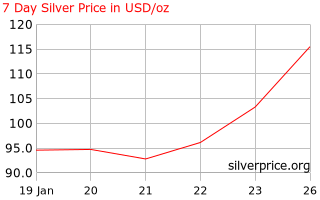

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

1. 2026 Silver Market Review and Latest Price Developments

Source: https://goldprice.org/

As 2026 begins, silver prices continue their strong upward trend, with volatility markedly increasing. During the year, spot silver briefly hit a record high of around $117 per ounce before pulling back. Despite this correction, prices remain elevated, signaling that the bullish trend is still intact.

Recently, several market institutions and media outlets have noted that after surging in early trading, silver prices retreated, reflecting heightened market divergence at extreme highs. Technically, candlestick charts frequently display alternating long upper and lower shadows, indicating intense short-term battles between bulls and bears. This pattern suggests prices have entered a period of high-level consolidation.

2. 2026 Silver Price Forecast: Institutional Consensus and Market Expectations

For 2026, institutional and market perspectives on silver are clearly stratified:

- Conservative outlook: Most institutions, relying on mean reversion and macro assumptions, expect the average annual silver price to stay within the $56–$65 per ounce range, viewing current highs as partially overextended.

- Neutral to moderately bullish: Some analysts, considering trend models and technical structures, believe silver retains upward momentum and could test the $80–$95 per ounce region.

- Extremely optimistic scenario: If supply tightness persists and risk aversion intensifies, some trading communities and analysts see potential for silver to break above $100 per ounce, with further upside possible.

These forecast differences ultimately reflect varying emphases on fundamentals versus technicals, requiring ongoing assessment in the context of actual market conditions.

3. Silver Candlestick Analysis: Trend Structure, Support, and Resistance

On the daily chart, silver remains within an upward channel overall:

Trend Assessment: Bullish Structure Remains Intact

- Long-term moving averages are still aligned bullishly

- The upward trend channel is intact, and prices have not broken below key trendlines

Key Support Zones

- The $76–$72 range serves as a crucial medium-term support area

- If this zone breaks, the short-term trend could shift from strength to a high-level correction

Resistance and Psychological Levels

- The $83–$88 region is a significant resistance zone; breaking above could open the way for higher targets

- $100 per ounce is a major long-term psychological barrier, with a pronounced effect on market sentiment

Overall, volume and momentum indicators suggest silver is in a high-level consolidation phase—trend remains, but momentum is easing at the margin.

4. Core Drivers of Silver Price Gains

The main drivers supporting silver in 2026 are as follows:

Sustained Safe-Haven Demand

Global geopolitical uncertainty and economic cycle swings continue to boost demand for precious metals, with silver benefiting from its safe-haven status.

Structural Growth in Industrial Demand

Silver’s use in photovoltaics, electronic components, and the EV supply chain is expanding, reinforcing its industrial metal role and providing a solid foundation for medium- and long-term demand.

Structural Supply Constraints

Limited growth in mining supply, persistent inventory tightness, and increased physical silver hoarding are reducing deliverable inventories, underpinning prices.

5. Risk Factors and Potential Correction Pressures

Despite a fundamentally strong outlook, the following risks remain:

- Technical overheating correction: Prices are significantly above medium- and long-term moving averages, indicating a need for technical pullback.

- Macroeconomic policy shifts: Changes in Federal Reserve policy or interest rate paths could temporarily suppress non-yielding assets.

- Profit-taking driven by sentiment: At extreme highs, short-term capital is more likely to realize gains quickly, increasing volatility.

6. Investor Strategy Recommendations

- Medium-term allocation: Watch key support zones, build positions in tranches, and set clear stop-losses.

- Short-term trading: Use the high-level consolidation range, focusing on breakout or breakdown signals.

- Risk control principles: Avoid chasing rallies at highs; use position diversification and pace management.

Summary: Core Outlook for Silver in 2026

Taking both technical structure and fundamentals into account, silver retains bullish potential in 2026, especially with the dual drivers of safe-haven and industrial demand. The medium- to long-term thesis remains intact. However, with prices at historical highs, heightened volatility and periodic corrections are likely to become the norm.

Continuous monitoring of candlestick patterns and key support and resistance zones can provide actionable insights for silver investors and traders.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About