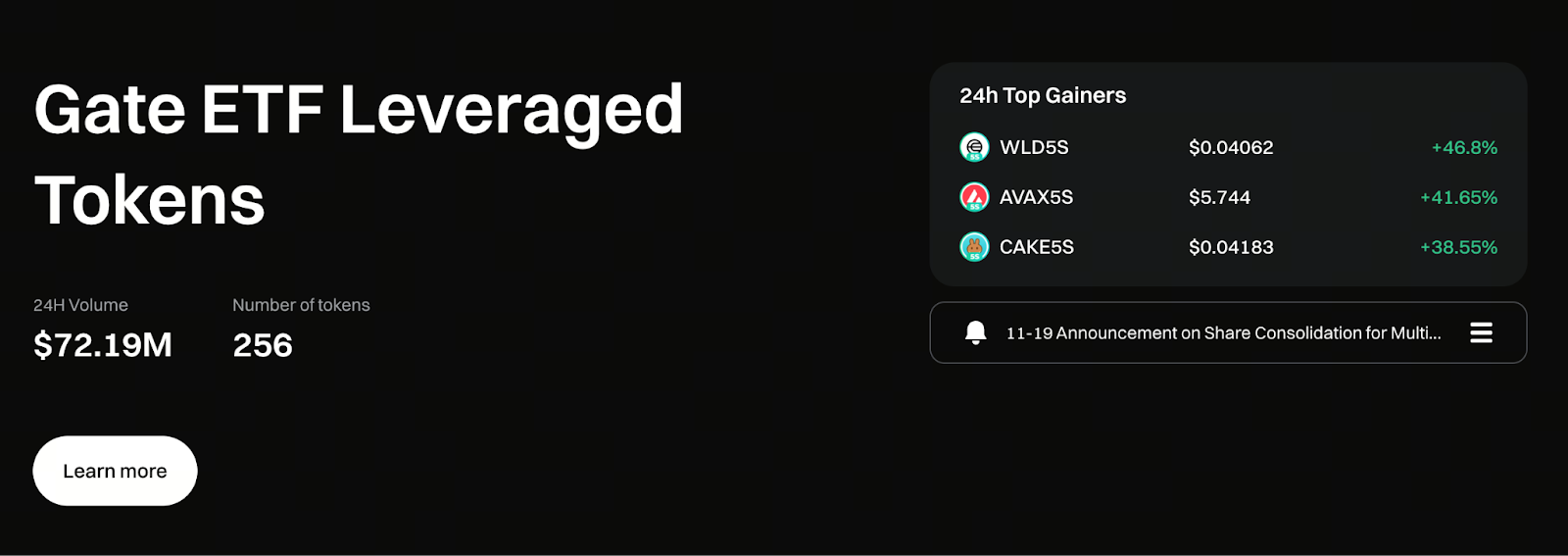

A Complete Guide to Gate Leveraged ETF Tokens: An Easy Way to Access Multi-X Market Moves

Gate Leveraged ETFs and ETF Evolution

ETFs were initially designed to package various assets into a single tradable product, enabling investors to diversify risk, track market performance, and reduce transaction costs through stock-like trading. As investment strategies have grown more complex, passive tracking alone no longer satisfies many investors. Products with directional exposure and leverage have gained prominence, making leveraged ETFs a mainstream solution in response to these evolving needs.

What Are Gate Leveraged ETF Tokens?

Gate’s leveraged ETF tokens are derivatives that use perpetual contract positions to maintain a fixed leverage ratio. Unlike traditional contracts, you don’t need to manage margin, adjust leverage, or oversee positions—the system fully automates these processes. By simply buying and selling spot tokens, users gain leveraged exposure without facing the typical liquidation risks found in contract trading.

Start trading Gate ETF leveraged tokens now: https://www.gate.com/leveraged-etf

How Do Leveraged ETFs Stay Stable?

- Maintaining leverage ratios via perpetual contract positions

Every leveraged ETF token is backed by a corresponding perpetual contract position, ensuring the product maintains a constant leverage level, such as 3x or 5x.

- System-driven daily rebalancing

When market conditions change, the system automatically adjusts positions to restore leverage to the target level, preventing deviation caused by market volatility.

- Simple spot trading experience

Trading works just like spot transactions, eliminating the need to interact with contract interfaces and significantly lowering the barrier to entry.

- Daily management fee deduction

The platform deducts a 0.1% management fee each day to cover rebalancing, hedging, and transaction costs.

Four Key Benefits of Using Gate Leveraged ETFs

- Amplify market trends

When the market direction is clear, leverage can significantly boost your potential returns.

- Eliminate liquidation risk

The system maintains all positions, so insufficient margin will never trigger forced liquidation.

- Built-in compounding effect

During favorable market moves, the rebalancing mechanism automatically increases position size, allowing returns to accumulate.

- Beginner-friendly leveraged tool

Operates just like spot trading, with no need for borrowing or complex contract management—making it the most accessible leveraged product for new users.

Risks Associated with Leveraged ETFs

- Amplified volatility

Leverage magnifies not just gains but also losses.

- Greater cost in sideways markets

Frequent rebalancing during range-bound markets can increase costs, leading to weaker long-term performance.

- Leverage returns may not be strictly proportional

Rebalancing frequency and market volatility can cause actual results to deviate from the “expected multiple.”

- Costs reduce final returns

Daily management fees, hedging costs, and rebalancing transaction fees all impact net performance.

Leveraged ETFs are best suited for short-term or trending markets and are not recommended for long-term holding.

How Management Fees Are Used

To maintain leverage, the platform must rebalance, hedge, and trade in the perpetual contract market. These activities incur:

- Contract transaction fees

- Funding rates

- Slippage

The daily 0.1% fee charged by Gate covers these operating costs and is relatively low compared to similar products. The platform also absorbs part of these costs itself.

Conclusion

Leveraged ETFs let users participate in amplified market moves through spot trading, without the complexity of contract management or liquidation risk. Their advantages include intuitive operation, fixed leverage, and transparent costs. However, they also carry risks such as increased volatility and performance erosion from frequent rebalancing. For investors seeking to boost returns in clear trends or short-term strategies, leveraged ETFs are a streamlined tool that should still be used with caution.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B