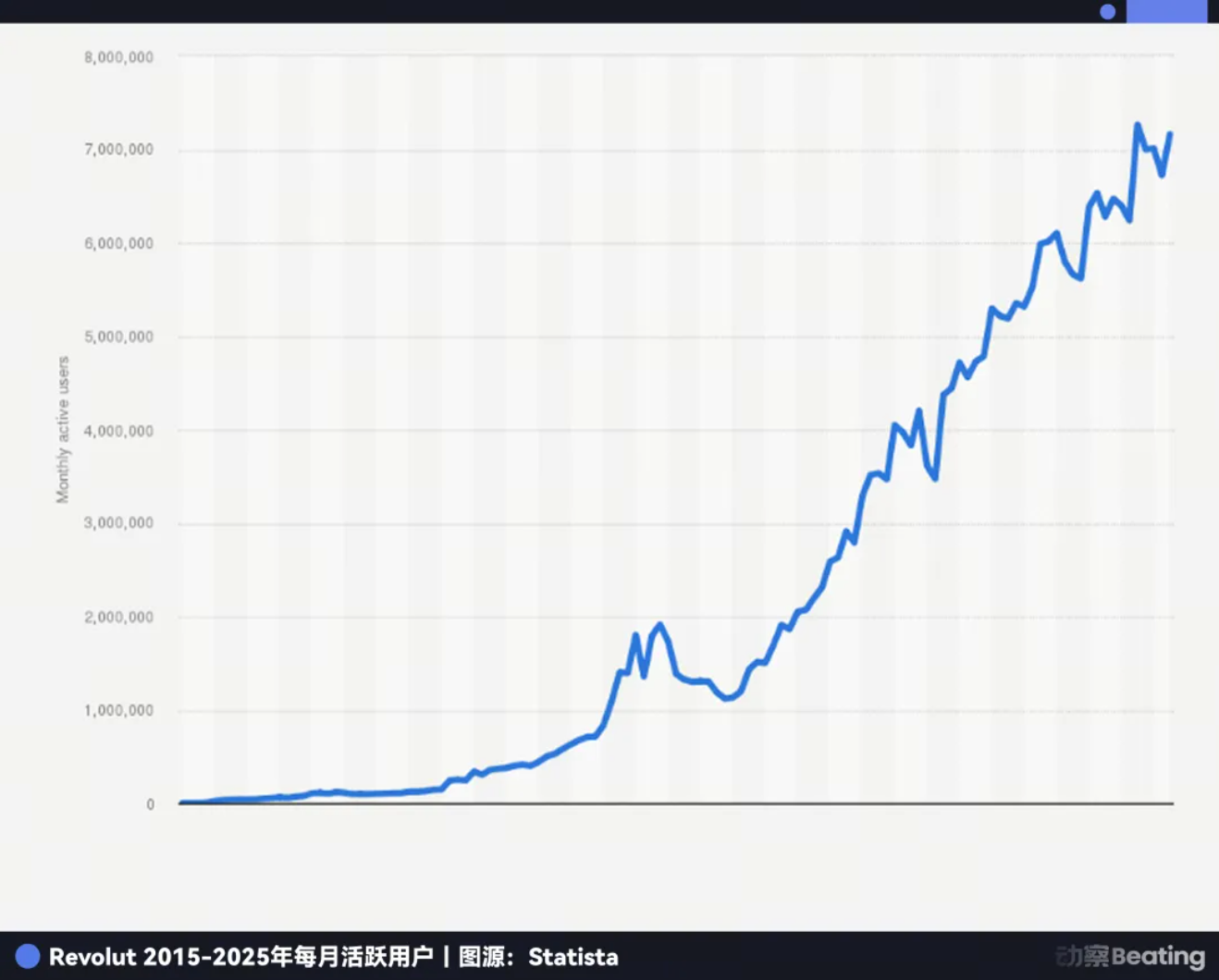

Over 11 years, Revolut grew from a grassroots project rejected by Y Combinator into a fintech giant valued at $75 billion, recognized as Europe’s most valuable fintech company. Today, Revolut serves over 65 million users globally, generates annual revenues exceeding $4 billion, posts annual profits of over $1 billion, and processes tens of billions of dollars in transactions daily.

By 2025, Balderton Capital had realized approximately $2 billion by gradually selling portions of its Revolut stake. Its remaining shares, based on the latest valuation, are still worth over $4 billion. This means Balderton’s total return from Revolut exceeds $6 billion—nearly 1,400 times its investment.

Even more remarkable, the fund holding Balderton’s Revolut shares—Balderton Capital Fund V, established in 2014—raised just $305 million. By 2025, the fund had returned more than 20 times its capital to investors through the sale of Revolut shares. This means that even if all other investments in the fund went to zero, its return multiple would still far outpace the industry’s top-tier average of 3–5x.

This story reveals the essence of venture capital. In a world where business certainty has disappeared, how do we face uncertainty? When everyone sees risk, where are the hidden opportunities?

People from Two Worlds

This story begins with the meeting of two fundamentally different individuals in early 2015.

The first is Nikolay Storonsky, a naturally restless Russian. His father was an executive at Gazprom, and he grew up in a privileged family.

Storonsky holds dual master’s degrees in physics from the Moscow Institute of Physics and Technology and in economics from the New Economic School. He’s also a sports enthusiast—a former national swimming champion, passionate about boxing and surfing.

In 2006, he moved to London and became a derivatives trader at Lehman Brothers, handling billions of dollars in trades every day. After the collapse of Lehman Brothers in 2008, he joined Credit Suisse. With frequent travel, he lost thousands of dollars each year to currency exchange fees, which he found both unreasonable and unfair.

He connected with Vlad Yatsenko, a software engineer with a decade of experience at Credit Suisse and Deutsche Bank, and together they decided to solve the problem themselves.

In 2014, they founded Revolut at the Level39 incubator in Canary Wharf, London. Storonsky invested his entire savings—£300,000—staking his future on the venture.

The second person, Tim Bunting, who was soon to meet Storonsky, came from a completely different world.

In 2007, at age 43, Bunting decided to leave Goldman Sachs.

He had spent 18 years at Goldman Sachs, rising to Global Head of Equity Capital Markets and International Vice Chairman, and was a partner at the firm. He stood atop a world of certainty, where every transaction was modeled precisely, every decision was backed by massive data, risk was quantified, and the future was forecasted.

Yet he chose to leave and leap into a fundamentally different world—venture capital.

He joined Balderton Capital. The heart of venture capital is seeking possibility amid uncertainty. There are no perfect models here—only intuition and judgment about people.

When they met in February 2015, Revolut was in dire straits. Their product demo wasn’t functional, and they’d just been rejected by Y Combinator, Silicon Valley’s most renowned incubator. In any typical investment process, this project would have been dismissed outright.

But Bunting saw something different.

He later recalled that in Storonsky’s eyes, he saw the ambition and drive to disrupt the entire European banking sector. At the same time, in technical co-founder Yatsenko, he saw steadiness and reliability.

One understood finance, the other technology; one was bold, the other steadfast. This was the perfect founding team.

When everyone sees risk, great investors see opportunity. Consensus only brings average returns—only non-consensus can deliver outsized gains.

In July 2015, Balderton officially led Revolut’s seed round, investing £1 million at a post-money valuation of £6.7 million.

But are outstanding founders and bold investors enough? What greater forces drive a 1,400x return miracle?

Timing, Geography, and People

Revolut’s success was a product of timing, geography, and people.

First, the aftershocks of the 2008 financial crisis nearly destroyed public trust in traditional banks.

According to Eurobarometer, after the crisis, trust in banks among Europeans hit historic lows. Banks themselves struggled, with profitability plunging. The average return on equity (ROE) for European banks dropped from about 11% before the crisis to just 4–5% around 2015, far below their US counterparts.

To survive, banks launched massive layoffs. Between 2012 and 2015, over 10,000 branches closed across Europe, with tens of thousands of employees laid off. This led to a sharp decline in service quality and customer experience, leaving a huge market gap for new challengers.

Meanwhile, technology was reshaping the landscape. In 2015, smartphone adoption soared in Europe, and mobile banking usage rose rapidly. The shift from physical branches to mobile apps became irreversible.

Regulation also arrived at the right time. At the end of 2015, the EU passed the revised Payment Services Directive (PSD2), with “open banking” at its core. This broke banks’ monopoly on customer data, allowing third-party fintechs, with user consent, to access bank account data and provide innovative financial services—paving the way for the fintech industry’s growth.

A new generation of consumers was also coming of age. As digital natives, they were frustrated by traditional banks’ cumbersome processes and poor experiences. A 2015 survey showed 80% of consumers under 45 believed they should be able to conduct any financial transaction via a mobile app.

The fragmented nature of the European market further propelled Revolut. Europe is made up of dozens of countries, languages, and currencies; cross-border transactions were inconvenient and costly—a persistent pain point.

Against this backdrop, Europe’s fintech race took off around 2015. Germany’s N26, the UK’s Monzo and Starling, and TransferWise (now Wise), focused on cross-border payments, all emerged at roughly the same time. Each carved out its own niche—N26 emphasized design, Monzo focused on social features. The industry consensus was to conquer one market or product category at a time.

But Revolut was different from day one.

Its core insight was that banking could be built as a global software product—full-stack and borderless from the start. While competitors focused on niche markets, Revolut was already expanding globally. This bold, controversial strategy ultimately set it far ahead of its rivals.

But turning a grand vision into a great company is never easy. Revolut’s journey was anything but smooth.

Running Amid Controversy

One of Revolut’s core values is “Never Settle.” This value is deeply embedded in the company’s DNA, driving it to push forward amid controversy for the past 11 years.

This relentless drive first showed in the speed of product expansion.

In July 2015, Revolut officially launched, processing more than $500 million in transactions in its first year. By the end of 2016, it had over 300,000 users and nearly £1 billion in transaction volume. In November 2017, Revolut announced it had surpassed 1 million users—reaching this milestone in just over two years.

Storonsky’s motto is “Release and iterate faster to maximize your chances of winning.” After launching its core low-fee currency exchange card, Revolut rapidly rolled out new features: cryptocurrency trading in 2017, then stock trading, savings vaults, budgeting tools, insurance, P2P payments, and business accounts. Revolut became a comprehensive financial super app, while competitors were still guarding their small territories.

This aggressive expansion strategy fueled explosive growth. In 2017, Revolut’s user base tripled and revenue grew nearly fivefold. In 2018, users jumped from 1.5 million to 3.5 million, with revenue up 354%. By April 2018, Revolut completed a $250 million Series C round at a $1.7 billion valuation, officially entering unicorn status.

Revolut’s ability to launch new features quickly stemmed from its VC-style product strategy.

They didn’t rely on elite “top-down design.” Internally, many new products and features were tested in parallel, but only a small fraction “graduated” to become real business lines. Those that didn’t gain traction were cut, while validated products received additional resources.

None of Revolut’s core revenue products today came from top-down strategic planning; all emerged from this internal competition and trial-and-error culture.

But this came at a cost. Over 11 years, Revolut faced at least three existential crises.

The first test was about trust.

In 2016, the company needed more funding to expand, but traditional financing channels were blocked. Storonsky proposed a bold idea: raise funds from the public via the Crowdcube platform. This was unconventional at the time, and many investors opposed it.

But Balderton stood firm in support, seeing it not only as a funding solution but also as great marketing and a test of public trust in Revolut. In the end, 433 ordinary people participated, investing an average of about £2,152 each. They believed in Revolut’s vision and voted with their money.

Now, these early supporters have seen astonishing returns. The price of an iPhone then is now a down payment on a house in the London suburbs. The initial £2,152 investment is now worth over £380,000—a return of more than 170 times.

The second test was about culture.

In February 2019, Wired UK published a major exposé highlighting serious problems in Revolut’s corporate culture, accusing the company of ruthless growth at the expense of employees and resulting in high turnover. The company was plunged into a PR crisis.

At the time, Revolut was in a period of rapid growth. In 2019, users exceeded 10 million, and the company began expanding into Australia and Singapore. But the crisis severely damaged its reputation.

As a board member, Bunting immediately engaged in deep discussions with Storonsky. He shared his experience managing large teams at Goldman Sachs, helping Storonsky realize that as the company grew, it needed a more mature and people-centric management system. With Balderton’s help, Revolut brought in experienced managers and began systematically improving its corporate culture.

The third test was about compliance.

Starting in 2021, Revolut applied for a banking license from the UK Financial Conduct Authority (FCA), but after three years, approval was still pending. Regulators raised serious concerns about its anti-money laundering systems and corporate governance—a potentially fatal blow for a fintech company.

While waiting for the UK license, Revolut did not slow its expansion. In 2020, it completed a $580 million Series D round, reached 14.5 million users, and entered the US and Japanese markets. In 2021, it completed an $800 million Series E round at a $33 billion valuation. By 2022, users had grown to 26 million.

At a critical moment, Bunting leveraged his industry network. He personally invited Martin Gilbert, chairman of abrdn (Aberdeen Standard Investments) and a titan of UK finance, to become Revolut’s chairman. This move greatly increased regulators’ trust in Revolut. In July 2024, Revolut finally secured the coveted UK banking license.

With the UK license in hand, Revolut also delivered impressive results. In 2024, users surpassed 50 million, annual revenue reached $4 billion (up 72%), annual profit broke $1 billion for the first time, and total customer transaction volume exceeded $1 trillion. The company became the most downloaded financial app in 19 countries.

Through 11 years of challenges, Balderton Capital remained firmly behind Revolut. Bunting has always served as a board member, providing vital support at every key stage and participating in every subsequent funding round.

The “American Dream” of European VC

Revolut’s breakout success brought Balderton, long behind the scenes, into the spotlight. The foundation of this London VC’s ability to spot miracles is not luck, but the Silicon Valley DNA inherited from Benchmark Capital.

In 1999, Benchmark’s partners set up a European branch in London—Benchmark Capital Europe—bringing not just capital but a unique organizational structure: equal partnership.

In traditional VC funds, a handful of general partners hold most of the power and rewards, while others are in subordinate positions. This pyramid structure often leads to internal competition and conflicts of interest.

Equal partnership is entirely different. At Balderton, all partners have equal ownership and an equal voice in every decision. Economic returns are shared equally, regardless of who sourced or led the deal. This ensures fully aligned interests and enables the team to operate in sync.

This system’s advantages were clear in the Revolut investment.

First, better due diligence. When Bunting first met Storonsky, he was an expert in finance but not technology. He immediately brought in partner Suranga Chandratillake, who had an engineering background, to help evaluate. There was no jockeying for credit—only a shared goal of backing the best company.

Second, with all partners’ interests tied together, decisions are made in the company’s best interest. Balderton provided unwavering support in each of Revolut’s funding rounds, never hesitating due to internal disputes.

Finally, more comprehensive post-investment support. Startups face different challenges at different stages. Equal partnership means founders can always tap the resources of the entire partner team.

In 2007, the European team spun out from Benchmark and was renamed Balderton Capital, after the street of its first office. The equal partnership system was retained and became key to Balderton’s rise in the European VC landscape.

But a good system alone can’t guarantee every investment’s success. In venture capital, what ultimately determines the outcome?

The Power Law

The power law is the extreme version of the 80/20 rule.

In venture capital, it means a small number of investments contribute the vast majority of returns, while most end up average or as total losses.

According to PitchBook, the top 10% of investments in the VC industry account for 60–80% of total returns. VCs cast a wide net, but must double down on the rare few with the potential to be super-winners.

In its 25-year history, Balderton Capital has invested in over 275 companies, including stars like Darktrace, Depop, and GoCardless. Without Revolut, Balderton might still be an excellent European VC, but it would not be the legend it is today.

This means venture capital is ultimately a game of non-consensus. If a project is already widely recognized, its valuation will be high and future returns limited. Only early-stage, controversial, non-consensus projects can deliver disruptive, outsized rewards.

For venture capital, success is not about hit rate—it’s about the magnitude of returns. Nine failed investments don’t matter if the tenth returns 1,000x. It may sound like gambling, but top VCs use disciplined philosophies and processes to improve their odds.

Is there a replicable formula behind this 1,400x miracle?

The Thousandfold Return Formula

Outsized Return = (Non-consensus Founder × Structural Opportunity of the Era) ^ Patience Across Cycles

First, the non-consensus founder.

In venture capital, people always come first. Especially at the seed stage, when products, markets, and data are absent, the founder is almost the sole criterion.

A top founder must be a relentless optimist—someone with bold visions for the future and the ability to solve present problems pragmatically.

Second, structural opportunities of the era. Revolut’s success was inseparable from Europe’s unique window in 2015: the aftermath of the financial crisis, the rise of mobile internet, regulatory openness, and generational change. Great companies are products of their times. They capture structural shifts and become synonymous with those changes through their products and services.

Finally, and most importantly, patience across cycles. From 2015 to 2026, Revolut endured cultural crises, regulatory challenges, and fierce competition.

Throughout these 11 years, Balderton remained a steadfast supporter—not only following on in every round but also providing invaluable advice and resources at critical moments. This long-term commitment and willingness to weather storms with founders is essential for outsized returns.

In the world of capital, time is both friend and foe. Only those who resist short-term temptations and persist in long-term value can ultimately benefit from the compounding effect of time.

Turning £1 million into $6 billion is not just a story about wealth—it’s a story of vision, courage, and patience. It shows that in a rapidly changing era, true opportunities always belong to those who can see the trends, embrace change, and are willing to partner with great entrepreneurs for the long haul.

Statement:

- This article is republished from [动察Beating], with copyright belonging to the original author [Sleepy.txt]. If you have any objections to this republishing, please contact the Gate Learn team, and the team will address it promptly in accordance with relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless otherwise noted, translated articles may not be reproduced, distributed, or plagiarized without referencing Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?