2026 Motley Fool 10 Best Stocks Investment Guide: Latest List and Stock Price Trend Analysis

What Is Motley Fool 10 Best Stocks?

The Motley Fool 10 Best Stocks is an annual selection published by the leading investment firm Motley Fool, designed for long-term growth investors. The list typically features 10 publicly traded companies identified as having strong long-term growth potential. Motley Fool’s recommendations are grounded in fundamental analysis, industry trends, and market outlook, providing investors with a foundation for building a buy-and-hold portfolio.

Keep in mind, these recommendations are not investment advice. Investors should evaluate their own risk tolerance and financial situation before participating.

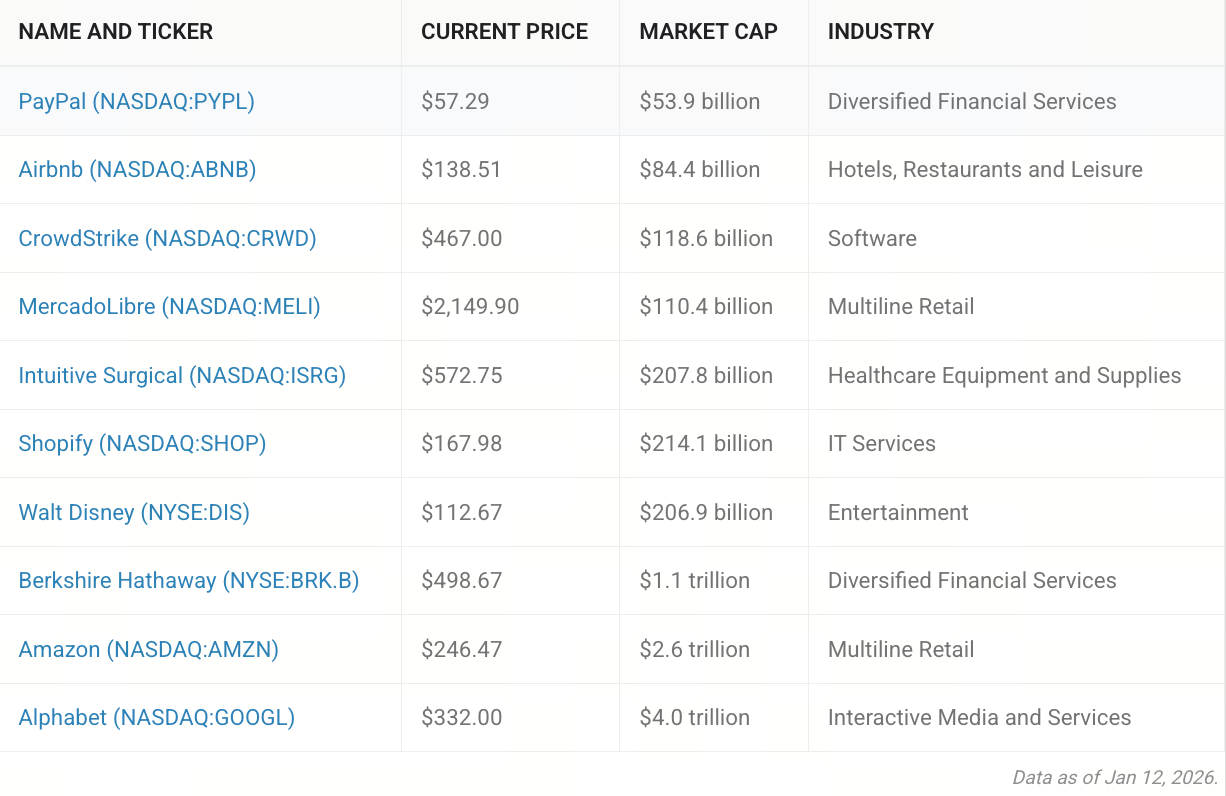

2026 Latest Motley Fool Top 10 Stocks List

Based on the most recent market compilation and public reports as of early 2026, here are 10 top-performing stocks drawing significant market attention (referenced from Top 10 or popular picks):

These stocks represent a range of industries, including technology, healthcare, consumer, and financial services, supporting the creation of a diversified investment portfolio.

Current Stock Performance and Market Trends

As 2026 begins, the market is experiencing structural divergence:

Technology Giants:

- Alphabet (GOOGL) posted strong results in 2025, with stock prices rising on robust demand for AI and cloud services, at times leading gains among large-cap tech stocks.

- Amazon (AMZN) saw modest gains in 2025, yet analysts remain focused on AWS cloud growth and improved operational efficiency.

- Shopify (SHOP) and PayPal (PYPL), key players in e-commerce and payments, continue to offer long-term growth potential in the post-pandemic environment.

Healthcare and Consumer:

- Intuitive Surgical (ISRG) benefits from steady demand for surgical robotics, maintaining solid fundamentals.

- Airbnb (ABNB) continues to gain from the ongoing recovery in travel.

Blue-Chip and Diversified: Berkshire Hathaway (BRK.B) delivers consistent long-term results and exemplifies value and diversification.

Overall, the divide between technology and consumer sectors is becoming more pronounced. However, fundamentally strong companies remain the primary focus for long-term investors.

Investment Strategies: Long-Term vs. Short-Term Perspectives

Long-Term Investment Perspective

Motley Fool’s recommendations typically target compound growth over a five- to ten-year horizon. For growth-oriented tech companies such as Amazon, Alphabet, and Shopify, maintaining a long-term position can significantly increase overall returns.

Short-Term Strategy Considerations

Short-term price volatility is difficult to predict. Investors not committed to long-term holding should establish clear stop-loss and target profit levels, while closely monitoring macroeconomic conditions and industry trends. For example, cyclical shifts in AI and cloud computing can intensify short-term market swings.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About