2026 RWA Market Breakout: On-Chain Real-World Asset Growth Hits Record Highs and Price Trend Analysis

RWA: What Are Real World Assets?

RWA (Real World Assets) refers to the process of tokenizing traditional financial or physical assets using blockchain technology, enabling digital assets to be issued on decentralized networks. Examples include real estate, bonds, U.S. Treasuries, and private credit. Compared to conventional finance, representing RWAs on-chain enhances liquidity, divisibility, and transparency.

Simply put, RWA allows real assets to be traded 24/7 like cryptocurrencies and to integrate seamlessly with DeFi applications. This capability is a key reason why RWA has become a central narrative in today’s crypto market.

2026 RWA Market Size and Growth Data

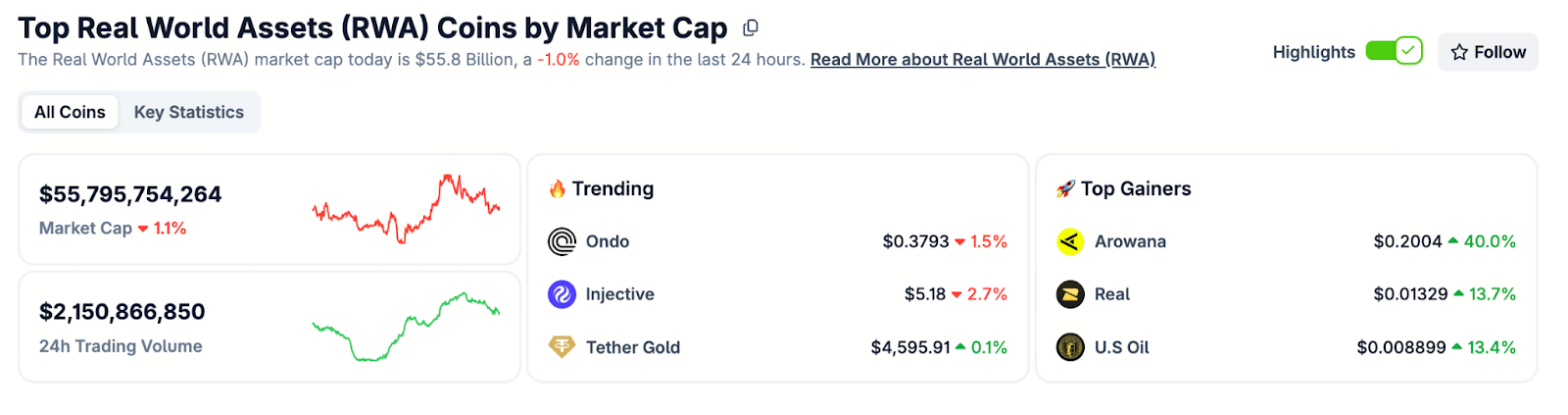

Chart: https://www.coingecko.com/en/categories/real-world-assets-rwa

As we enter 2026, the total on-chain value of RWAs continues to grow at a rapid pace.

The latest report shows that by early 2026, the total on-chain RWA market value has surpassed $2.08 billion, reflecting an increase of more than 6% over the previous week. This demonstrates that the RWA market is expanding quickly and remains a leading category in the DeFi sector.

Earlier data indicated that the global RWA market neared $2.95 billion in 2025, marking significant year-over-year growth. This expansion was primarily driven by credit assets and institutional capital.

Looking ahead, industry research and financial institutions forecast substantial growth potential for RWAs over the next several years. Some predict the global RWA market could reach the multi-trillion-dollar level by 2028.

Price Trends: Major RWA Token Performance Analysis

While RWA fundamentally involves asset tokenization, on-chain tokens and related asset prices within this sector are also receiving significant attention.

Key assets in RWA-related categories include stablecoins, tokenized bonds, and commodity tokens. According to CoinGecko, the total market capitalization for the RWA sector currently exceeds $5.5 billion. Notable tokens with active on-chain data include Zebec Network, Chainlink, and Tether Gold.

It’s important to note that individual RWA asset prices can be highly volatile, as they depend on underlying assets and market supply and demand. For instance, precious metals tokens like XAUT fluctuate with gold prices, while bond tokens are closely tied to interest rates.

When analyzing RWA token prices, consider not only digital asset market factors but also the fundamentals of the underlying real-world assets.

Institutional Investment and Global Regulatory Developments

The surge in RWA’s popularity in recent years is closely linked to large-scale allocations by global institutional investors. Many traditional banks and financial firms are actively launching tokenized deposit and real asset products, unlocking new pathways for on-chain liquidity. For example, BNY Mellon—one of the world’s largest custodian banks—has announced tokenized deposit services for institutional investors on private blockchains.

Meanwhile, global regulatory policies are evolving rapidly. Some regions, such as the United States, are piloting digital asset collateral policies, while others, such as China, are imposing stricter restrictions on RWA tokenization.

This shows that the development of RWAs involves not only technology and market dynamics but also compliance frameworks and regulatory environments. Investors should closely monitor the latest regulatory trends in each country or region when considering RWA allocations.

Future Opportunities and Risk Considerations

Opportunities:

- Enhanced liquidity and divisibility: RWA allows large assets that were previously difficult to trade to be split and traded, attracting greater participation from small and medium-sized investors.

- Institutional involvement drives growth: As institutional investors enter the market, overall market size is expected to expand rapidly.

- Integration with on-chain financial ecosystems: DeFi protocols can leverage RWAs to develop new financial products, such as RWA-based lending and insurance.

Risks:

- Regulatory uncertainty: Differing regulatory approaches worldwide may affect the pace of RWA development.

- Liquidity challenges: Despite innovative concepts, most RWA assets still have room for improvement in secondary market trading depth.

- Price correlation risks: Token values are significantly impacted by fluctuations in their underlying assets.

Conclusion

In summary, RWAs remain a major focus in the crypto market in 2026. With the ongoing rise in on-chain value, increasing institutional participation, and the gradual establishment of global regulatory frameworks, RWAs are moving from the experimental stage to large-scale adoption. From technology and market perspectives to asset allocation strategies, RWAs warrant long-term attention. However, every investment carries risk, so thorough research and risk assessment are recommended before participating in RWA assets.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About