After a Failed Public Sale, Infinex Admits Mistakes — Why Do Projects Keep Misreading Users?

On January 5, midway through the INX token public sale on Sonar, the cross-chain DeFi aggregator Infinex publicly acknowledged that “the sales mechanism was flawed.” The team announced three major rule changes: they removed the $2,500 per-user investment cap, allowing participants to decide their own contribution amounts; shifted from random allocation to a “max-min fair distribution” to ensure all participants receive equal allocations until supply runs out, with any excess refunded; and maintained priority for Patron holders, though the specifics of priority distribution will be determined after the sale ends.

In their announcement, the team attributed the lack of interest to trying to satisfy existing supporters, new participants, and fair allocation simultaneously. This approach ultimately resulted in minimal engagement. “Regular users dislike lock-up mechanisms, whales dislike caps, and everyone dislikes complicated rules.”

Infinex’s Sales Mechanism

Infinex is a crypto project launched by Synthetix co-founder Kain Warwick. Initially, it was positioned as a unified DeFi entry point or frontend layer. Over time, Infinex evolved into a non-custodial wallet super app, focused on chain abstraction and intent-driven multi-chain experiences, aiming to deliver a user experience similar to centralized exchanges (CEX).

The Infinex token sale on Sonar runs from January 3 to 6, offering 5% of the total token supply. The fundraising target was reduced from $15 million to $5 million, and the fully diluted valuation (FDV) was lowered from $300 million to $99.99 million. User registration opened on December 27, and the sale began on January 3. Additionally, 2% of the tokens will be sold separately on Uniswap CCA.

A key part of the sales rules reserves allocations for Patron NFT holders, while another portion is distributed by lottery to non-Patron holders. Each Patron NFT grants the holder rights to 100,000 INX tokens at the Token Generation Event (TGE). Holders of multiple Patron NFTs receive allocations proportional to their holdings.

According to Infinex, one Patron NFT entitles the holder to $2,000 in tokens, five Patrons to $15,000, 25 Patrons to up to $100,000, and 100 Patrons unlock a maximum allocation of $500,000. Participants without Patron NFTs can still join the sale through a separate lottery, with a per-person cap of $5,000 and a minimum purchase of $200.

In October 2024, Infinex raised $67.7 million through Patron NFT sales. Investors included billionaire Peter Thiel’s Founders Fund, Wintermute Ventures, Framework Ventures, Solana Ventures, and angel investors such as Ethereum co-founder Vitalik Buterin, Solana co-founder Anatoly Yakovenko, and Aave founder Stani Kulechov. Infinex stated that this fundraising model involved selling Patron NFTs to VCs, angel investors, and the community.

Infinex sold approximately 43,244 Patron NFTs across Ethereum, Solana, Arbitrum, Base, Polygon, and Optimism. On Monday, these NFTs were distributed to buyers on the Ethereum blockchain and are now available for trading on OpenSea and Blur NFT marketplaces.

Why the Change? Less Than 10% Raised on Launch Day

The sales rules triggered controversy within the community. The main criticism focused on the requirement for retail participants in the public sale to lock tokens for one year. Many argued this conflicted with the expected liquidity of a public sale, especially in a cautious macro environment where capital prefers rapid movement. Extended lock-ups naturally increase opportunity costs.

There was also skepticism about the FDV being excessively high. At a stage where the project remains unproven and lacks stable, quantifiable revenue and cash flow, launching a public sale at a nearly nine-figure or higher FDV essentially asks participants to prepay for several years of future execution and growth.

As a result, on the first day of the token sale on Sonar, Infinex raised just over $400,000—about 8% of the $5 million target. The INX token sale will last for seven days, and the probability of the public sale exceeding $5 million on Polymarket has dropped to 25%.

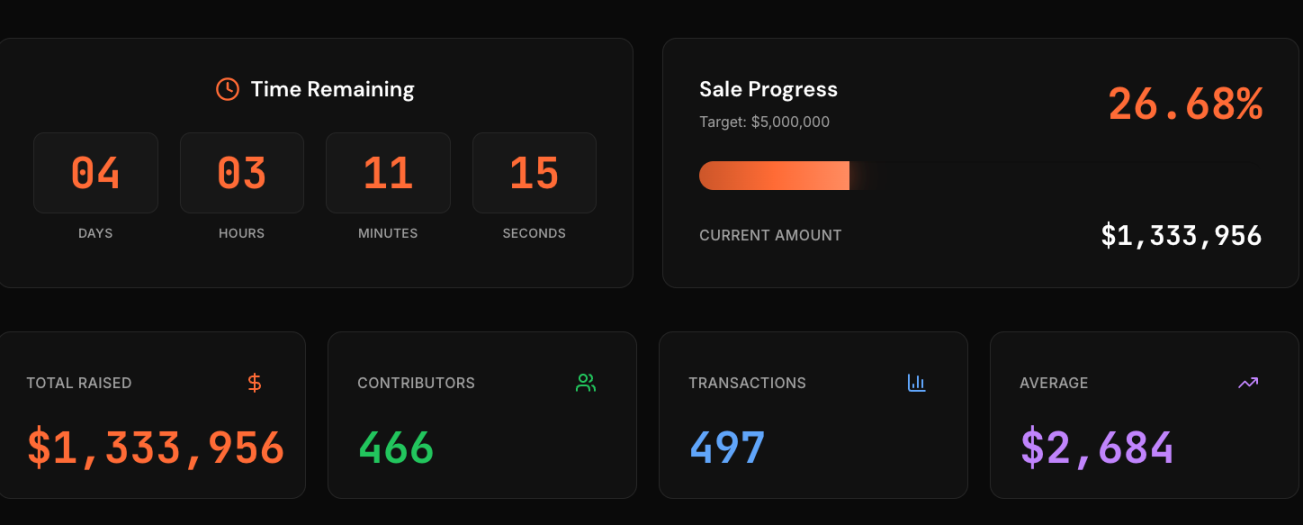

After the rule changes, the relevant webpage shows Infinex has raised over $1.33 million, reaching 26.68% of the $5 million target, with 466 participating addresses and 497 total transactions.

Suspicious Polymarket Bets During the Sale

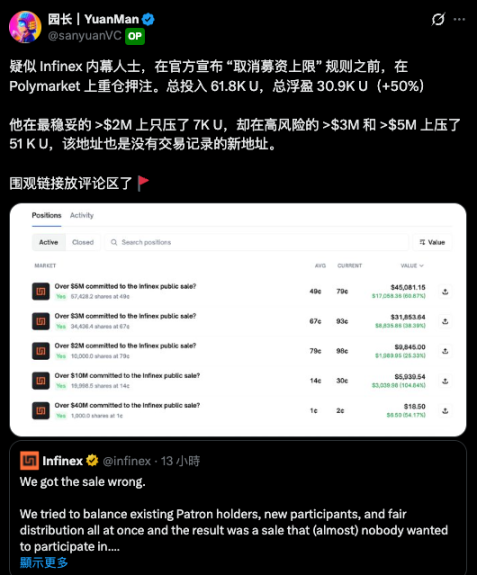

In addition to the controversy over the sales rules, a notable development emerged on the prediction market. Community members observed that, before Infinex’s official announcement removing the individual cap and adjusting the allocation mechanism, there were early buy-ins on Polymarket tied to the fundraising thresholds for this sale.

@sanyuanVC found that before the official announcement canceling the fundraising cap, a total of $61,800 was invested on Polymarket, with an unrealized profit of about $30,900. The address placed only $7,000 on the safer bet of exceeding $2 million, but wagered $51,000 on higher-risk bets of exceeding $3 million and $5 million. This address is new and has no prior transaction history.

Some commenters speculated about insider trading or information leaks, but there is no conclusion and the project team has not responded.

As of press time, Polymarket shows a 98% probability that Infinex’s public sale will exceed $2 million, 93% for exceeding $3 million, and 78% for exceeding $5 million. Cumulative trading volume for this event has reached $3.25 million.

Disclaimer:

- This article is reprinted from [Foresight News]. Copyright belongs to the original author [ChandlerZ, Foresight News]. If you have any objections to this reprint, please contact the Gate Learn team, who will address it promptly according to standard procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless otherwise noted, do not copy, distribute, or plagiarize the translated article without mention of Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?