10 Predictions for 2026

1. AI Agents Start Transacting Autonomously

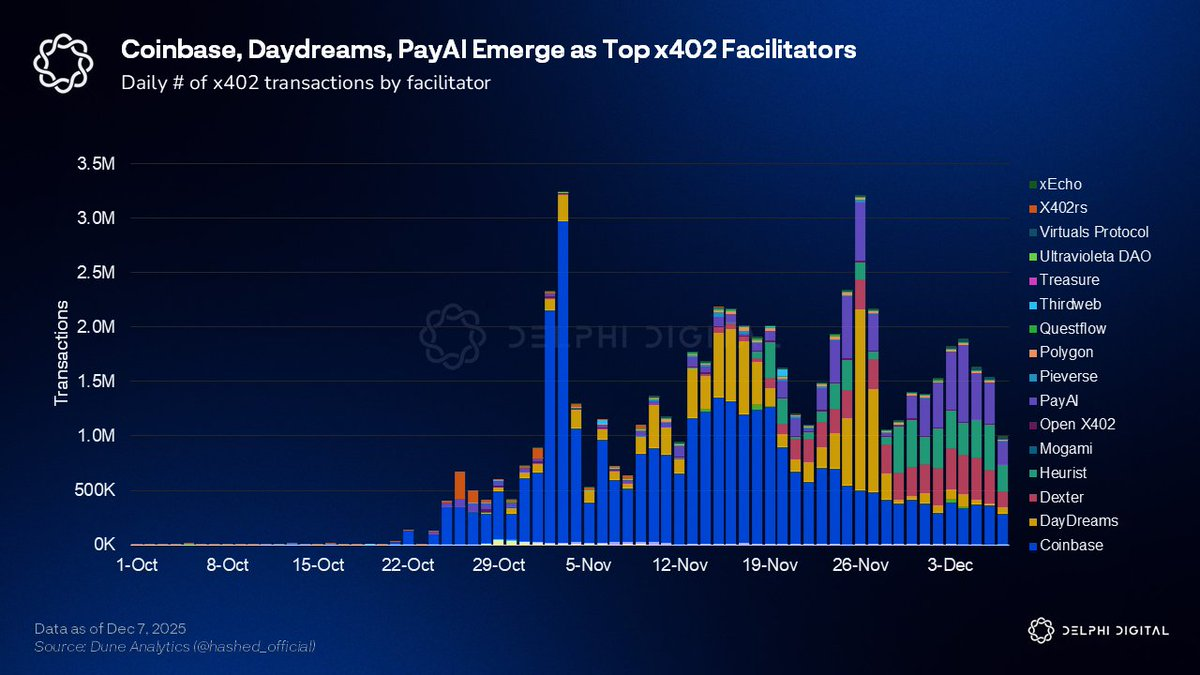

The x402 protocol lets any API gate access via crypto payments. When an agent needs a service, it pays instantly with stablecoins. No shopping carts, no subscriptions. ERC-8004 adds trust by creating reputation registries for agents, complete with performance histories and staked collateral.

Combine these and you get autonomous agent economies. A user could delegate travel planning. Their agent subcontracts a flight search agent, pays for data via x402, books tickets onchain, all without human intervention.

2. Perp DEXs Eat Traditional Finance

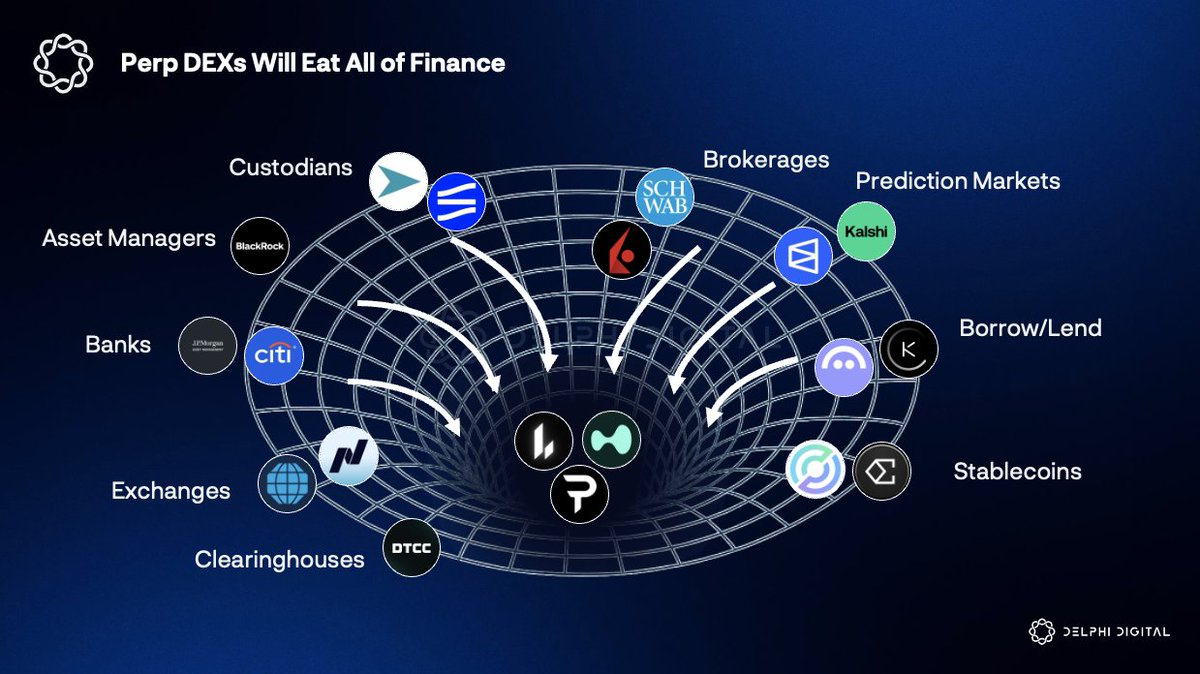

Traditional finance is expensive due to fragmentation. Trading happens on exchanges, settlement through clearinghouses, and custody through banks. Blockchain collapses all of this into one smart contract.

Now Hyperliquid is building native lending. Perp DEXs could become brokerage, exchange, custodian, bank, and clearinghouse all at once. Competitors like @ Aster_DEX, @ Lighter_xyz, and @ paradex are racing to catch up.

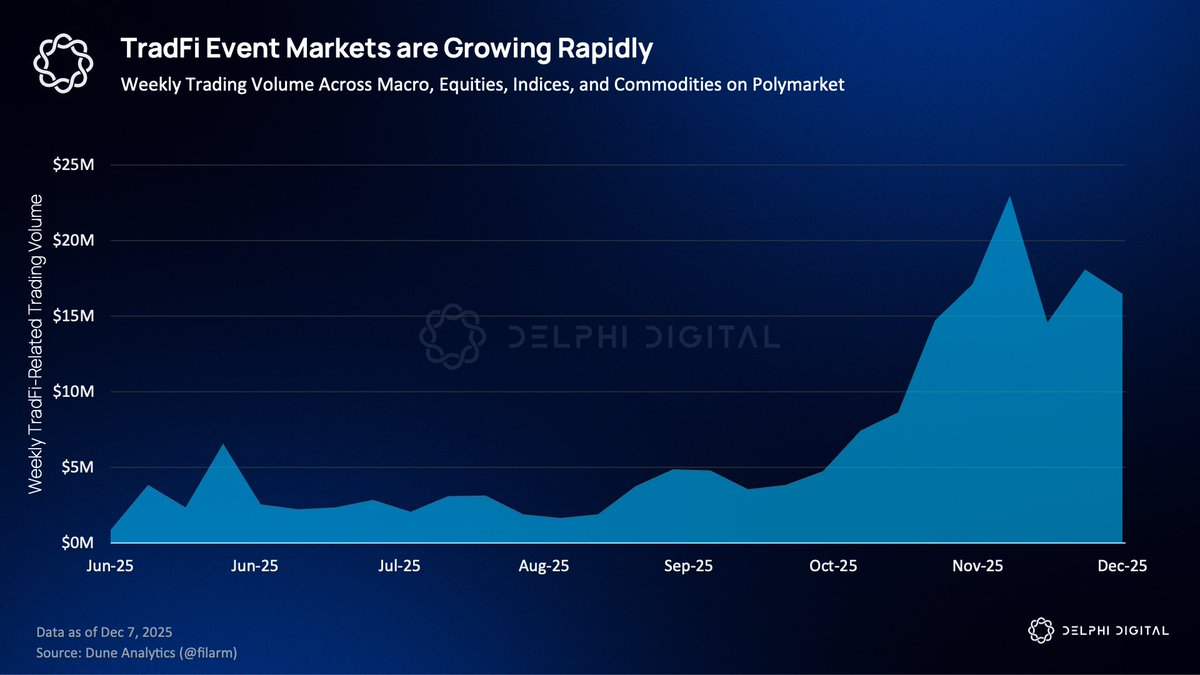

3. Prediction Markets Graduate to TradFi Infrastructure

Thomas Peterffy, chairman of Interactive Brokers, frames prediction markets as a live information layer for portfolios. Early demand on IBKR is concentrated in weather contracts for energy, logistics, and insurance risk.

2026 opens new categories: equity event markets for earnings beats and guidance ranges, macro prints like CPI and Fed decisions, cross-asset relative value markets. A trader holding tokenized AAPL could hedge earnings risk through a simple binary contract rather than navigating options. Prediction markets become a first-class derivative.

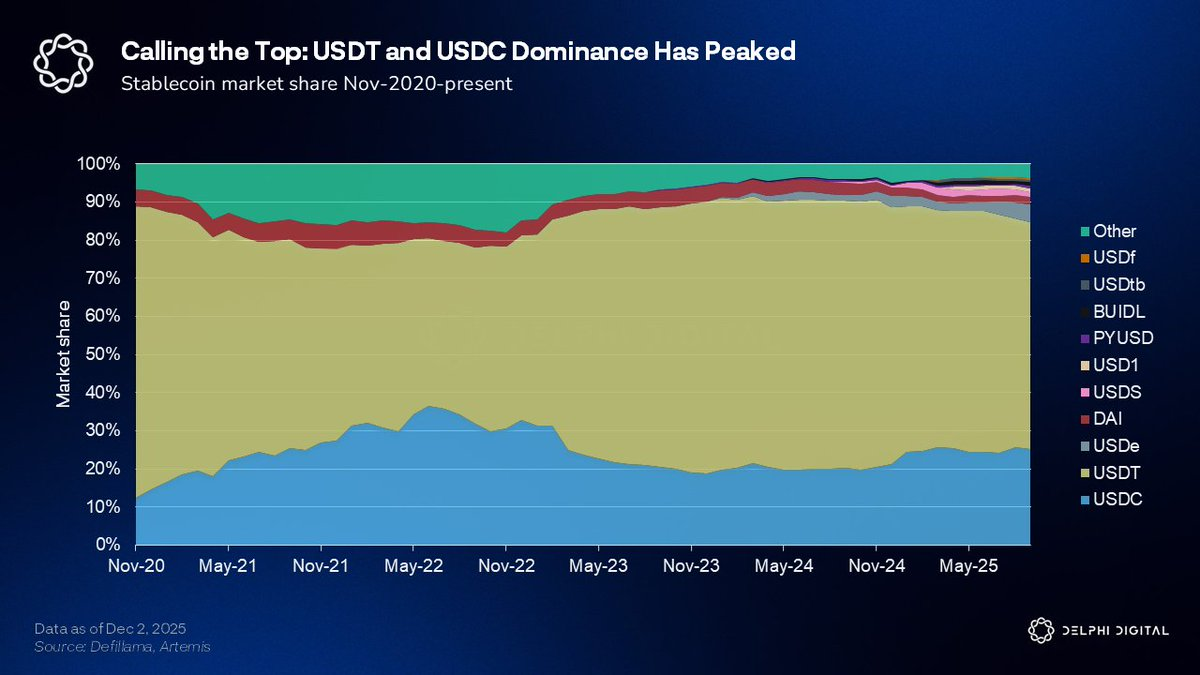

4. Ecosystems Reclaim Stablecoin Yield From Issuers

Coinbase captured more than $900 million of USDC reserve income last year just by controlling distribution. Chains like Solana, BSC, Arbitrum, Aptos, and Avalanche collectively earn around $800 million annually in fees while over $30 billion in USDC and USDT sits on their networks. The platforms driving stablecoin usage are leaking more to issuers than they earn themselves.

Now this is changing. Hyperliquid ran a competitive bidding process for USDH and now captures half the reserve yield for its Assistance Fund. Ethena’s stablecoin as a service model is now being adopted by Sui, MegaETH, and Jupiter. The yield that accrued passively to incumbents is being reclaimed by the platforms that generate demand.

5. DeFi Cracks Undercollateralized Lending

DeFi lending protocols hold Billions in TVL, but nearly all of them require overcollateralization. The unlock is zkTLS. Users can prove their bank balance exceeds a certain amount without revealing account numbers, transaction history, or identity.

@ 3janexyz offers instant undercollateralized USDC credit lines using verified Web2 financial data. The algorithm monitors borrowers in real time and adjusts rates dynamically. The same framework can underwrite AI agents using performance history as a credit score. @ maplefinance, @ centrifuge, and @ USDai_Official are attacking adjacent problems. 2026 is when undercollateralized lending graduates from experiment to infrastructure.

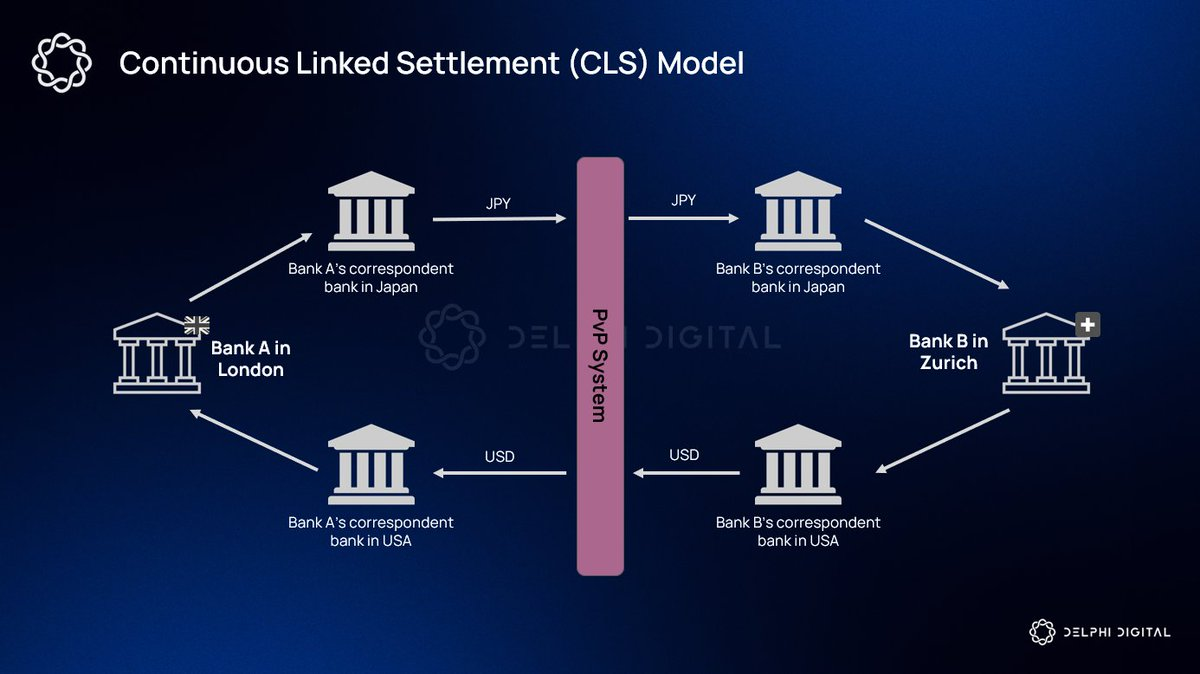

6. Onchain FX Finds Product Market Fit

USD stablecoins represent 99.7% of total supply, but this dominance could be the peak. Traditional FX is a multi-trillion dollar market riddled with intermediaries, fragmented settlement rails, and expensive fees. Onchain FX collapses this stack by enabling all currencies to exist as tokenized assets on a shared execution layer, eliminating multiple intermediary hops.

Product market fit could emerge in emerging market pairs where traditional FX rails are most expensive and inefficient. These underserved corridors are where crypto’s value proposition is clearest.

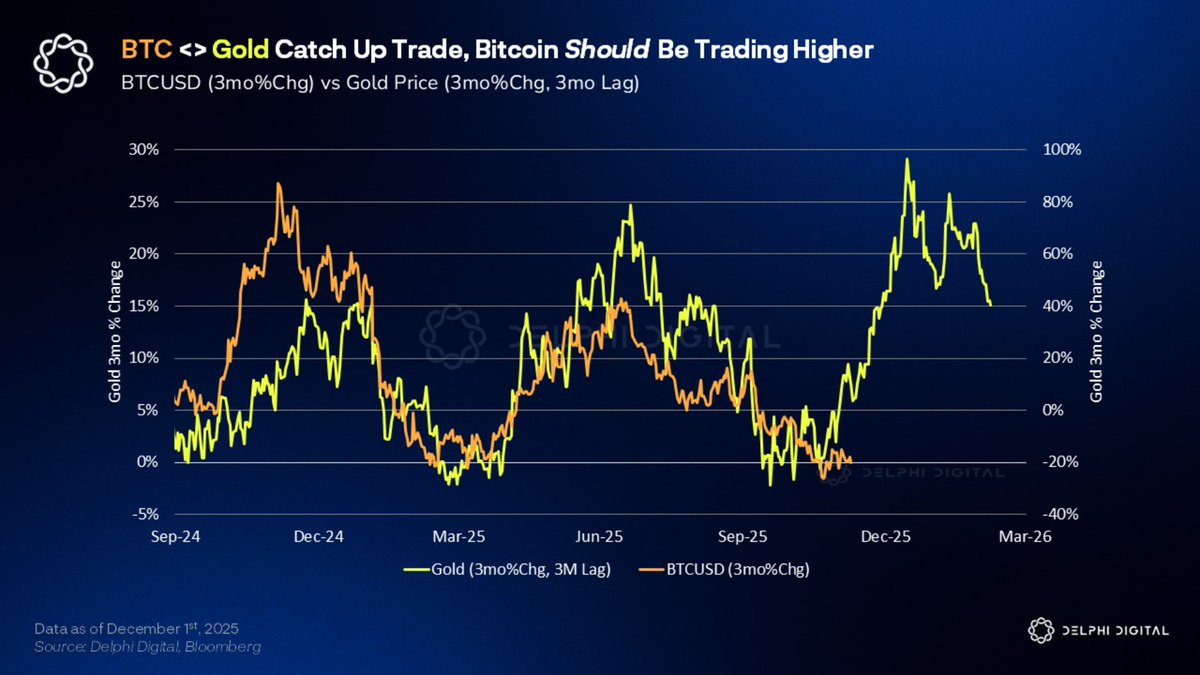

7. Gold and Bitcoin Lead the Debasement Trade

Gold surged 60% after we flagged it as one of the best charts to watch. Central banks bought over 600 tonnes despite record prices. China has been among the most aggressive buyers.

The macro setup supports continued strength. Global central banks are cutting. Fiscal deficits persist through 2027. Global M2 is breaking highs. The Fed is ending QT. Gold typically leads Bitcoin by three to four months. As debasement becomes a mainstream issue heading into the 2026 midterms, both assets capture flight-to-quality flows.

8. Exchanges Become Everything Apps

Coinbase, Robinhood, Binance, and Kraken are no longer building exchanges. They’re building everything apps.

Coinbase has Base as the OS, the Base App as the interface, USDC revenue as the floor, and Deribit for derivatives. Robinhood’s Gold membership grew 77% YoY and functions as a retention engine. Binance already operates at superapp scale with over 270 million users and $250B in Pay volume. When distribution becomes cheap, value accrues to whoever owns the user. 2026 is when the winners start pulling away.

9. Privacy Infrastructure Catches Up to Demand

Privacy is under pressure. The EU passed the Chat Control Act. Cash transactions are being capped at 10,000 euros. The ECB plans a digital euro with a 3,000 euro holding limit.

Privacy infrastructure is catching up. @ payy_link is launching private crypto cards. @ SeismicSys provides protocol-level encryption for fintechs. @ KeetaNetwork enables onchain KYC without revealing personal data. @ CantonNetwork powers privacy infrastructure for major financial institutions. Without private rails, stablecoins hit an adoption ceiling.

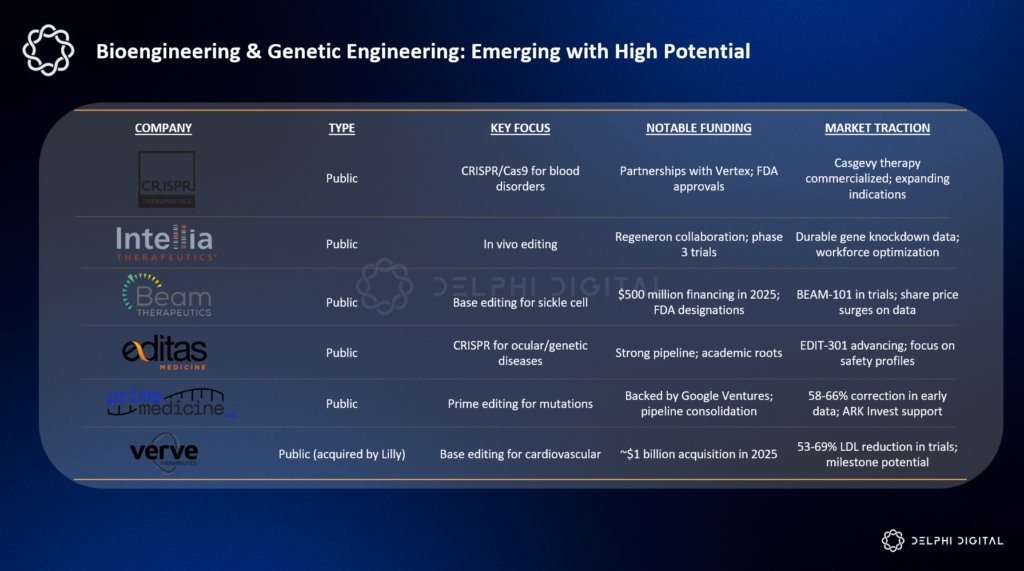

10. Altcoin Returns Stay Dispersed

The blanket rallies of previous cycles are not coming back. Over $3 billion in token unlocks loom. Competition from AI, robotics, and biotech has intensified. ETF flows concentrate into Bitcoin and a handful of large caps.

Capital will coalesce around structural demand: tokens with ETF flows, protocols with real revenues and buybacks, applications with genuine product market fit. The winners will be concentrated among teams that build defensible moats in categories with real economic activity.

Conclusion

Crypto is graduating into the next phase. Institutionalization is already here. Prediction markets, onchain credit, agent economies, and stablecoins as infrastructure represent real paradigm shifts.

Crypto is becoming the infrastructure layer for global finance. The teams that understand this will define the next decade.

Disclaimer:

- This article is reprinted from [Delphi_Digital]. All copyrights belong to the original author [Delphi_Digital]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?